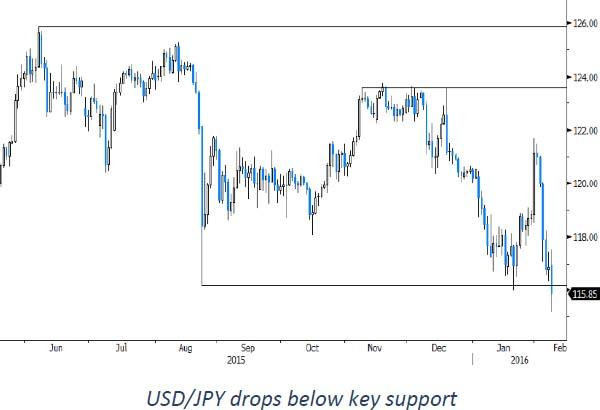

On Monday, global markets slipped again in outright risk‐off modus even as Chinese markets were closed. On the currency market, the yen obviously remained the preferred safe haven currency. USD/JPY dropped below the key 115.98 support and closed the session at 115.85 (from 116.87 on Friday).

Initially, the dollar rather than the euro was the preferred second best. EUR/USD dropped temporary below 1.11 but rebounded later as the US equity sell‐off accelerated. EUR/USD closed the session at 1.1193 (from 1.1158 on Friday). So, the jury is still out on which currency will be the second best among the majors to take up a safe haven role. The trade‐weighted dollar reversed an earlier rebound and closed the session in the red.

This morning, a lot of Asian markets are still closed for the Lunar New Year holidays. Japanese markets are again in very rough weather. Japanese equity indices show losses of about 5%. The 10‐year government bond yield dropped below 0%. The yen strengthens further after yesterday’s break below the USD/JPY 115.96 support. The pair trades currency at 114. 75. Brent oil hovers near $ 33 p/b but the losses are moderate given the wild swings on markets. The same conclusions applies for commodity currencies like the Aussie dollar (AUD/USD currently 0.7035) and Canadian dollar (CAD/USD at 1.3950). EUR/USD trades marginally higher at 1.1205.

Today, the calendar is thin. In the US, NFIB small business confidence, JOLTS job report and wholesale inventories will be released. A big negative surprise can reinforce the negative ST momentum, but we don’t see a lasting impact on USD trading. Global factors will again set the tone for currency trading.

Global sentiment on risk will probably be driven by headlines on the stress in the financial sector. Over the previous days, intra‐EMU government bond spreads also widened in a substantial way. On the other hand, interest rate differentials between the dollar and the euro might narrow further as markets price out the chances of more Fed tightening. It’s difficult to assess the relative weight of both factors for the EUR/USD balance. However, with important pockets of rising financial stress coming to the surface, we don’t see a big case for the euro to be a better safe haven than the dollar. Ever deeper negative interest rates are also no help for the euro. The jury is still out and currency markets made some wild, chaotic swings of late. However, we don’t see a big case for big sustained euro gains.

From a technical point of view, EUR/USD broke above the 1.1060/1.1124 resistance area (15 Dec top: 62% retracement). This is a dollar negative. The short‐term correction high stands at 1.1246. Next important resistance kicks in at 1.1495.The jury is still out, but we have think that the EUR/USD rebound might be topping out. The picture for USD/JPY improved temporarily as the pair rebounded above 120 after the BoJ easing two weeks ago. However, the gains evaporated very soon. The pair yesterday even dropped below the key 115.98 pre‐BOJ correction low. This a high profile warning signal. We expect the BOJ to send warning signals. However, for now there is no good reason to fight current yen strength as long as global uncertainty persists.

