Outlook:

US data today might encourage a less gloomy mood. The University of Michigan preliminary consumer sentiment index is expected to rise to 92.5 in Feb from 92 in Jan. Also, retail sales are expected up 0.2% m/m.

But the problem is not that economic data indicate a looming recession. It doesn’t. The problem is that market behavior indicates a recession, and can become a self-fulfilling prophecy through such mechanisms as hiring intentions, credit tightening, the wealth effect from the stock market, and so on. This is the theme of a WSJ story by Greg Ip, the Fed-watcher. He writes “Declining markets, worsening psychology and economic weakness can feed on each other. If such a vicious spiral threatened to pull the economy into recession, central banks step in as circuit breakers. These days they are less equipped to do that.” Besides, we have presidential candidates out in force promising extreme spending.

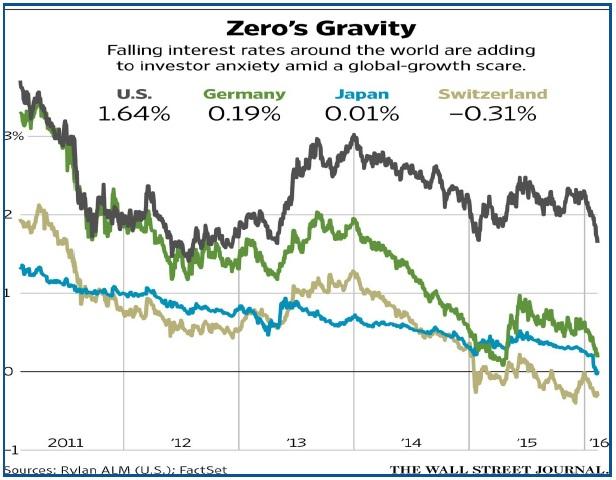

Do falling-to-negative rates automatically drag down US yields, too? The WSJ has an interesting chart. We need to re-examine cause and effect. We don’t buy that deflation and recession and falling yields automatically and mechanically get transferred to another market.

Some folks think the world is going to hell in a handbasket. Market News reports High Frequency Economics chief Weinberg complains that he hasn’t seen such awful conditions in 40 years. “Why is no government leader or finance minister anywhere in the G-7 calling a confab to do something pro-active to address a global economic and financial market collapse?” The current situation could turn into an “uncontrolled spiral that cannot correct itself without a policy intervention” and become an outright depression.

Weinberg is both right and wrong. We don’t doubt the phone lines are burning up around the world, not least because it’s not the job of central banks to “manage” equity or commodity or FX markets--but at the same time, central banks have a duty to prevent disorderly markets. On the whole, central banks (including the Fed) take the stance “let the market decide.” It goes without saying that these two things--let the market decide and preventing disorderly markets--are contradictory and mutually exclusive. Any central banker who comes down on the side of intervention is poking his head up and making it vulnerable to getting hammered.

We wrote yesterday that Japan would not intervene unless it could plausibly claim markets are disorderly. While the dollar/yen was clearly disorderly yesterday, it’s not disorderly today, and possibly because of expectations of intervention. Perhaps expectations of intervention were being priced in when dollar/yen rose up off the low ahead of the US open (110.98) and managed a high of 113.07, only to give it back but still close higher on the US day at about 112.50.

If not central banks or governments offering leadership, who will give guidance? It’s not entirely lacking. JP Morgan CEO Dimon bought $26 million of his own stock. The FT reports the recovery in European bourses this morning was inspired at least in part by Commerzbank restoring its dividend. And after oil prices and energy company equity slides, it’s the financial sector leading equity indices down.

The FT reports that the Nikkei is down 21% year-to-date—but the TSE bank index is down 38%. “… before the current session its S&P 500 and Stoxx 600 peers were off 23 per cent and 29 per cent respectively.” Maybe the Dimon and Commerzbank actions are a feather on a scale, but sometimes a feather is all it takes. Banks have to demonstrate two things—they can make money is a negative rate environment and they have adequate capital if investors dump their paper, like the infamous coco’s. (The correct course of action is to just buy up all the coco’s, of course, which is what a company acquiring another does to keep the tabletop clean.)

As for governments, exactly what happened in Japan is not clear, but the FT reports BoJ chief Kuroda reassured Parliament that the central bank will boost monetary stimulus to achieve 2% inflation. This is not a new message but at least the Japanese leadership is not silent. The WSJ reports after speaking to Parliament, Kuroda walked across the street to PM Abe’s office and they went for an unscheduled lunch. Afterwards, Kuroda said the meeting was “routine.” Yeah, sure. We are not even sure it was Kuroda. Several FX websites report the guy who visited Abe was MoF currency expert Asakawa, reportedly from a Dow-Jones report. Wait a minute—isn’t the WSJ a division of Dow-Jones?

Be careful what you read.

The WSJ interviewed Abe advisors, one of whom points out diverging policies among countries are “not harmonized.” Also, FinMin Aso said “currency movements have been ‘rough’ and ‘we will act appropriately if that becomes necessary.’” The newspaper omits to specify exactly when Aso made this remark. He had made it many times before. Is it new?

