The Australian dollar is presently trading in a small range just below 0.94 after surging higher to the well established resistance level at 0.9425 and being rejected again in recent hours. It has started this week by slowly easing away from the resistance level around 0.9425 which continues to stand tall and play havoc with buyers. The Australian dollar enjoyed a solid surge higher reaching a new eight month high above 0.95 a few weeks ago, only to return most of its gains in very quick time to finish out that week. Since the middle of June the Australian dollar has made repeated attempts to break through the resistance level around 0.9425, however despite its best efforts it was rejected every time as the key level continued to stand tall, even though it has allowed the small excursion to above 0.95.

After the Australian dollar had enjoyed a solid surge in the first couple of weeks of June which returned it to the resistance level around 0.9425, it then fell sharply away from this level back to a one week low around 0.9330 before rallying higher yet again. Its recent surge higher to the resistance level around 0.9425 was after spending a couple of weeks at the end of May trading near and finding support at 0.9220. The 0.9220 level has repeatedly reinforced its significance as it is again likely to support price should the Australia dollar retreat further. Throughout April and into May the Australian dollar drifted lower from resistance just below 0.95 after reaching a six month high in that area and down to the recent key level at 0.93 before falling lower. During this similar period the 0.93 level has become very significant as it has provided stiff resistance for some time.

The Australian dollar appeared to be well settled around 0.93 which has illustrated the strong resurgence it has experienced throughout this year. For the best part of February and March the Australian dollar did very little other than continue to trade around the 0.90 level, although at the beginning of March it crept a little lower down to a three week low below 0.89. Towards the end of March however, the Australian dollar surged higher strongly moving to the resistance level at 0.93 before consolidating for a week or so.

Australian consumers appear to have shaken off their budget cut woes, with confidence levels enjoying a solid rebound. ANZ-Roy Morgan's latest survey found consumer confidence levels are now back to pretty much where they were before worries set in about the government's planned spending cuts. Consumer confidence rose 4.4 per cent in the past week, the survey found. ANZ senior economist Justin Fabo said confidence levels had risen eight per cent in the past two weeks, aided by parliament's repeal of the carbon tax and other Senate ructions around government policies. "This is a very encouraging sign that the 'sticker shock' from the budget was temporary," he said. "While debate in the Senate around the slated budget policies could be important for the future trajectory of consumer confidence, soft income growth is likely to be a more important driver of the consumer spending outlook."

(Daily chart / 4 hourly chart below)

AUD/USD July 22 at 23:45 GMT 0.9391 H: 0.9395 L: 0.9389

AUD/USD Technical

During the early hours of the Asian trading session on Wednesday, the AUD/USD is trading in a small range just below 0.94 after surging higher to the well established resistance level at 0.9425. The Australian dollar was in a free-fall for a lot of last year falling close to 20 cents and it has done very well to recover slightly to well above 0.95 again. Current range: trading below 0.9400 around 0.9390.

Further levels in both directions:

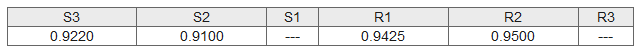

- Below: 0.9220 and 0.9100.

- Above: 0.9425 and 0.9500.

Recommended Content

Editors’ Picks

EUR/USD hovers around 1.0700 ahead of German IFO survey

EUR/USD is consolidating recovery gains at around 1.0700 in the European morning on Wednesday. The pair stays afloat amid strong Eurozone business activity data against cooling US manufacturing and services sectors. Germany's IFO survey is next in focus.

GBP/USD steadies near 1.2450, awaits mid-tier US data

GBP/USD is keeping its range at around 1.2450 in European trading on Wednesday. A broadly muted US Dollar combined with a risk-on market mood lend support to the pair, as traders await the mid-tier US Durable Goods data for further trading directives.

Gold: Defending $2,318 support is critical for XAU/USD

Gold price is nursing losses while holding above $2,300 early Wednesday, stalling its two-day decline, as traders look forward to the mid-tier US economic data for fresh cues on the US Federal Reserve interest rates outlook.

Crypto community reacts as BRICS considers launching stablecoin for international trade settlement

BRICS is intensifying efforts to reduce its reliance on the US dollar after plans for its stablecoin effort surfaced online on Tuesday.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.