On Tuesday, the dollar correction initially continued helped by surprisingly strong EMU PMI’s, but the tide turned after higher US CPI data, bringing EUR/USD and USD/JPY again close to the opening levels. EUR/USD closed the session at 1.0924 (from 1.0946). USD/JPY ended the day at 119.76, almost unchanged from the previous close at 119.73.

Overnight, most Asian equities trade in positive territory with China underperforming as yesterday’s poor PMI data still weigh. The major currency cross rates show no clear direction and are trading near yesterday’s closing levels. USD/JPY trades in the 119.65 area. EUR/USD is changing hands in the 1.0925 area.

Today, in Europe the French industrial confidence data and the German IFO business climate will be published. A further improvement is expected. This looks reasonable in the wake of strong German PMI’s. Yesterday, the euro profited slightly from the strong EMU PMI, but the gains couldn’t be sustained later. In the US, the durable goods orders are expected to show a moderate rebound. Over the previous months, core orders (ex-transportation) were clearly in a weak spot. A positive surprise is possible, but it is far from sure that it will be enough to change fortunes in favour of the US currency. The series is very volatile and currency investors probably want more consistent confirmation that the US economy is regaining momentum. Greece remains a wildcards. Markets will look for the ECB decision on ELA support. However, of late Greece was seldom a big issue for euro trading.

The dollar lost quite some interest rate support after last week’s FOMC decision as markets anticipate a very gradual Fed tightening cycle. Yesterday, the dollar decline halted ahead of the post-Fed high in EUR/USD (1.1043). We have the impression that the EUR/USD rally/correction is slowing. However, any sustained comeback of the dollar looks difficult as long as US bond yields keep falling. Or will QE again take over as a driver for euro trading? We look how the 1.1043/1.1098 resistance area holds. We eventually prefer to sell into strength, but are in no hurry to rush in already at this stage.

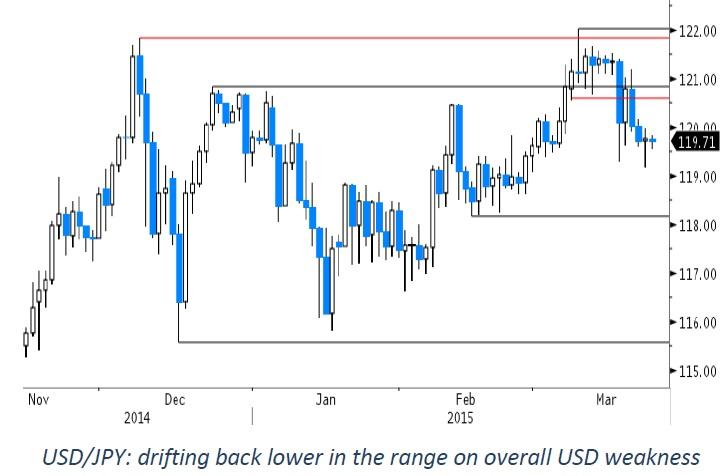

The technical picture for the EUR/USD cross rate is bearish since the pair dropped below the previous cycle low (1.1098). The 1.0500 area was extensively tested, but a sustained break didn’t occur. In the wake of the Fed meeting, a first intermediate resistance at 1.0717 area was easily regained, an indication that the euro decline lost momentum. The 1.1043/98 (post FOMC high/prev. low) is a very important resistance. A rebound north of 1.1534, still far away, is needed however to question the downtrend. USD/JPY tested the 121.85/122.03 resistance, but a break didn’t occur. The post-Fed setback doesn’t change the USD/JPY picture fundamentally, but some further decline in the established consolidation pattern might be on the cards.

Sterling still fighting an uphill battle

On Tuesday, EUR/GBP started rising after the European open, supported by strong EMU business sentiment. Headline UK Inflation fell to zero in February from 0.3% Y/Y previously. It was 0.1%-point below expectations as was core CPI (1.2% Y/Y). EUR/GBP traded volatile and it took some time before the pair broke higher, setting a high in the 0.7370 area by noon. Afterwards, the rally was exhausted and the pair reverted lower again, as traders felt that the 0.74 resistance would remain out of reach. Cable basically kept a downward trajectory too, especially as the dollar regained some ground after the US CPI data. The 1.50 barrier is a high hurdle.

Today, only the BBA loans for home purchases will be published. In an interview, BoE’s Shafik played a less dovish card compared to some of her colleagues of late. She said that underlying inflation isn’t that low and forces behind low inflation are due to external factors. The central expectation of the MPC is that the next move for rates will be up. We didn’t see a big reaction of sterling yet.

Recently, we advocated to protect EUR/GBP shorts against a temporary countermove and were in no hurry to reinstall EUR/GBP shorts as we want to see the reaction of sterling to elections news. The correction in EUR/GBP last week was already substantial. Even so, we want a clear sign that the correction has run its course before reconsidering new EUR/GBP shorts. We didn’t get such a signal yet. Any decline in EUR/GBP will probably be due to euro weakness rather than a sustained rebound of sterling. We keep a neutral/wait-and-see bias on EUR/GBP short-term.

This non-exhaustive information is based on short-term forecasts for expected developments on the financial markets. KBC Bank cannot guarantee that these forecasts will materialize and cannot be held liable in any way for direct or consequential loss arising from any use of this document or its content. The document is not intended as personalized investment advice and does not constitute a recommendation to buy, sell or hold investments described herein. Although information has been obtained from and is based upon sources KBC believes to be reliable, KBC does not guarantee the accuracy of this information, which may be incomplete or condensed. All opinions and estimates constitute a KBC judgment as of the data of the report and are subject to change without notice.

Recommended Content

Editors’ Picks

AUD/USD tumbles toward 0.6350 as Middle East war fears mount

AUD/USD has come under intense selling pressure and slides toward 0.6350, as risk-aversion intensifies following the news that Israel retaliated with missile strikes on a site in Iran. Fears of the Israel-Iran strife translating into a wider regional conflict are weighing on the higher-yielding Aussie Dollar.

USD/JPY breaches 154.00 as sell-off intensifies on Israel-Iran escalation

USD/JPY is trading below 154.00 after falling hard on confirmation of reports of an Israeli missile strike on Iran, implying that an open conflict is underway and could only spread into a wider Middle East war. Safe-haven Japanese Yen jumped, helped by BoJ Governor Ueda's comments.

Gold price jumps above $2,400 as MidEast escalation sparks flight to safety

Gold price has caught a fresh bid wave, jumping beyond $2,400 after Israel's retaliatory strikes on Iran sparked a global flight to safety mode and rushed flows into the ultimate safe-haven Gold. Risk assets are taking a big hit, as risk-aversion creeps into Asian trading on Friday.

WTI surges to $85.00 amid Israel-Iran tensions

Western Texas Intermediate, the US crude oil benchmark, is trading around $85.00 on Friday. The black gold gains traction on the day amid the escalating tension between Israel and Iran after a US official confirmed that Israeli missiles had hit a site in Iran.

Dogwifhat price pumps 5% ahead of possible Coinbase effect

Dogwifhat price recorded an uptick on Thursday, going as far as to outperform its peers in the meme coins space. Second only to Bonk Inu, WIF token’s show of strength was not just influenced by Bitcoin price reclaiming above $63,000.