“But analysts said it would be hard for Japanese officials to persuade counterparts in the U.S. that the yen was overvalued, especially during a U.S. presidential campaign when candidates are taking a skeptical view of global trade. Nomura Securities chief foreign-exchange strategist Yunosuke Ikeda said the yen was still slightly undervalued according to an Organization for Economic Cooperation and Development calculation. To buy a basket of goods at the same price, the yen would have to trade at 105 to the U.S. dollar, according to the OECD. ‘It would be difficult to go ahead with currency intervention’ until the yen surpasses that level, Mr. Ikeda said.” We don’t buy it—who responds to market crises by reference to the reviled OECD and its cockamamie data?—but never mind. At the least it shows intervention is on the table. Maybe.

Bottom line, Weinberg’s distress cry that something must be done was answered by Dimon, Commerzbank and Japanese chatter. Markets find a way—sometimes. By the time of the next G7 and G20 meetings, this episode may be behind us.

Next is the weekend, with China expected to report various data, including bank lending and trade. What everyone will be watching is how the Shanghai opens on Monday and how it fares. Unless China announces something new over the weekend, the equity crowd can (1) track other indices lower or (2) rise up on bottom-fishing. Take your choice. Remember, Monday is technically a national holiday in the US. Don’t get into any positions you can’t get out of.

Note 1: We know that growth has slowed globally so it’s no surprise that the shipping of commodities and other goods will have fallen off, too. This is what the Baltic Dry Index measures—shipping volumes. We don’t know how good an indicator it is but some analysts swear by it, so we give a whirl once in a while. Here is the current reading, on a monthly basis that includes the giant collapse of 2008-09. Note that this year is the first time since late 2008 that the index has fallen below horizontal red support.

Note 2: Monday is a national holiday in the US, President’s Day (celebrating both Washington and Lincoln but not actually on either’s exact date). The stock and bond markets will be closed but some banks will be open. That means some will trade FX so we don’t get the day off. The CME holiday calendar requires a PhD in physics, math and astrology, but we know there is no settlement on Monday. We will produce reports as usual. It’s probably going to be an eventful day.

| Current | Signal | Signal | Signal | |||

| Currency | Spot | Position | Strength | Date | Rate | Gain/Loss |

| USD/JPY | 112.56 | SHORT USD | STRONG | 02/04/16 | 117.57 | 4.26% |

| GBP/USD | 1.4559 | LONG GBP | STRONG | 02/02/16 | 1.4386 | 1.20% |

| EUR/USD | 1.1289 | LONG EURO | STRONG | 02/04/16 | 1.1182 | 0.96% |

| EUR/JPY | 127.06 | SHORT EURO | STRONG | 02/11/16 | 126.19 | -0.69% |

| EUR/GBP | 0.7753 | LONG EURO | WEAK | 10/23/15 | 0.7194 | 7.77% |

| USD/CHF | 0.9739 | SHORT USD | STRONG | 01/04/16 | 0.9979 | 2.41% |

| USD/CAD | 1.3907 | SHORT USD | STRONG | 02/01/16 | 1.4031 | 0.88% |

| NZD/USD | 0.6672 | LONG NZD | WEAK | 02/02/16 | 0.6486 | 2.87% |

| AUD/USD | 0.7111 | LONG AUD | WEAK | 01/25/16 | 0.6980 | 1.88% |

| AUD/JPY | 80.04 | SHORT AUD | WEAK | 02/11/16 | 78.47 | -2.00% |

| USD/MXN | 19.1099 | LONG USD | STRONG | 12/07/15 | 16.7258 | 14.25% |

This morning FX briefing is an information service, not a trading system. All trade recommendations are included in the afternoon report.

Recommended Content

Editors’ Picks

AUD/USD tumbles toward 0.6350 as Middle East war fears mount

AUD/USD has come under intense selling pressure and slides toward 0.6350, as risk-aversion intensifies following the news that Israel retaliated with missile strikes on a site in Iran. Fears of the Israel-Iran strife translating into a wider regional conflict are weighing on the higher-yielding Aussie Dollar.

EUR/USD extends its downside below 1.0650 on hawkish Fed remarks

The EUR/USD extends its downside around 1.0640 after retreating from weekly peaks of 1.0690 on Friday during the early Asian session. The hawkish comments from Federal Reserve officials provide some support to the US Dollar.

Gold price edges higher on risk-off mood hawkish Fed signals

Gold prices advanced late in the North American session on Thursday, underpinned by heightened geopolitical risks involving Iran and Israel. Federal Reserve officials delivered hawkish messages, triggering a jump in US Treasury yields, which boosted the Greenback.

Dogwifhat price pumps 5% ahead of possible Coinbase effect

Dogwifhat price recorded an uptick on Thursday, going as far as to outperform its peers in the meme coins space. Second only to Bonk Inu, WIF token’s show of strength was not just influenced by Bitcoin price reclaiming above $63,000.

Israel vs. Iran: Fear of escalation grips risk markets

Recent reports of an Israeli aerial bombardment targeting a key nuclear facility in central Isfahan have sparked a significant shift out of risk assets and into safe-haven investments.