Dollar holding tight ranges

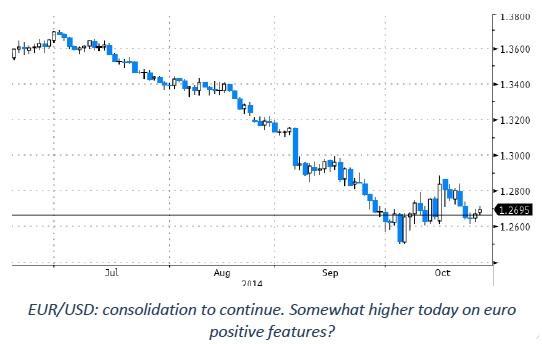

On Friday, there was no big story to guide trading in EUR/USD or in USD/JPY. The confirmation of an NY Ebola patient stopped the risk rally. However, despite declining European equities the dollar held up well. Yield changes were minimal in a daily perspective, but also when they declined in the morning session, it hardly affected FX trading. Uncertainty on the outcome of the AQR also capped the topside in the euro. In a daily perspective, EUR/USD closed at 1.2671, up 25 pips from Thursday’s close. USD/JPY was nearly unchanged at 108.16, down from 108.27 previously.

Overnight, Asian equities trade mixed, following moderate gaines in WS on Friday. The ECB AQR and stress tests will be positively received, even if one shouldn’t draw too many conclusions from it for the overall markets. Focus can now go to other issues like growth and deflation fighting. It will ease concerns about European banks and should address over time loan supply issues. It does nothing on the tepid loan demand though. So, it is a modest risk-on positive. Elsewhere, Dilma Roussef secured a new term as Brazilian president, narrowly beating her opponent. In Ukraine, pro-western parties linked to the president gained the elections. Also here, the lowering of uncertainty is a risk-on item. The FX reaction is mixed. EUR/USD, as one should expect, goes a bit higher, trading now just above 1.27, up about 40 pips. On the other hand, USD/JPY is slightly weaker at 107.93, down from 108.16 Friday eve.

Today, three items may affect trading. First, the AQR/stress tests which are a euro positive and currently already affecting the pair. Second, the IFO business sentiment. We see risks on the upside (see Fixed Income), which would be euro supportive too. Third, the ECB announcement on Covered Bond purchases. If the amount the ECB bought is big, it would suggest that the ECB really wants to raise its balance sheet fast and substantially. That would be euro negative. If the amount of purchases is disappointingly low, which we are afraid it will, it is euro supportive. US eco data are second tier. The market reaction will of course happen against the upcoming FOMC meeting (start tomorrow) and thus keep investors cautious. So, most elements in today’s trading points to a stronger EUR/USD, but can the pair deliver? In a longer perspective, we still think that dollar strength will prevail. So, we would see any euro strengthening as temporary in nature. Technically, the 1.2995 resistance is the line in the sand, but we don’t expect this to be approached today.

The technical picture of EUR/USD deteriorated after the break below the key 1.2662 support level (Nov 2012 low). We have a LT negative bias on EUR/USD. The trend is intact, but the price action over the last two weeks suggests that the market was too long USD. In the meantime, dollar overbought conditions have been worked off. The 1.2043/1.1877 support is the next LT target, but a drop below 1.25 is needed before the picture becomes again dollar bullish ST. A re-break above 1.2995 would be really significant and question longstanding EUR/USD downtrend. This is not our preferred scenario though.

Sterling little changed as UK GDP meets expectations

Friday, the focus for sterling trading was on the advance reading of the UK Q3 GDP. However, growth was reported exactly as expected. UK economic activity expanded 0.7% Q/Q and 3.0% Y/Y. Sterling gained a few ticks against the euro and the dollar after the report. EUR/GBP declined slightly to the 0.7875 area. Cable returned to the 1.6070 area. Investors apparently feared a negative surprise. However, the move had no strong legs and was soon reversed. In the afternoon session, sterling did well and eked out some gains against both euro and dollar. EUR/GBP settled at 0.7875, slightly lower from the 0.7889 previous close. Cable closed at 1.6090, up from 1.6030 previously. There was no specific trigger behind the sterling move, but it was technically not relevant either.

Today, EUR/GBP trading will be largely determined by the AQR/stress tests, the IFO business sentiment and the ECB announcement on covered bond purchases. In our EUR/USD section, we elaborate on these items which we consider as euro positive. The UK calendar contains the CBI retail sales for October. In past months the CBI survey was more upbeat than the hard retail sales data and other surveys. So, while the markets already expect a decline in reported sales to 25 from 31, we see downside risks. It isn’t a strong market mover, but if anything such an outcome would be sterling negative. So, we might see EUR/GBP going somewhat higher today, but as per EUR/USD we see little reasons for a sustained euro rally of technical relevant nature.

Of late, we had a sell-on upticks approach for EUR/GBP. We maintain the view that the trend in EUR/GBP stays downward longer term. Short-term, the trend shows some signs of fatigue. The 0.7850/0.7755 is a tough support short-term. Important resistance stands around 0.8066. We take a more neutral approach on the EUR/GBP cross rate short-term.

This non-exhaustive information is based on short-term forecasts for expected developments on the financial markets. KBC Bank cannot guarantee that these forecasts will materialize and cannot be held liable in any way for direct or consequential loss arising from any use of this document or its content. The document is not intended as personalized investment advice and does not constitute a recommendation to buy, sell or hold investments described herein. Although information has been obtained from and is based upon sources KBC believes to be reliable, KBC does not guarantee the accuracy of this information, which may be incomplete or condensed. All opinions and estimates constitute a KBC judgment as of the data of the report and are subject to change without notice.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.