Outlook

Fed chief Yellen has come clean about adding global concerns to the Fed’s short mandate list, saying it’s not only employment and inflation the Fed is looking at, but also global economic and financial uncertainty, especially the widespread expectation that growth is slowing. The risks to the outlook justify proceeding with caution.

We almost crashed into a tree when we heard that on the car radio. Surely some Congressman will object to the Fed adding a new mandate on its own? Probably not. Congressmen don’t bother themselves with actually listening to the Fed, let alone understanding any of it. We should start a betting pool on how long it takes for the first Congressman to question the addition of a new criterion.

Yellen also said the US economy has done quite well despite the external risks in part because markets expect “lower for longer.” Now there’s a feedback loop that can become impossibly tangled in no time. She also said the Fed has only a modest ability to provide additional stimulus but at the same time, the Fed has “considerable scope to provide additional accommodation," which sounds contradictory. It is. Note Yellen did not mention negative rates as among the tools in its scope. She mentioned increasing the duration of the Fed's securities portfolio. Yellen also complained that the Fed is operating without any help from fiscal policy. Yellen admitted that falling oil prices up to now have restrained inflation expectations.

And finally, Yellen admitted she doesn’t know the long-term “neutral” rate, meaning the rate that encourages neither slowing down nor speeding up economic activity. Evidently Yellen believes real inter-est rates are 1.25% under the neutral rate, meaning the Fed can justify raising rates at any time. But the neutral rate issue can tie you up in knots for weeks on end. At its core is the economist’s always annoying concept of equilibrium, which everyone knows is a fiction but is set as a goal anyway. It’s a little bit like spending all of your time preparing your clothes, maps and weapons to go hunting a uni-corn and spending no time at all finding out if unicorns are to be found anywhere in the first place. Yellen has to deal with it because we pay her to be a conventional economist, but we are not going to waste another minute on it. Now that global concerns have been added to the Fed’s plate, does that mean payrolls this Friday will have less effect than usual? We get the ADP private sector forecast today, expected to be a gain of 200,000 after 214,000 last time. At a guess, the “global concern” idea has been mostly priced in and traders are free to treat payrolls as they always have with OCD like attention to detail and plenty of overreaction.

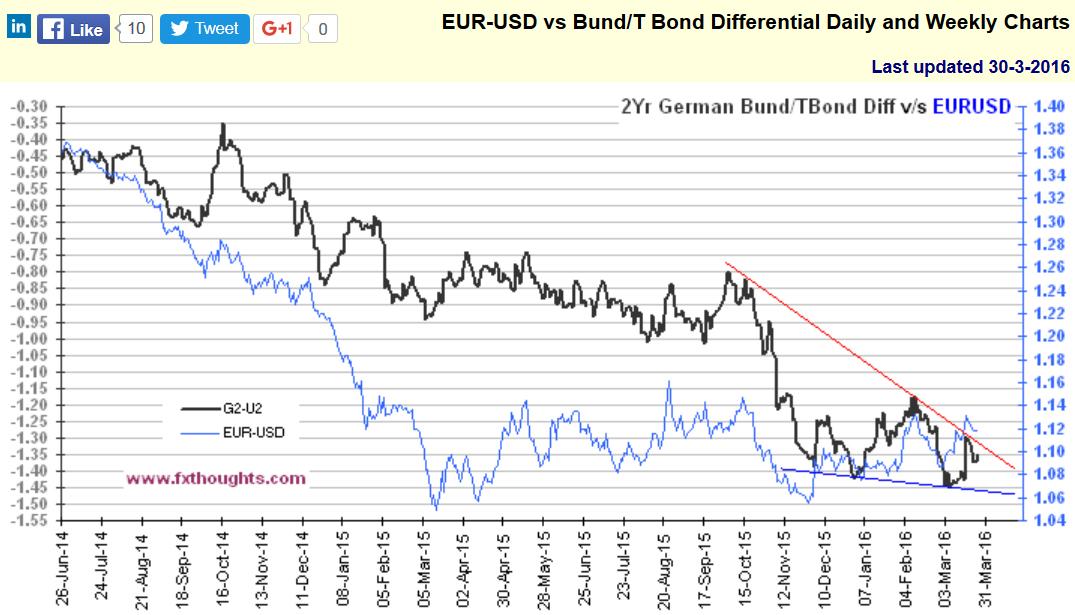

All the same, the employment numbers are in fact less powerful as a predictor of Fed policy intentions. Fed funds futures now show the probability of an April hike as zero, five hawkish regional Fed presidents notwithstanding. And even the probability of a hike in November has fallen from 65.2% on Mon-day has fallen to 53.6% at the close yesterday, according to the FT. The 2-year yield, the supposedly most sensitive one, was at 1% just two weeks ago and 0.78% this morning. Meanwhile, the equivalent German 2-year is at minus 0.49%. On what planet does a small drop in yield against a negative one result in a rise in the negative-yield currency?

