Uneventful trading ahead of FOMC decision

Yesterday, the FOMC meeting continued to overshadow trading. Mixed US eco data resulted in some modest dollar weakness against the euro, suggesting traders remain somewhat concerned that the FOMC may surprise by not ending QE purchases, which might have helped equities too. EUR/USD rose more on weak US durable orders, while it gave back only marginally ground on super strong US consumer and Richmond manufacturing sentiment surveys.

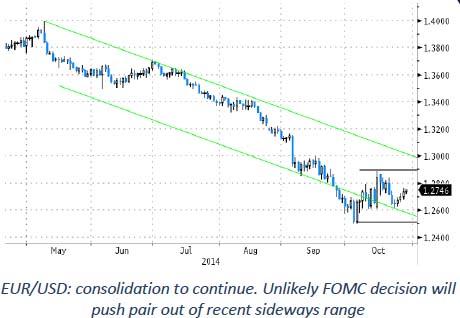

We’ll know more about the FOMC this evening. EUR/USD closed at 1.2735, up from the 1.2698 previous close. It was the third session in which EUR/USD rose, but gains are still modest and technically irrelevant. Stronger equities (risk-on) underpinned USD/JPY that closed at 108.16 from 107.82 at yesterday’s close, which is a bit disappointing given strong late session equity gains. Also here the changes were technically irrelevant. 108.38 is first key resistance.

Overnight, Asian equities trade higher following a strong finish at Wall Street. Facebook is sharply lower in after-trade on guidance for difficult Q4. Japan’s production for September was stronger than expected. However, markets are clearly waiting on the FOMC verdict. EUR/USD trades flat.

Today, European eco data remain second tier, even if French consumer confidence and Belgian GDP (see FI section) are interesting. The ECB’s Bank Lending Survey is interesting too (see FI section). The Q2 report showed the first easing in credit conditions and higher credit demand since 2007. A further improvement would be encouraging for the EMU economy longer term. It might be a slight euro positive, as it, at the margin, diminishes the likely size of ECB balance sheet expansion. Less QE than expected is euro positive. However, we shouldn’t expect too much effect on FX. On its own, the report is unlikely to shift market thinking on QE and the market is more focussed on the FOMC decision this evening.

Regarding the FOMC meeting, we see the FOMC end its QE purchase programme, despite some earlier comments of St-Louis Fed Bullard who suggested that they could postpone the end of QE buying. We see no good reason for such postponement. Economic data were sufficiently strong since the previous FOMC with the unemployment rate also dropping to 5.9% and inflation broadly stabilizing. Finally, calm returned to markets. If we and most analysts are wrong on this point and the FOMC does postpone the end of QE, the dollar should sell off. Secondly, there is the forward guidance. Most likely it will be kept at least until the December meeting when new forecasts are available and a press conference follows.

An, albeit unlikely change in the forward guidance like replacing the “considerable period of time” phrase, would likely give the dollar a boost. It will be seen as a step closer to the rate lift-off. While we have a longer term dollar bullish view, we wouldn’t anticipate a resumption of the dollar rally on the FOMC decision. Most likely, the Fed will be steady as she goes keeping EUR/USD in its 1.25 to 1.2995 range. A weakening of the dollar toward 1.2995 is worth a dollar buy, as would be a break below 1.25. However, none of these are likely on the FOMC decision.

The technical picture of EUR/USD deteriorated after the break below the key 1.2662 support level (Nov 2012 low). We have a LT negative bias on EUR/USD. The trend is intact, but the price action over the last two weeks suggests that the market was too long USD. In the meantime, dollar overbought conditions have been worked off. The 1.2043/1.1877 support is the next LT target, but a drop below 1.25 is needed before the picture becomes again dollar bullish ST. A re-break above 1.2995 would be really significant and question the longstanding EUR/USD downtrend. This is not our preferred scenario though.

Cable cannot take out resistance

Yesterday, EUR/GBP kept a sideways profile in technically inspired trading, ranging between 0.7872 and 0.79. There were no eco releases that mattered and dovish talk of BoE deputy governor Ms. “Minouche” Shafik and ex-BoE governor Blanchflower were bluntly ignored. Weak US durables orders sent cable in early afternoon to 1.6178 from 1.6120 earlier. The 1.6178/1.6227 resistance in cable is technically important, as it is the neckline of a ST triple bottom with final target at 1.6481. A sustained break would suggest that the MT downtrend that started in July is over. However, stronger US consumer sentiment and Richmond Fed manufacturing sentiment protected the resistance after which cable bulls took profit, sending cable back to around opening levels. This cable move dragged sterling a bit lower against the euro too, leaving EUR/GBP at 0.7894 in the close, up from 0.7877 previously.

Overnight, there were no spectacular moves. EUR/GBP trades nearly flat (0.7892); cable is marginally stronger (1.6145). The UK eco calendar contains the lending data, but we don’t expect them to affect trading. Yesterday evening, BoE Cunliffe spoke dovishly. He sees evidence of slowing UK growth amid deteriorating global economic prospects and cites a softening in UK wage data.

A further decline in inflation is a risk. In this context he concluded that the need to raise interest rates has receded. Following Shafik on Monday, another BoE member suggests that tightening is off the table for now. It had little impact on sterling trading though, but of course remains sterling negative and fits in our neutral approach short term.

Of late, we had a sell-on upticks approach for EUR/GBP. We maintain the view that the trend in EUR/GBP stays downward longer term. Short-term, the trend shows signs of fatigue. The 0.7850/0.7755 is a tough support, key resistance stands around 0.8066. We have a neutral approach on EUR/GBP short-term.

This non-exhaustive information is based on short-term forecasts for expected developments on the financial markets. KBC Bank cannot guarantee that these forecasts will materialize and cannot be held liable in any way for direct or consequential loss arising from any use of this document or its content. The document is not intended as personalized investment advice and does not constitute a recommendation to buy, sell or hold investments described herein. Although information has been obtained from and is based upon sources KBC believes to be reliable, KBC does not guarantee the accuracy of this information, which may be incomplete or condensed. All opinions and estimates constitute a KBC judgment as of the data of the report and are subject to change without notice.

Recommended Content

Editors’ Picks

AUD/USD could extend the recovery to 0.6500 and above

The enhanced risk appetite and the weakening of the Greenback enabled AUD/USD to build on the promising start to the week and trade closer to the key barrier at 0.6500 the figure ahead of key inflation figures in Australia.

EUR/USD now refocuses on the 200-day SMA

EUR/USD extended its positive momentum and rose above the 1.0700 yardstick, driven by the intense PMI-led retracement in the US Dollar as well as a prevailing risk-friendly environment in the FX universe.

Gold struggles around $2,325 despite broad US Dollar’s weakness

Gold reversed its direction and rose to the $2,320 area, erasing a large portion of its daily losses in the process. The benchmark 10-year US Treasury bond yield stays in the red below 4.6% following the weak US PMI data and supports XAU/USD.

Bitcoin price makes run for previous cycle highs as Morgan Stanley pushes BTC ETF exposure

Bitcoin (BTC) price strength continues to grow, three days after the fourth halving. Optimism continues to abound in the market as Bitcoiners envision a reclamation of previous cycle highs.

US versus the Eurozone: Inflation divergence causes monetary desynchronization

Historically there is a very close correlation between changes in US Treasury yields and German Bund yields. This is relevant at the current juncture, considering that the recent hawkish twist in the tone of the Federal Reserve might continue to push US long-term interest rates higher and put upward pressure on bond yields in the Eurozone.