The Australian dollar has started this week well slowly edging higher and regaining some of the lost ground from late last week which saw it drop two a two week low just above 0.93. This recent movement higher has seen it return to the key resistance level at 0.9425 and ease away again. The Australian dollar enjoyed a solid surge higher reaching a new eight month high above 0.95 in the middle of last week, only to return most of its gains in very quick time to finish out last week. Over the last few weeks the Australian dollar has made repeated attempts to break through the resistance level around 0.9425, however despite its best efforts it was rejected every time as the key level continued to stand tall, even though it has allowed a small excursion in the last week to above 0.95. After the Australian dollar had enjoyed a solid surge in the first couple of weeks of June which returned it to the resistance level around 0.9425, it then fell sharply away from this level back to a one week low around 0.9330 before rallying higher yet again. Its recent surge higher to the resistance level around 0.9425 was after spending a couple of weeks at the end of May trading near and finding support at 0.9220. The 0.9220 level has repeatedly reinforced its significance as it is again likely to support price should the Australia dollar retreat further.

It was only a month or so ago the Australian dollar was placing pressure on the resistance level at 0.94 when it was able to poke through for a short period and reach a four week high in the process, however in recent times it has surpassed those levels and achieved new levels around 0.9425. Throughout April and into May the Australian dollar drifted lower from resistance just below 0.95 after reaching a six month high in that area and down to the recent key level at 0.93 before falling lower. During this similar period the 0.93 level has become very significant as it has provided stiff resistance for some time. The Australian dollar appeared to be well settled around 0.93 which has illustrated the strong resurgence it has experienced throughout this year. For the best part of February and March the Australian dollar did very little other than continue to trade around the 0.90 level, although at the beginning of March it crept a little lower down to a three week low below 0.89. Towards the end of March however, the Australian dollar surged higher strongly moving to the resistance level at 0.93 before consolidating for a week or so.

For several months either side of the New Year the Australian dollar established and traded within a narrow range roughly between 0.88 and the previous resistance level at 0.90. Back in January the Australian dollar was able to rally higher pushing through the resistance at 0.90 to a one month high near 0.91, however it quickly returned to more familiar territory below the resistance levels at 0.90 and 0.88. After showing some resilience in early December moving to a one week high above 0.9150, the AUD/USD spent the next two weeks turning around sharply and falling heavily down to a then three month low close to 0.88.

A measure of Australian consumer sentiment improved modestly in July as worries about family finances eased, a survey showed on Wednesday, though the depressing impact of an unpopular federal budget continued to linger. The survey of 1,200 people by the Melbourne Institute and Westpac Bank showed the index of consumer sentiment rose a seasonally adjusted 1.9 percent in July, from June when it had inched up only 0.2 percent. The index still has not fully recovered from May's 6.8 percent dive which followed a budget of welfare reforms, cutbacks and increased charges for services. The index reading of 94.9 for July was down 7.1 percent on the same month last year and means pessimists still exceed optimists. Fewer Australians are spiraling into bankruptcy, with figures showing the lowest level of personal insolvency in almost 10 years. Personal insolvency fell nine per cent in the June quarter, Australian Financial Security Authority (AFSA) statistics show. "Bankruptcies are at their lowest annual level since 1995-96," AFSA said in a statement. The figures also showed bankruptcies fell 25 per cent in the June quarter of 2014 compared to the June quarter of 2013. In the same period total personal insolvency activity fell in all states and territories except Western Australia and the Northern Territory.

(Daily chart / 4 hourly chart below)

AUD/USD July 10 at 00:05 GMT 0.9411 H: 0.9414 L: 0.9406

AUD/USD Technical

During the early hours of the Asian trading session on Thursday, the AUD/USD is just easing back a little from the key resistance level at 0.9425 having recently surged higher and run into it. The Australian dollar was in a free-fall for a lot of last year falling close to 20 cents and it has done very well to recover slightly to well above 0.95 again. Current range: trading right below 0.9425 around 0.9410.

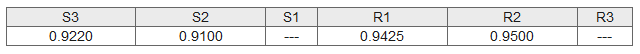

Further levels in both directions:

- Below: 0.9220 and 0.9100.

- Above: 0.9425 and 0.9500.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.