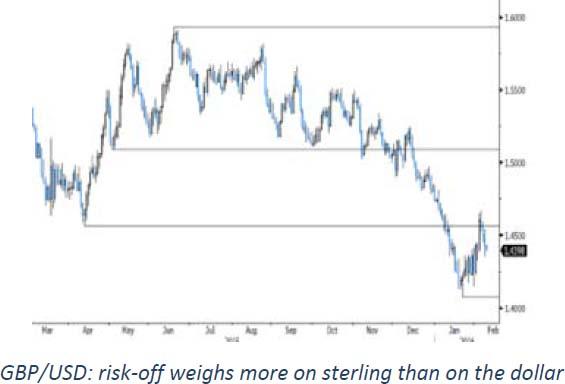

Global sell-off continues to weigh on sterling

There were no important UK eco data yesterday. Global risk‐off sentiment weighed again heavily on the UK currency. This was in the first place visible in cable. The pair traded in the 1.4545 area just before the open of the European markets, but at some point lost almost 2 big figures. In volatile trading, the pair closed the session at 1.4433 (from 1.4503). In the global risk‐off trade, cable again underperformed EUR/USD (even as EUR/USD dropped temporary around noon). EUR/GBP rebounded to the key 0.7756 resistance and closed the session at 0.7767 (from 0.7670). Uncertainty on Brexit apparently still makes sterling an easy victim when risk sentiment plummets.

This morning, the BRC sales (Iike‐for‐like) were reported at 2.6.% Y/Y in January, much strong than expected (consensus 0.3% Y/Y). However, the report didn’t help sterling much. EUR/GBP still trades in the 0.7775 area. Later today, the UK foreign trade data will be published. The December trade deficit is expected little changed from November. We don’t have a strong reasons to take a different view from the consensus. A weaker figure might be a slight additional negative for sterling. We don’t expect sentiment on sterling to improve in a sustained way even not in case of better than expected trade data. Global factors will continue to set the tone for sterling trading. For now, it looks that the context remains sterling negative. We maintain the view that a sustained comeback of sterling will be difficult as long as there is no clear sign how the Brexit debate will turn out. The medium term technical picture of sterling against the euro remains negative as EUR/GBP broke above the 0.7493 Oct top. Next big resistance stands at 0.7854/75. A return below EUR/GBP 0.74 would be a first indication that sterling enters calmer waters.

This non-exhaustive information is based on short-term forecasts for expected developments on the financial markets. KBC Bank cannot guarantee that these forecasts will materialize and cannot be held liable in any way for direct or consequential loss arising from any use of this document or its content. The document is not intended as personalized investment advice and does not constitute a recommendation to buy, sell or hold investments described herein. Although information has been obtained from and is based upon sources KBC believes to be reliable, KBC does not guarantee the accuracy of this information, which may be incomplete or condensed. All opinions and estimates constitute a KBC judgment as of the data of the report and are subject to change without notice.

Recommended Content

Editors’ Picks

EUR/USD holds steady near 1.0650 amid risk reset

EUR/USD is holding onto its recovery mode near 1.0650 in European trading on Friday. A recovery in risk sentiment is helping the pair, as the safe-haven US Dollar pares gains. Earlier today, reports of an Israeli strike inside Iran spooked markets.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD is rebounding toward 1.2450 in early Europe on Friday, having tested 1.2400 after the UK Retail Sales volumes stagnated again in March, The pair recovers in tandem with risk sentiment, as traders take account of the likely Israel's missile strikes on Iran.

Gold: Middle East war fears spark fresh XAU/USD rally, will it sustain?

Gold price is trading close to $2,400 early Friday, reversing from a fresh five-day high reached at $2,418 earlier in the Asian session. Despite the pullback, Gold price remains on track to book the fifth weekly gain in a row.

Bitcoin Price Outlook: All eyes on BTC as CNN calls halving the ‘World Cup for Bitcoin’

Bitcoin price remains the focus of traders and investors ahead of the halving, which is an important event expected to kick off the next bull market. Amid conflicting forecasts from analysts, an international media site has lauded the halving and what it means for the industry.

Geopolitics once again take centre stage, as UK Retail Sales wither

Nearly a week to the day when Iran sent drones and missiles into Israel, Israel has retaliated and sent a missile into Iran. The initial reports caused a large uptick in the oil price.