Outlook:

Just when we think we have a grip on world conditions, something comes along to disabuse us of that notion. The latest game-changer is Saudi Arabia willing to impose an output freeze even without Iran, according to an unnamed OPEC official. We will presumably get more information before the meeting in Doha on April 17. OPEC Sec-Gen el-Badri said yesterday perhaps Iran can join at a later date. You have to wonder whether OPEC has a stick.

According to the FT report, some 15 countries support the freeze from inside and outside OPEC. Just talking about the freeze has already helped the price. “Hedge funds and other speculators have dramatically increased their bets on a higher oil price in the past several weeks. Their combined net long positions in Nymex and ICE WTI are now at 172m barrels, from just 35m barrels on January 12.” The motivation is not hard to find. Producers are desperate to improve the economic situation, including Russia, which is now taking a leading role. The Jan output level may end up being the benchmark or some other number, like Q1. Whatever it is, it has to have credibility.

The story rings true despite not having a named source. OPEC may be dying off in favor of another coalition that includes previously non-OPEC producers. Given it’s the Saudis and the Russians leading, it seems not to be particularly political in nature, although it’s “anti-US” in some basic way. Notice that Mexico is not joining (so far).

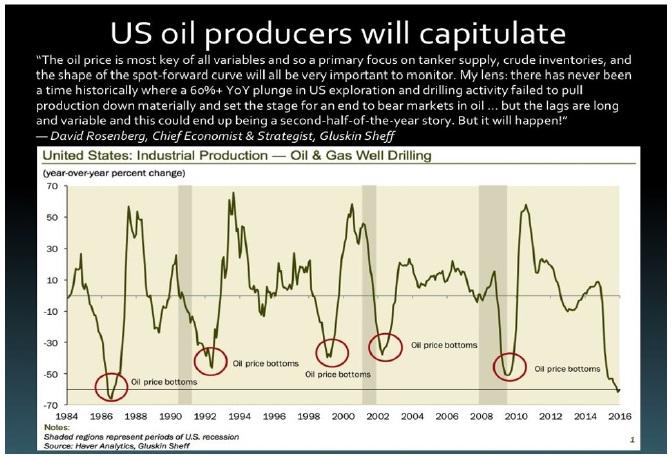

Stabilization of oil prices is always a Good Thing, even if the higher level is a negative for consumers. Consumers haven’t done much with their oil price windfall, anyway. And there is at least one school of thought that finds general industrial production rising after oil bottoms. See the chart from Haver Analytics, courtesy of a Reader. We are not exactly clear on why this should be so—maybe a rush to get product out the door before costs rise—but it’s an interesting chart. See the next page.

The other game-changer, maybe, is the Fed speakers sounding so hawkish hot on the heels of the Fed cutting the number of expected hikes and seeming to want to delay normalization until Europe catches up. San Francisco Fed President Williams. St. Louis Fed Pres Bullard and Atlanta Fed Pres Lockhart are all indicating the Fed could get back on track for a hike as soon as April, or at least it’s not off the table.

According to Market News, San Francisco Fed President Williams “left no doubt he will be advocating for another interest rate hike as early as the April meeting of the Fed's rate-setting Federal Open Market Committee - or, failing that, at the June meeting - provided the economy continues to do as well as it has been. Williams, in an exclusive interview with Market News International Friday, suggested there is no justification for long delaying further Fed rate hikes in the face of continued labor market improvement and ‘very encouraging’ progress toward meeting the Fed's 2% inflation target.

He said ‘All else equal, assuming everything else is basically the same and the data flow continues the way I hope and expect, then April or June would definitely be potential times to have an increase in interest rates.’

“His sentiment was echoed later in the day by Atlanta Federal Reserve Bank President Dennis Lockhart, who said Monday that as the economy continues down the path envisioned by the policymaking Federal Open Market Committee when it raised rates in December, the time is soon approaching for a second rate hike. ‘In my opinion, there is sufficient momentum evidenced by the economic data to justify a further step at one of the coming meetings, possibly as early as the meeting scheduled for end of April,’"

This is contrary to what Fed fund futures indicate—a 10% probability of April. For what it’s worth, the Atlanta Fed’s GDPNow tracker has Q1 at 1.9%. This week we get additional speeches by Chicago Fed Evans and Philadelphia Fed Harker.