See the chart. It shows the 2-year yield differential vs. the euro/dollar. We love charts but have to admit we don’t understand this one. The euro rises as the differential becomes less negative from the November lowest low but the whole thing is negative in the first place. The implication is that negative rates per see do not necessarily drive a currency down. If Mr. Draghi was hoping to get a currency devaluation from negative rates, he must be gnashing his teeth right now. It’s a sad truth that the differential alone is a lousy FX predicter.

The future of the dollar is up to the bond market now. It remains to be seen whether the benchmark 10-year yield falls any further. Earlier this year, we had a lot of talk about yields dipping because the US economy is falling back into recession. Those commentators seems to have fallen away now that the data is somewhat better.

Or maybe not. The Atlanta Fed GDP Now model forecast for real GDP growth in Q1 is now 0.6%. That’s the seasonally adjusted annual rate. But it was 1.4% last week (March 24).

See the T-note chart in the chart package. The current yield is under the gold line marking the worst-case lowest low yields. It is now nearing the previous lows from early Feb 2015 and again in Feb 2016. The implication is that the US economy has made zero progress over the past year. We know this is not true because of rising PCE inflation, jobs growth and a bunch of other economic data. But the bond market is shrugging off that data and sticking to its guns the Fed is a wuss.

Thus we have to acknowledge the same long-standing bias against the dollar. From an economic view-point, this is probably a good thing, although we would fight to the death anyone who says Yellen was specifically targeting a weaker dollar. All the same, a weaker dollar raise the prices of imported goods and thus raises inflation, and helps exports, at least a little and thus helps incomes, at least a little. So we are in a strange place where more than one kind of perversity rules. The US has rising inflation but a recalcitrant central bank. Europe has inflation near zero and negative rates buy euros. The more dovish central banks wins with a rising currency. Go figure.

| Current | Signal | Signal | Signal | |||

| Currency | Spot | Position | Strength | Date | Rate | Gain/Loss |

| USD/JPY | 112.37 | SHORT USD | WEAK | 02/04/16 | 117.57 | 4.42% |

| GBP/USD | 1.4388 | SHORT GBP | WEAK | 03/24/16 | 1.4296 | -0.64% |

| EUR/USD | 1.1313 | LONG EURO | WEAK | 03/11/16 | 1.1094 | 1.97% |

| EUR/JPY | 127.12 | LONG EURO | STRONG | 03/29/16 | 127.24 | -0.09% |

| EUR/GBP | 0.7862 | LONG EURO | WEAK | 03/11/16 | 0.7759 | 1.33% |

| USD/CHF | 0.9642 | SHORT USD | STRONG | 03/11/16 | 0.9877 | 2.38% |

| USD/CAD | 1.3035 | SHORT USD | STRONG | 02/01/16 | 1.4031 | 7.10% |

| NZD/USD | 0.6920 | LONG NZD | STRONG | 02/01/16 | 0.6478 | 6.82% |

| AUD/USD | 0.7660 | LONG AUD | STRONG | 01/25/16 | 0.6980 | 9.74% |

| AUD/JPY | 86.08 | LONG AUD | STRONG | 03/03/16 | 83.57 | 3.00% |

| USD/MXN | 17.2866 | SHORT USD | WEAK | 02/23/16 | 18.1208 | 4.60% |

This morning FX briefing is an information service, not a trading system. All trade recommendations are included in the afternoon report.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0650 after US data

EUR/USD retreats from session highs but manages to hold above 1.0650 in the early American session. Upbeat macroeconomic data releases from the US helps the US Dollar find a foothold and limits the pair's upside.

GBP/USD retreats toward 1.2450 on modest USD rebound

GBP/USD edges lower in the second half of the day and trades at around 1.2450. Better-than-expected Jobless Claims and Philadelphia Fed Manufacturing Index data from the US provides a support to the USD and forces the pair to stay on the back foot.

Gold is closely monitoring geopolitics

Gold trades in positive territory above $2,380 on Thursday. Although the benchmark 10-year US Treasury bond yield holds steady following upbeat US data, XAU/USD continues to stretch higher on growing fears over a deepening conflict in the Middle East.

Ripple faces significant correction as former SEC litigator says lawsuit could make it to Supreme Court

Ripple (XRP) price hovers below the key $0.50 level on Thursday after failing at another attempt to break and close above the resistance for the fourth day in a row.

Have we seen the extent of the Fed rate repricing?

Markets have been mostly consolidating recent moves into Thursday. We’ve seen some profit taking on Dollar longs and renewed demand for US equities into the dip. Whether or not this holds up is a completely different story.