Yesterday, global markets traded volatile. At the end of the day two developments did catch the eye. First, oil rebounded sharply even as equities traded very volatile and as US oil inventories were much higher than expected. Second, the dollar was sold across the board. The US data were mixed with a good ADP labour report, but the non-manufacturing ISM missed the consensus by a wide margin. The latter reinforced the dollar sell-off and pushed EUR/USD beyond 1.10. Soft comments from Fed members Brainard and Dudley also added to the USD selling. EUR/USD closed the session at 1.1105 (from 1.0919 on Tuesday). USD/JPY dropped further and closed the day at 117.90 (from 119.97). The traded-weighed dollar lost more than 1.5%.

This morning, most Asian equities markets trade with modest gains after a positive reversal in the US yesterday. Japan underperforms as the decline in USD/JPY weighs. The PBOC fixed the yuan slightly stronger against the dollar. The CNH trades slightly weaker at USD/CNH 6.6138. With the dollar sharply lower across the board, the yuan is also trading weaker against most of its regional competitors. The commodity currencies remain well bid with the Canadian dollar trading in the USD/CAD 1.3765 area. AUD/USD has rebounded to the 0.7175 area. The dollar stabilizes against the yen (USD/JPY 117.95) and the euro (EUR/USD 1.1080) after yesterday’s sell-off.

Today the US calendar is better filled, but without market movers. However, there are plenty of other events on the calendar. We keep an eye at the winter economic forecasts of the European commission. Especially, the inflation forecast is interesting. A soft inflation forecast might provide ammunition for further ECB easing. Various central bankers will speak, including ECB’s Draghi.

Yesterday’s price move changed the short-term picture for the US currency in a profound way. The reaction to the BOJ implementation of a negative interest rate illustrates that it is no guarantee for a sustained decline of the currency.

The situation in the EMU is different as rates are substantially more negative in absolute terms which we consider a negative for the currency. We also keep an eye at the link between the dollar and commodities, especially oil. Will the inverse link between oil and the dollar be restored. Last but not least, the decline in the interest rate differential between the euro and the dollar (and between the dollar and other currencies) probably added to the US correction. At the same time, most expected Fed tightening for 2016 has been priced out.

EUR/USD as now arrived at levels that could be interesting to reconsider EUR/USD shorts as we assume that the threat of more ECB easing should finally cap the topside in EUR/USD. That said, we first want confirmation that there is no follow-through price action on yesterday’s repositioning. In this respect, tomorrow’s payrolls play an important role.

From a technical point of view, EUR/USD broke (temporary?) above the 1.1060/1.1124 resistance area (15 Dec top: 62% retracement). Next important resistance is seen at 1.1495. The picture for USD/JPY improved temporarily as the pair rebounded above 120 after Friday’s BOJ policy decision. However, the gains could not be sustained. We remain negative on USD/JPY, especially as long as global uncertainty persists.

Cable jumps on USD weakness

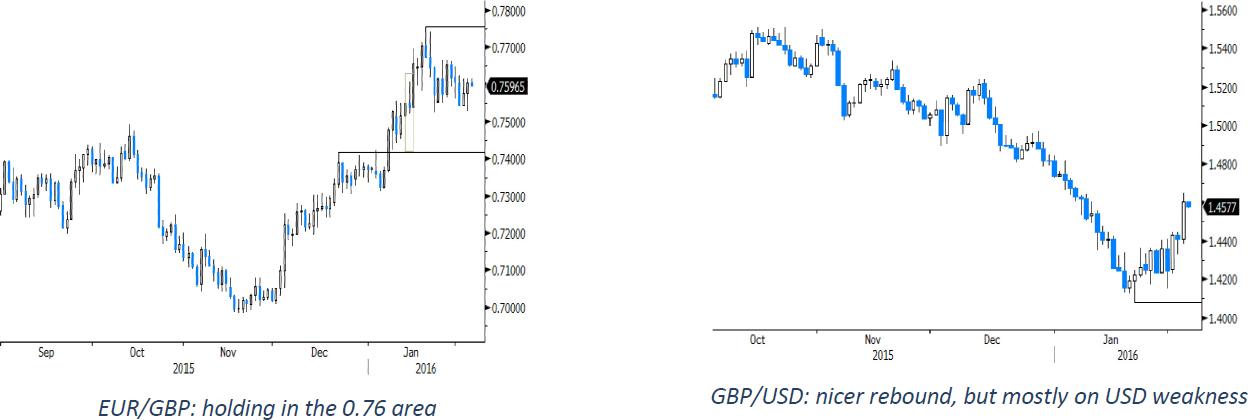

Yesterday, the price action in sterling was fairly constructive given the volatility on other markets. The news flow was again mixed, at best. Oil rebounded but equities struggled. The UK services PMI was marginally better than expected, but the details didn’t convince. Investors apparently feared a worse report. The sterling rebound and EUR/GBP drifted to the 0.7530 area. Cable regained the 1.45 level. Investors maybe also reduced sterling shorts ahead of tomorrow’s BoE policy statement. The BoE is expected to remain soft, but this is probably discounted after the recent sterling decline. In the afternoon, the sterling trading was driven by the repositioning in the dollar. EUR/GBP rebounded in line with EUR/USD and closed the session at 0.7604 (from 0.7577). Cable rebounded further on USD weakness to close the session at 1.4603.

Today, the focus is on the BOE policy decision and in particular on the press conference from ECB’s Carney and on the inflation report. The BoE is expected to keep a soft tone as inflation will be seen low for longer. However, this should already be discounted as the market only expects a first rate hike after March 2017. Over the previous days, sterling entered calmer waters and event staged a nice rebound against the dollar. A further rebound of the oil price could help to put a floor for sterling short-term. In a longer term perspective, uncertainty on Brexit and global risk-off sentiment remain a negative for sterling. As long as these issues aren’t solved, a sustained sterling rebound is unlikely. The medium term technical picture of sterling against the euro remains negative as EUR/GBP broke above the 0.7493 Oct top. Next resistance stands at 0.7875. A return below 0.74 would be a first indication that sterling enters calmer waters.

This non-exhaustive information is based on short-term forecasts for expected developments on the financial markets. KBC Bank cannot guarantee that these forecasts will materialize and cannot be held liable in any way for direct or consequential loss arising from any use of this document or its content. The document is not intended as personalized investment advice and does not constitute a recommendation to buy, sell or hold investments described herein. Although information has been obtained from and is based upon sources KBC believes to be reliable, KBC does not guarantee the accuracy of this information, which may be incomplete or condensed. All opinions and estimates constitute a KBC judgment as of the data of the report and are subject to change without notice.

Recommended Content

Editors’ Picks

EUR/USD regains traction, recovers above 1.0700

EUR/USD regained its traction and turned positive on the day above 1.0700 in the American session. The US Dollar struggles to preserve its strength after the data from the US showed that the economy grew at a softer pace than expected in Q1.

GBP/USD returns to 1.2500 area in volatile session

GBP/USD reversed its direction and recovered to 1.2500 after falling to the 1.2450 area earlier in the day. Although markets remain risk-averse, the US Dollar struggles to find demand following the disappointing GDP data.

Gold climbs above $2,340 following earlier drop

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.