Rates

Uneventful session with slightly weaker US Treasuries

Global core bonds were narrowly mixed yesterday with the US underperforming Europe. German yields fell less than 1 bp across the curve. The US yield curve slightly bear steepened with yields between 1.8 and 3.6 bps higher. On intra‐EMU bond markets, 10‐yr yield spread changes versus Germany dropped up to 3 bps with Greece underperforming (+13 bps).

Initially a mild risk‐on climate pushed core bonds lower, as Asian stocks and commodities found their composure. In the afternoon session, Bund trading gradually morphed into some upside movement. Very weak US consumer confidence was a positive for bonds, but it was mitigated by a stronger Richmond Fed business survey and stronger equities. Today, the focus is on the FOMC meeting. The eco calendar only contains US pending home sales. They are forecast to have increased for a sixth consecutive month. The consensus is looking for a 0.9% M/M and 11.1% Y/Y rise in June We see risks for a downward surprise given the very strong data of the last few months.

No FOMC hints about timing liftoff

We expect no policy changes from the Fed. We still see the September meeting as the likely lift‐off. Ms. Yellen showed optimism on the economy and suggested that rates would be raised this year. She also sees still slack in the economy and labour market and cited global developments like Greece and China as concerns. Greece should now be off her list, but China is still a potential source of market distress. The timing of the lift‐off will be the main focal point of markets, but we don’t expect the statement to become more specific on this point. The FOMC is looking meeting by meeting whether they need to act and it makes little sense to prepare markets already now for an eventual September move. There will still be two full months of data before that key meeting. We are aware that a number of governors like Bullard, George and Williams, but also less outspoken Powell, Fisher and even Dudley marked the September meeting as a likely start of the tightening cycle, but giving today guidance towards that meeting remains unlikely. The Fed will evaluate the situation via the prism of the labour market and inflation data with some attention for the financial market conditions. The labour market is going in the right direction with the unemployment rate at 5.3% in June (from 5.5%), but a number of indicators suggest remaining slack.

Wages were flat in the previous payrolls report and while some other wage data (ECI) show an increase, the Fed probably wants more signs of accelerating wages. The economy is doing ok, but no euphoria. Consumer confidence fell sharply lower in July, June retail sales disappointed and business investment is lacklustre. On the inflation side, the most recent data were a shade below expectations and low or lower (core measures). The recent oil price decline suggests headline inflation will remain lower for longer. We agree with the Fed that inflation will move towards target in medium term, but various Fed governors are very sensitive to the current low inflation. We don’t want to sound negative, as we still believe in a September lift‐off, but psychologically the time doesn’t seem ripe yet to give guidance for the lift‐off. We doubt whether the statement will be more optimistic on growth and inflation than in June. We saw in recent weeks sometimes a bear flattening of the curve, but these trading days were few and so no consistent bear flattening has taken place, which would be the traditional signal that tightening is coming (much) closer.

Today: No changes expected from the Fed

Overnight, most Asian equity indices trade marginally positive with China underperforming (up to ‐1%). However, given recent volatility one might argue that calm returned to Chinese markets while commodity markets rebounded. The US Note future trades stable overnight, suggesting a neutral opening for the Bund.

Today’s only relevant trading item is the Fed decision. In the run‐up to the statement, after European closure, trading risks being dull and range bound. We don’t expect a policy change from the Fed, while also a verbal hint for a September rate hike is unlikely. We believe that such scenario is discounted by markets and shouldn’t leave a big stamp on trading. In case the Fed does flag a September hike (wildcard), US Treasuries will suffer with the front end of the curve underperforming. We hold our sell‐on‐up ticks approach for the US Note future around the recent highs (127‐23) based on our own September rate hike bet.

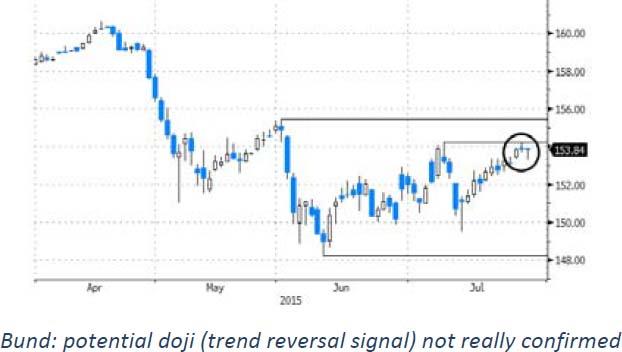

The technical picture of the German Bund showed a potential short term trend reversal signal (doji) on Monday. While we didn’t set a new high yesterday, the doji wasn’t really confirmed. Nevertheless, we’d still prefer to short the Bund around current levels for return action towards the lower bound of range.

This non-exhaustive information is based on short-term forecasts for expected developments on the financial markets. KBC Bank cannot guarantee that these forecasts will materialize and cannot be held liable in any way for direct or consequential loss arising from any use of this document or its content. The document is not intended as personalized investment advice and does not constitute a recommendation to buy, sell or hold investments described herein. Although information has been obtained from and is based upon sources KBC believes to be reliable, KBC does not guarantee the accuracy of this information, which may be incomplete or condensed. All opinions and estimates constitute a KBC judgment as of the data of the report and are subject to change without notice.

Recommended Content

Editors’ Picks

AUD/USD hovers around 0.6500 amid light trading, ahead of US GDP

AUD/USD is trading close to 0.6500 in Asian trading on Thursday, lacking a clear directional impetus amid an Anzac Day holiday in Australia. Meanwhile, traders stay cautious due ti risk-aversion and ahead of the key US Q1 GDP release.

USD/JPY finds its highest bids since 1990, near 155.50

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, testing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming Japanese intervention risks. Focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold price treads water near $2,320, awaits US GDP data

Gold price recovers losses but keeps its range near $2,320 early Thursday. Renewed weakness in the US Dollar and the US Treasury yields allow Gold buyers to breathe a sigh of relief. Gold price stays vulnerable amid Middle East de-escalation, awaiting US Q1 GDP data.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price. Coupled with broader market gloom, INJ token’s doomed days may not be over yet.

Meta Platforms Earnings: META sinks 10% on lower Q2 revenue guidance Premium

This must be "opposites" week. While Doppelganger Tesla rode horrible misses on Tuesday to a double-digit rally, Meta Platforms produced impressive beats above Wall Street consensus after the close on Wednesday, only to watch the share price collapse by nearly 10%.