Nobody really thinks April is likely for the next hike. It’s too soon after the dot-plot was revised, the market doesn’t expect it (and the Fed wants to coddle the market), and not enough has changed in the global situation to justify such a swift change of heart. Maybe the Fed speakers are just reminding every-one that every meeting is “live,” Yellen’s code for “open to a rate change.”

Or maybe the Fed wants to stop coddling the market. While regional Fed presidents do not have to get their speeches and comments to the press vetted by Washington ahead of time, it’s fishy that no fewer than three are coming out with basically the same message. What can it mean? Nobody knows. We get a speech by Yellen next week that will be parsed with every bit as much attention as the official FOMC statements.

The consensus of opinion about the euro/dollar seems to be that after the current pullback/consolidation ends, the euro will likely make a third impulse wave upward. We see it this way ourselves. But if these Fed speakers continue to hint that normalization is not postponed for very much longer, this scenario of could be dead wrong. Is the market ready for another burst upward in the dollar? We’d guess it was priced in so long ago that everyone has forgotten it by now.

| Current | Signal | Signal | Signal | |||

| Currency | Spot | Position | Strength | Date | Rate | Gain/Loss |

| USD/JPY | 111.74 | SHORT USD | STRONG | 02/04/16 | 117.57 | 4.96% |

| GBP/USD | 1.4303 | LONG GBP | STRONG | 03/11/16 | 1.4296 | 0.05% |

| EUR/USD | 1.1208 | LONG EURO | STRONG | 03/11/16 | 1.1094 | 1.03% |

| EUR/JPY | 125.24 | SHORT EURO | WEAK | 02/11/16 | 126.19 | 0.75% |

| EUR/GBP | 0.7835 | LONG EURO | WEAK | 03/11/16 | 0.7759 | 0.98% |

| USD/CHF | 0.9714 | SHORT USD | STRONG | 03/11/16 | 0.9877 | 1.65% |

| USD/CAD | 1.3071 | SHORT USD | STRONG | 02/01/16 | 1.4031 | 6.84% |

| NZD/USD | 0.6746 | LONG AUD | STRONG | 02/01/16 | 0.6478 | 4.14% |

| AUD/USD | 0.7596 | LONG AUD | STRONG | 01/25/16 | 0.6980 | 8.83% |

| AUD/JPY | 84.89 | LONG AUD | STRONG | 03/03/16 | 83.57 | 1.58% |

| USD/MXN | 17.4022 | SHORT USD | STRONG | 02/23/16 | 18.1208 | 3.97% |

This morning FX briefing is an information service, not a trading system. All trade recommendations are included in the afternoon report.

Recommended Content

Editors’ Picks

EUR/USD holds steady near 1.0650 amid risk reset

EUR/USD is holding onto its recovery mode near 1.0650 in European trading on Friday. A recovery in risk sentiment is helping the pair, as the safe-haven US Dollar pares gains. Earlier today, reports of an Israeli strike inside Iran spooked markets.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD is rebounding toward 1.2450 in early Europe on Friday, having tested 1.2400 after the UK Retail Sales volumes stagnated again in March, The pair recovers in tandem with risk sentiment, as traders take account of the likely Israel's missile strikes on Iran.

Gold price defends gains below $2,400 as geopolitical risks linger

Gold price is trading below $2,400 in European trading on Friday, holding its retreat from a fresh five-day high of $2,418. Despite the pullback, Gold price remains on track to book the fifth weekly gain in a row, supported by lingering Middle East geopolitical risks.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Geopolitics once again take centre stage, as UK Retail Sales wither

Nearly a week to the day when Iran sent drones and missiles into Israel, Israel has retaliated and sent a missile into Iran. The initial reports caused a large uptick in the oil price.