Rates

Yesterday, global core bonds gradually slid lower, while equities continued their rebound boosted by M&A news and good corporate earnings. Ukrainian tensions and eco data (stronger Richmond manufacturing sentiment, existing home sales and EMU consumer confidence, were mostly ignored. Later in the US session, core bonds were able to fight back allowing the Treasuries to end the session narrowly mixed while German bonds limited the damages. In yield terms, German yields were flat to 2.1 bps higher, steepening the curve. In the US, Treasury yields were up 0.8 and 1.2 bps at the 2- and 5-yr while down 0.5 and 2.8 bps at the 10- and 30-yr tenor. The 2-yr Note auction was okay (see below).

Today, the eco calendar is enticing with the first estimate of the euro zone PMI’s for April, the US Markit manufacturing PMI and US new home sales. The Bank of England will release the minutes of its latest MPC meeting and the US Treasury will tap the market (5-yr).

Following a substantial improvement in January, the euro zone PMI’s hovered broadly sideways over the previous months and no change is expected in April. Regarding the manufacturing PMI, the consensus is looking for a stabilization at 53.0 in April, following a marginal drop in March. In the previous months, manufacturing sentiment slowed in Germany as export demand weakened, while also the Ukraine crisis weighed on sentiment. After the weakening in the previous two months, we see risks for a limited rebound in the manufacturing PMI. The services PMI is expected to show a small rebound, from 52.2 to 52.5, following a slight drop in March.

Domestic demand in the euro area seems to have improved somewhat recently, which might support sentiment in the services sector. For the services PMI too, we hope to see an upward surprise. In the US, the markit PMI has been somewhat stronger than the official manufacturing ISM over the previous months. After a drop in March however, the consensus is looking for an increase from 55.5 to 56.0 in April. Finally, US new home sales are expected to show a small increase in March, by 2.3% M/M to 450 000. The impact of bad weather conditions on new home sales was limited over the previous months, but tight inventories are a more important factor weighing on sales. We believe therefore that the risks remain for a weaker outcome.

The Portuguese debt agency taps the on the run 10-yr OT (5.65% Feb2024) for a total amount of €0.5-0.75B. It’s the first regular Portuguese tap auction since early 2011. Portugal follows in the footsteps of Ireland, which successfully started tapping bonds again earlier this year. The bond didn’t cheapen going into the auction, but offers the largest pick-up in ASW spread terms on the long end of the Portuguese yield curve. Overall, we believe that the auction will go well. Investors continue their hunt for yield and in that respect, Portugal offers them a nice opportunity.

The US $32B 2-yr Note auction was okay, nothing special. The auction stopped just below the WI. Overall demand was good with a 3.35 bid cover versus 3.20 last month and a 3.32 average. The buy-side figures were weakish with a small Indirect bid. Also the Direct bid was small, but it was made up for by an above average Dealer bid. Today, the Treasury continues its end-month financing operation with a $35B 5-yer Note auction, which currently trades at 1.755% bid.

Overnight, Asian equity markets trade again mixed. Japan outperforms, whereas China is an underperformer. The HSBC Manufacturing PMI came out exactly in line with expectation but showed only a very limited improvement from 48 to 48.3. The US Note future trades flat, giving no indication for the start of trading.

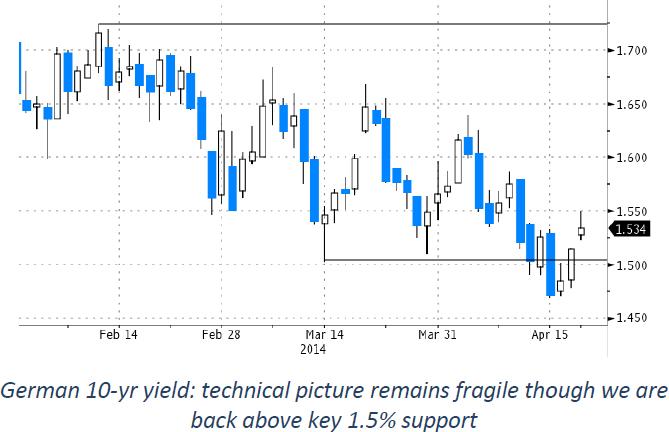

Today, the eco calendar heats up in EMU with April PMI’s. We see risks for a stronger outcome and we hope to see a reaction on bond markets (lower). We add though that of late, eco data are bluntly ignored and of course in EMU, most attention currently goes to inflation numbers. Earnings results and tensions in Ukraine are important for risk sentiment on equity markets. Last week, this was an important driver for bond markets, though yesterday, there was some disconnection. Finally, technical elements should be considered as well. The technical picture of the German 10-yr yield remains fragile though we moved back north of 1.50% support since Thursday. Overall, we don’t anticipate a clean break below 1.50%.

This non-exhaustive information is based on short-term forecasts for expected developments on the financial markets. KBC Bank cannot guarantee that these forecasts will materialize and cannot be held liable in any way for direct or consequential loss arising from any use of this document or its content. The document is not intended as personalized investment advice and does not constitute a recommendation to buy, sell or hold investments described herein. Although information has been obtained from and is based upon sources KBC believes to be reliable, KBC does not guarantee the accuracy of this information, which may be incomplete or condensed. All opinions and estimates constitute a KBC judgment as of the data of the report and are subject to change without notice.

Recommended Content

Editors’ Picks

EUR/USD regains traction, recovers above 1.0700

EUR/USD regained its traction and turned positive on the day above 1.0700 in the American session. The US Dollar struggles to preserve its strength after the data from the US showed that the economy grew at a softer pace than expected in Q1.

GBP/USD returns to 1.2500 area in volatile session

GBP/USD reversed its direction and recovered to 1.2500 after falling to the 1.2450 area earlier in the day. Although markets remain risk-averse, the US Dollar struggles to find demand following the disappointing GDP data.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.