ECB comments block euro rebound

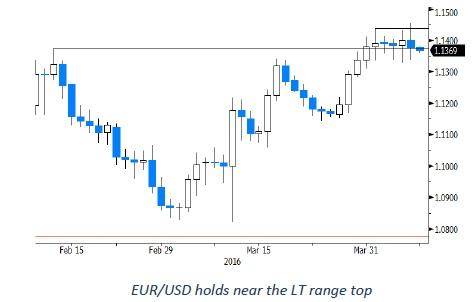

Yesterday, the dollar stayed under pressure against the yen in the wake of Wednesday’s soft Fed‐minutes. The yen remains the biggest “victim’ of the overall USD setback. USD/JPY dropped temporary below the 108, but closed the session off the intraday low at 108.21, still substantially lower from Wednesday’s 109.79 close. The picture of EUR/USD was different. ECB members countered euro strength by flagging the possibility of further easing if necessary. EUR/USD set a new correction top in the mid 1.14 area but closed the day at 1.1378 (from 1.1399 on Wednesday).

Overnight, most Asian equities trade with losses, but the damage could have been worse given the performance of WS yesterday evening. Japanese equities opened in the red, but rebounded as the yen is coming off yesterday’s highs.

Japanese officials, including Fin Min Aso, labelled the rise of the yen as onesided and said the government would take action if needed. USD/JPY rebounded, at least temporary, and trades currently in the 108.85 area. Brent Oil also tries to regain the $40/barrel mark as investors ponder the possibility of coordinated production cuts. Even so, the oil rebound this times hardly supports the likes of the AUD, with AUD/USD struggling to hold north of 0.75. EUR/USD settles in the upper half of the 1.13 big figure after yesterday’s ECB speak. The pair trades currently at 1.1360.

Today, there are only second tier eco data on the agenda in Europe and in the US. Trading in the major USD cross rates will be at the mercy of global sentiment, the swings in the oil price and central bankers’ speak. In the US, Fed Dudley speaks. He is a close ally of Yellen. Oil rebounded overnight, but the direct impact on dollar was not really clear. If risk sentiment turns a bit more positive, it could inspire a modest USD rebound short‐term. Especially USD/JPY is entering in oversold territory and might be ripe for an upward correction if the global context allows it. Regarding EUR/USD, we look out whether there is any follow‐through price action after yesterday’s soft ECB speak. At least for now, the 1.1495 resistance looks a bit better protected. We also keep an eye at the intra‐EMU spreads. Of late they were no real an issue for euro trading. However, if the recent widening persists, it could become a negative for the euro.

After the dovish March ECB and FOMC meetings, the dollar was sold.

Subsequently, the EUR/USD 1.1376 resistance was broken after soft comments from Yellen. EUR/USD set an new reaction top/2016 high at 1.1438. The 1.1495 resistance is the key line in the sand medium term, but is left intact for now. We see no trigger for a clear directional move in EUR/USD short‐term.

Medium term, the dollar probably needs really good news from the US to regain substantial ground. The soft Fed approach and the risk‐off sentiment pushed USD/JPY below the 110.99/114.87 range. The pair set a new correction low below 108 yesterday. It is difficult for USD/JPY to regain ground in a sustainable way as long as risk sentiment remains fragile. We look out whether official talk on more BOJ easing or some kind of verbal interventions from the BOJ can slow/stop the rebound of the yen. USD/JPY has moved into oversold territory. So, there is room for a technical rebound/consolidation.

EUR/GBP holds near the recent highs

Yesterday, morning it looked that the sterling sell‐off would continue unabatedly. EUR/GBP set a minor new correction top in the 0.8117 area.

However, the ECB comments also capped the topside in this cross rate. The overall euro correction finally pushed EUR/GBP back below the 0.81 big figure. EUR/GBP closed the session at 0.8094 (from 0.8071). Cable closed the session at 1.4053. So, the pair struggled to hold above the recent lows. Regarding the UK data, Halifax house prices rose at a strong 10.1% Y/Y. At the same time unit labour costs remained low at 1.3% Y/Y. The impact of the data on sterling, if anything, was very limited.

Today, the eco calendar in the UK is well filled, with the February production data, the trade balance en the NIESR March GDP estimate. Manufacturing production is expected to decline ‐0.2% M/M after a strong rebound (0.7% M/M) in January. The trade deficit is expected to remain at the high levels of the previous months. So, the data are expected weak and we doubt that a modest positive surprise will be able to help sterling. Political pressure on PM Cameron also won’t help the Pro EU campaign. If global tensions ease, the decline of sterling might also take a breather. However, we don’t see room for a sustained sterling rebound.

The technical picture of EUR/GBP improved further as the pair broke above the 0.7929/31 resistance and currently even above the 0.8066 level. The recent sterling decline has been fast, which heightens the chances for a (temporary) pause. Even so, we don’t try to catch a falling knife and remain cautious on sterling longs.

This non-exhaustive information is based on short-term forecasts for expected developments on the financial markets. KBC Bank cannot guarantee that these forecasts will materialize and cannot be held liable in any way for direct or consequential loss arising from any use of this document or its content. The document is not intended as personalized investment advice and does not constitute a recommendation to buy, sell or hold investments described herein. Although information has been obtained from and is based upon sources KBC believes to be reliable, KBC does not guarantee the accuracy of this information, which may be incomplete or condensed. All opinions and estimates constitute a KBC judgment as of the data of the report and are subject to change without notice.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.