Outlook:

We get a slew of data today and the Fed star ts the policy meeting. Befor e the Fed statement and the press conference tomorrow, we get a ton of new data. We have to be careful not to imagine the Fed has any of it ahead of time and it will influence the members. We get retail sales, the PPI and CPI, industrial production, NAHB housing index, and housing starts. Oh, yes, and business inventories.

Instead of watching the data, watch the 10-year yield. It’s the benchmark and behaving quite strangely.

Yesterday it put in an inside day, indicating the bond gang is deeply uncertain in its outlook. Market News notes that Friday, the 10-year yield hit a high of 1.988%, the most since late Jan and a giant step from 1.70% March 1.

Everyone will be waiting for two things from the Fed tomorrow—the dot-plots and the tone of the statement, hawkish or dovish. Just about everybody expected the Fed to retreat from four hikes this year—it’s only a question of by how much. The net ending rate is obviously affected by the number of moves and thus spilling over into 2017. The majority of analysts think the total number of hikes will get cut to one or two, with the first one in June, although April is not out of the question.

But several naysayers, like Morgan Stanley, see nothing from the Fed until December. Market News reports “Morgan Stanley also expects a mid-year rally in Treasuries that will take the 10-year yield back down to 1.45% by the end of this year. It also thinks the 2-year note yield will retest 0.60% from the current level closer to 1.00%.”

The FT reports economist Michele at JP Morgan Asset Management has a similarly gloomy view—the “US interest rate cycle is stuck in low gear.” He says “The Fed is raising rates to normalise markets and to stop penalising savers. There is little growth and inflationary pressure on the horizon for them to lean into. Ultimately, markets will begin to flatten the government yield curve around where they believe the terminal Fed funds rate is for this cycle.” He says if the target is not over 2%, 30-year yields at 2.5% are too high. Accordingly, the 10-year should slip back to 1.5%.

These are two of the biggest and most influential players on the Street. We need to worry, a lot, about what the Fed says tomorrow. We imagine that fear of global turmoil, the excuse last fall, will become the perennial excuse, no matter what the economy is doing. After all, you can always slant economic interpretations. And if the Fed is gloomy, the economy becomes gloomy.

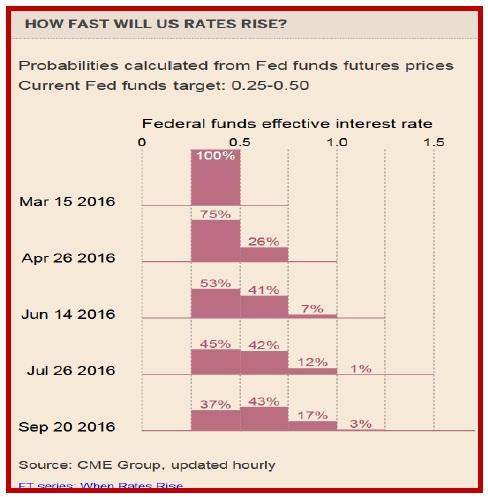

The FT survey shows a majority of 52 economists predict two further Fed rate increases this year, whereas the market itself as seen in the futures prices, sees just one. This divergence is not a healthy thing. See the FT table.

The Fed is the biggest threat to our FX market scenario that has the euro resuming the upmove after the current corrective phase. As noted above, the euro should stop falling near the bottom of the standard error channel, somewhere around 1.1070 but perhaps a little more, like the appealing midpoint 1.1050. We see the euro resuming the upmove in the direction of the breakout because the attitude toward the dollar will shift to negative if the Fed is cowardly.

If the ECB manages to keep the Bund yield stable or rising, as it did today, while the US 10-year is falling, and if the two Morgans are right, the narrowing of the differential favors the euro even if the outright number favors the dollar.

Weird, but that’s how it tends to work. The Japanese will like the US yield as their own economy remains mired in recession (why are they sticking to a sales tax hike next year?) and their own negatives, but Japan is just one source of flow.

Not that it matters to the Fed, at least not openly, but today is a big voting day in Republican primaries, too. Rubio is expected to lose his home state Florida to Trump and to withdraw, leaving Cruz as the only real contender to Trump. The sane and reasonable Kasich will probably win home-state Ohio, but can’t catch up in delegate count now. The Republican establishment made a big mistake not backing Kasich in the first place. Unless they can stage-manage a contested convention better than they have managed anything so far, we are stuck with the creepy Trump or the slimy Cruz.

The Fed is not exactly quaking in its boots, but must appreciate it is almost sure to suffer attacks from the right. Nearly all of the attacks we have seen so far are unfounded in fact or outright stupid, but it’s never a good thing for the world to see the supposedly independent central bank under threat of outright Congressional control. Judging from the questions at the bi-annual Fed chief testimony, few of them can walk and chew gum at the same time. Some are so ideology-addled that facts just slide off their back (for example, demanding audits when the Fed is already audited by six different auditors). The approval rating of Congress is 9%. Maybe sometimes the US voter is not so dumb.

| Current | Signal | Signal | Signal | |||

| Currency | Spot | Position | Strength | Date | Rate | Gain/Loss |

| USD/JPY | 113.09 | SHORT USD | WEAK | 02/04/16 | 117.57 | 3.81% |

| GBP/USD | 1.4151 | LONG GBP | WEAK | 03/11/16 | 1.4296 | -1.01% |

| EUR/USD | 1.1079 | LONG EURO | STRONG | 03/11/16 | 1.1094 | -0.14% |

| EUR/JPY | 25.29 | SHORT EURO | WEAK | 02/11/16 | 126.19 | 0.71% |

| EUR/GBP | 0.7829 | LONG EURO | WEAK | 03/11/16 | 0.7759 | 0.90% |

| USD/CHF | 0.9890 | SHORT USD | STRONG | 03/11/16 | 0.9877 | -0.13% |

| USD/CAD | 1.3383 | SHORT USD | STRONG | 02/01/16 | 1.4031 | 4.62% |

| NZD/USD | 0.6643 | LONG AUD | STRONG | 02/01/16 | 0.6478 | 2.55% |

| AUD/USD | 0.7457 | LONG AUD | STRONG | 01/25/16 | 0.6980 | 6.83% |

| AUD/JPY | 84.33 | LONG AUD | STRONG | 03/03/16 | 83.57 | 0.91% |

| USD/MXN | 17.8878 | SHORT USD | WEAK | 02/23/16 | 18.1208 | 1.29% |

This morning FX briefing is an information service, not a trading system. All trade recommendations are included in the afternoon report.

Recommended Content

Editors’ Picks

EUR/USD extends gains above 1.0700, focus on key US data

EUR/USD meets fresh demand and rises toward 1.0750 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

USD/JPY keeps pushing higher, eyes 156.00 ahead of US GDP data

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, recapturing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming intervention risks. The focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold closes below key $2,318 support, US GDP holds the key

Gold price is breathing a sigh of relief early Thursday after testing offers near $2,315 once again. Broad risk-aversion seems to be helping Gold find a floor, as traders refrain from placing any fresh directional bets on the bright metal ahead of the preliminary reading of the US first-quarter GDP due later on Thursday.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.