Dollar stalemate persists despite global uncertainty

On Thursday, USD trading was still at the mercy of the swings in global risk sentiment. This time, equity sentiment improved throughout the session. US equities even closed with good gains. Of course, a one day technical improvement in equity sentiment (without high profile economic news) is not enough to conclude that the financial instability is over. So, the impact on other markets, including currency ones, was modest. The dollar reversed earlier losses against the euro (EUR/USD 1.0865 from 1.0877 on Thursday) and the yen (USD/JPY 118.06 from 117.68).

Overnight, most Asian equity indices opened the session with substantial gains after the strong close in the US. However, there was no follow-through price action. The gains evaporated and most Asian markets trade currently even again in the red. Chinese financing data showed a mixed picture. Aggregate financing was higher than expected, but mostly due to off-balance sheet lending, which suggests reluctance from banks sector to provide credit. The PBOC fixed the on-shore yuan marginally weaker. Even so, the onshore yuan trades slightly stronger in the 6.5865 area. The off shore yuan weakens to 6.6170. The HKD is holding relatively weak (USD/HKD in the 7.7850 area.). Brent oil continues to trade in the $30 p/b area, holding commodity currencies (AUD, CAD, NZD..) near the recent lows against the dollar. The intraday reversal on the Asian equity markets has only a limited impact on EUR/USD (currently 1.0885 area) and on USD/JPY (117.80 area).

Today, at last, there are plenty potential market moving data, especially in the US (Retails sales, PPI, empire manufacturing, industrial production and Consumer confidence from the university of Michigan). For an in depth analysis see the FI part of this report. We see slight upward risks for core retail sales and the empire manufacturing, but downside risks for the Michigan confidence. From a market point of view, we see somewhat of an asymmetrical risk. Poor US data might reinforce fears on the global economy and be moderately negative for the dollar. On the other hand, data have to be really strong to inspire a genuine improvement in global investor sentiment and to support the dollar in a sustainable way. USD/JPY and EUR/USD held within tight ranges recently, despite the swings in global sentiment. For now , we don’t see a trigger to change this pattern of directionless USD trading. For EUR/USD, markets concluded that current global uncertainty won’t substantially affect the relative position between the Fed and the ECB. So, we see slight downside risks for the dollar today, but EUR/USD and USD/JPY to hold within recent ranges.

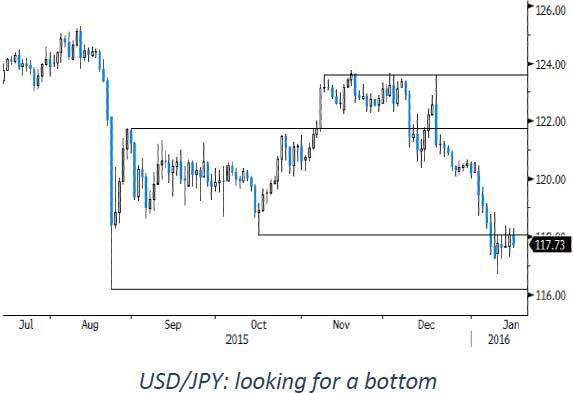

From a technical point of view, EUR/USD failed to regain important resistances at 1.1087 (breakdown) and 1.1124 (62% retracement from the October high). Last week, EUR/USD failed to sustain below 1.0796 support (07 Dec low). Next support is at 1.0650 (76% retracement off 1.0524/1.1060) and at 1.0524. On the topside, 1.1004 (reaction top) is a first reference. Next resistance comes in at 1.1060/1.1124 (15 Dec top/62% retracement). We expect this resistance to be strong and difficult to break. The picture for USD/JPY remains negative below 120. Next support comes in at 116.18 (August low). The pair moved into oversold territory and now tries to put a bottom in place.

Sterling rebounds slightly after BoE announcement

On Thursday, sterling weakened ahead of the BoE policy announcement, partially due to the risk-off sentiment. EUR/GBP tested the 0.76 area. Cable came within reach of the correction low (1.4352); but a real test didn’t occur.

The BoE voted again 8-1 to leave the base rate unchanged. The tone of the statement was soft, as expected, but not that much different from December and from the November inflation report. Staff projections for growth in Q4 and Q1 were revised slightly lower to 0.5% Q/Q. Recent events (domestically and external) suggest slightly lower inflation short-term, but the MPC still expects inflation to return to target at the end of the policy horizon given current market curves. Sterling rebounded modestly after the BoE announcement. Call it some kind of ‘sell the rumour, buy the fact reaction’. An improvement in global risk sentiment later the session also helped sterling. EUR/GBP closed the session at 0.7539 (from 0.7550); cable at 1.4413 (from 1.4407).

Today, only the UK November construction output data will be published. The series is volatile and a bit outdated so we don’t expect a lasting impact on sterling trading. Yesterday’s BoE decision/minutes don’t change the picture for sterling trading. The BoE stays in wait-and see modus as inflation will probably stay low for longer than expected. However is this largely discounted in the ST UK interest rate markets? The February inflation report might slightly amend the BoE’s assessment. For now, we keep the view that uncertainty on Brexit and global sentiment are also important drivers for sterling weakness. As these issues won’t be solved anytime soon, we don’t see a trigger for a sustained sterling rebound. The medium term technical picture of sterling against the euro remains negative as EUR/GBP broke above the 0.7493 Oct top. Next resistance stands at 0.7593 (Feb 2015 top). Sterling is in oversold territory against the euro and the dollar, but it is no good enough a reason to rush into sterling longs yet.

This non-exhaustive information is based on short-term forecasts for expected developments on the financial markets. KBC Bank cannot guarantee that these forecasts will materialize and cannot be held liable in any way for direct or consequential loss arising from any use of this document or its content. The document is not intended as personalized investment advice and does not constitute a recommendation to buy, sell or hold investments described herein. Although information has been obtained from and is based upon sources KBC believes to be reliable, KBC does not guarantee the accuracy of this information, which may be incomplete or condensed. All opinions and estimates constitute a KBC judgment as of the data of the report and are subject to change without notice.

Recommended Content

Editors’ Picks

EUR/USD extends gains above 1.0700, focus on key US data

EUR/USD meets fresh demand and rises toward 1.0750 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

GBP/USD extends recovery above 1.2500, awaits US GDP data

GBP/USD is catching a fresh bid wave, rising above 1.2500 in European trading on Thursday. The US Dollar resumes its corrective downside, as traders resort to repositioning ahead of the high-impact US advance GDP data for the first quarter.

Gold price edges higher amid weaker USD and softer risk tone, focus remains on US GDP

Gold price (XAU/USD) attracts some dip-buying in the vicinity of the $2,300 mark on Thursday and for now, seems to have snapped a three-day losing streak, though the upside potential seems limited.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.