Outlook:

Macro developments are starting to get a little scary. Not a new recession, but stagnation. Re-consider what the Markit economist said of the eurozone PMI’s this morning: growth is anemic. "The survey data therefore so far show no signs of European Central Bank stimulus or the weaker euro helping to revive the manufacturing sector, at least for the eu-ro area as a whole." We get the US ISM version later today, forecast to dip to 51.4 from 51.8. The jobs report on Friday, and the ADP private sector estimate on Wednesday, are powerful indicators, but ISM is (arguably) a more important indicator.

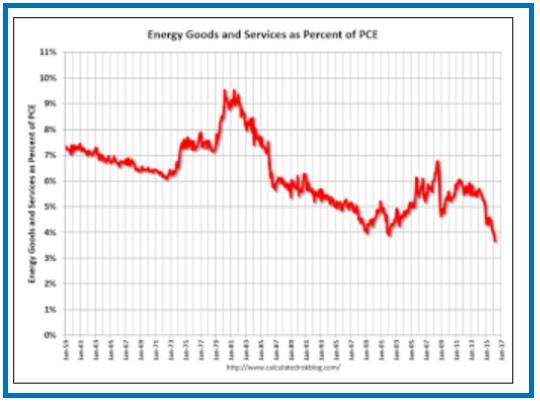

And this follows the personal income and expenditure on Friday. For some reason this data has already vanished from the radar screen, but it should not be dismissed. The latest PCE price index is a lousy 0.82% y/y, down from 0.96% (revised) the month before. The core PCE index came in at 1.56%, down from 1.72% (revised) the month before. And it’s interesting that that energy expenditure as a proportion of PCE is falling and has reached a record low of under 3.7%. Because of the recent price rises, this is will rise, too. See the chart. There is nothing in here to inspire the Fed to hike rates.

We have Feds speaking all over the place this week, stating with NY Fed Dudley but also Mester, Lock-hart, Lockhart and Williams, with Draghi and Abe also on the speaking circuit. And let’s not neglect publicity-hound Roubini, who asserts the SNB might seek authority to prevent banks from converting money from negative-yielding accounts to cash. This might come ahead of the Brexit referendum on June 23 so that the SNB can avoid spending money on intervention.

As for NY Fed chief Dudley, on Friday he said let’s go slow on hiking because “divergent signals” cloud the outlook for the US economy. Inflation expectations are still a “cause for concern” and “As past experience shows, it is difficult to push inflation back up to the central bank’s objective if inflation ex-pectations fall meaningfully below that objective,” he warned, citing Japan’s years-long struggle to stoke inflation.” According to the FT, “Mr Dudley added that he still expects inflation to rise to a 2 per cent annual pace in the medium run, but cautioned that ‘it is still possible that the return of inflation to our objective could take longer than I anticipate.’”

Then today, to make matters worse, Dudley said there are gaps in the Fed’s ability to provide emergency funding. He wants to offer the discount window to all comers. This might be a semi-political position, since Congress is on the hunt for something to criticize the Fed for. “Mr Dudley said regulators were currently examining holes in lender-of-last-resort provision on an international basis, with one key area of focus being gaps in backstops for globally systemic groups that operate in multiple jurisdictions.” This is exactly what Congress wants to avoid. Nobody noticed that last time the Fed lent almost $1 trillion to foreign banks—they got it all back, of course. It’s not impossible that Congress can shoot the US in the foot.

| Current | Signal | Signal | Signal | |||

| Currency | Spot | Position | WEAK | Date | Rate | Gain/Loss |

| USD/JPY | 106.46 | SHORT USD | STRONG | 04/29/16 | 107.07 | 0.57% |

| GBP/USD | 1.4610 | LONG GBP | STRONG | 04/12/16 | 1.4309 | 2.10% |

| EUR/USD | 1.1489 | LONG EURO | STRONG | 03/11/16 | 1.1094 | 3.56% |

| EUR/JPY | 122.33 | SHORT EURO | NEW*STRONG | 05/02/16 | 122.33 | 0.00% |

| EUR/GBP | 0.7864 | SHORT EURO | NEW*STRONG | 05/02/16 | 0.7864 | 0.00% |

| USD/CHF | 0.9575 | SHORT USD | WEAK | 04/29/16 | 0.9632 | 0.59% |

| USD/CAD | 1.2547 | SHORT USD | STRONG | 02/01/16 | 1.4031 | 10.58% |

| NZD/USD | 0.7006 | LONG NZD | STRONG | 02/01/16 | 0.6478 | 8.15% |

| AUD/USD | 0.7626 | LONG AUD | WEAK | 01/25/16 | 0.6980 | 9.26% |

| AUD/JPY | 81.17 | SHORT AUD | NEW*STRONG | 04/02/16 | 81.17 | 0.00% |

| USD/MXN | 17.1705 | SHORT USD | STRONG | 02/23/16 | 18.1208 | 5.24% |

This morning FX briefing is an information service, not a trading system. All trade recommendations are included in the afternoon report.

Recommended Content

Editors’ Picks

EUR/USD comes under pressure near 1.0630

Further gains in the Greenback encourage sellers to maintain their control over the risk complex, forcing EUR/USD to retreat further and revisit the 1.0630 region as the US session draws to a close.

GBP/USD stays firm amid BoE, Fed commentary and US data

GBP/USD edges lower in the second half of the day and trades at around 1.2450. Better-than-expected Jobless Claims and Philadelphia Fed Manufacturing Index data from the US provides a support to the USD and forces the pair to stay on the back foot.

Gold is closely monitoring geopolitics

Gold trades in positive territory above $2,380 on Thursday. Although the benchmark 10-year US Treasury bond yield holds steady following upbeat US data, XAU/USD continues to stretch higher on growing fears over a deepening conflict in the Middle East.

Ripple faces significant correction as former SEC litigator says lawsuit could make it to Supreme Court

Ripple (XRP) price hovers below the key $0.50 level on Thursday after failing at another attempt to break and close above the resistance for the fourth day in a row.

Have we seen the extent of the Fed rate repricing?

Markets have been mostly consolidating recent moves into Thursday. We’ve seen some profit taking on Dollar longs and renewed demand for US equities into the dip. Whether or not this holds up is a completely different story.