Outlook:

The ECB shot all of the arrows in its quiver. The market was mightily impressed. But when Draghi said at the press conference that he didn’t expect to have to do any more, the market chose to interpret that as meaning the ECB will not do any more. There’s a big differ-ence between trying to promote confidence in a new policy initiative and saying there are no more initia-tives to be had. We say the market willfully misinterpreted Draghi. It’s ridiculous to think Can-Do Draghi said he is giving up after this.

Or maybe the market thought Draghi was speaking to them when he was really speaking to the national governments. Draghi has been saying all along that monetary policy has limits and governments need to do their share by fiscal means and by restructuring, including loosening labor laws. It’s even possible traders got this point and their buying the euro can be interpreted as meaning they have no confidence in the governments pulling their weight.

Another idea is that the traders are predicting what investors will believe—that this latest policy initia-tive will work and investors will seek to raise the share of euros in their portfolios. In other words, the speculators are building an inventory ahead of investor demand--traders are front-running their Big cli-ents. This is not as far-fetched as it may seem. After all, various QE initiatives worked in the US. What the ECB is doing is far more aggressive. Why shouldn’t it work? It may take some time, but getting in early is no crime.

In addition, the ECB has the wind at its back now—oil and commodities are on the rise. Besides, one asset class that always benefits from cheap money is equities. You don’t have to be a long-term macro manager to want some European equities and right away. We are a little confused about why the Euro Stoxx 600 closed down 1.66% and the DAX closed down 2.31% yesterday. They “should” start staging a recovery any time now. So far today the Stoxx 600 is up 2.27%, the DAX, 4% and the Milan, 4%.

And let’s not ignore that Draghi is not targeting rates, even if expansion of the buying program to corporate paper obviously relieves some pressure on sovereign rates—he is targeting credit expan-sion. Banks will be rewarded for making loans and punished for parking funds at the central bank. Arguably the most important part of the initiative is new “targeted longer-term refinancing opera-tions” (TLTROs) that allow banks to borrow from the ECB at a rate that could fall as low as the deposit facility, or -0.40%. The actual rate will depend on the volume of lending to businesses and households. Draghi spent a lot of time on this measure during the press conference and weirdly, the reporters didn’t seem to get it. But the FT did and quotes various analysts saying it makes all the difference. Bank equity analysts got it, too—the sector is up this morning.

The ECB is literally doing a better job than the Fed in structuring QE. This is literally the only way in which negative rates make sense—as a whip to lenders. The US had only the carrot, no whip.

Finally, let’s continue to assume Draghi always knows what he is doing and is seven steps ahead of everyone else. Let’s further assume he knew perfectly well that the euro would tank on the size of the new plan and then rally on his saying no additional initiatives would be needed. The crash would be punishment to the weak-ECB crowd. Central banks have been known to put on a short squeeze before (!). The recovery would be another form of retribution—making the buyers pay more than if they had hung on to their original positions. The wages of speculation, or something. Does Draghi know enough about how the FX market thinks to have pulled this tricky stunt? You betcha. We’d say he is Machiavel-lian except that description tends to be taken as including only deceit and betrayal when it also includes plain old-fashioned cunning and one upmanship.

And of course Draghi never said there are no more initiative to be had. He said “new facts can change the outlook” and the ECB still has more than enough ammunition for further deployment, according to Market News. Vice Chairman Constancio threw fuel on the fire this morning when he wrote "Naturally, all policies have limits. In the case of the instruments we are now using, this is particularly true of nega-tive interest rates on our deposit facility.”

Constancio’s views are in an opinion piece titled “In Defense of Monetary Policy” on the ECB website. In other words, rates themselves may not go more negative (although other forms of stimulus may be used). This is NOT consistent with what Draghi said about rejecting tiers—it might give people the wrong idea about a floor on negative rates. Listening to the press conference, we though Draghi meant there is no floor on negative rates, but Constancio seems to be saying the opposite.

Now that we have to wait a few months to see the effectiveness of the new policies—the TLTRO begins in June--attention will turn to whether the Fed is too hot or too cold. In the twisty way the bond market thinks, some analysts believe the ECB actions make it easier for the Fed to raise rates. For one thing, everybody’s yield rose yesterday—the differential did not widen, or not by much. A rising differential is supposed to imply a stronger dollar and thus be an impediment for the Fed. We don’t buy this thesis—-the Fed observes but does not overreact or overweight other central bank actions. It also doesn’t manage to the level of the dollar. But the point is that the Fed is free to hike whenever it wants to without regard for a “crisis condition” in differentials and/or currencies.

Analysts are now staying the euro cannot be expected to fall to parity or below, the old idea last fall when ECB QE first become a realistic expectation. The main part of the accommodation is done and we didn’t get parity. Now that conditions have changed, the euro may well keep recovering forever.

Well, no. See the monthly chart. Granted, monthly charts are of no use in hedging or in managing posi-tions, but the bird’s eye view shows a series of lower highs and lower lows. This is a long-term down-trend. The Fibonacci lines are drawn to show the retracement from the move off the lowest low 0.8229 from Oct 2001 (not shown) to the highest high at 1.6038 in July 2008. We have no respect whatever for Fib retracement lines but never mind—the Big Picture trendline is downward-sloping and a return to the lowest low can’t be ruled out. Before then, however, traders see imaginary support around 1.0800 and the red resistance line, the channel top, indicates we could get 1.3000 before we get another low. Eek.

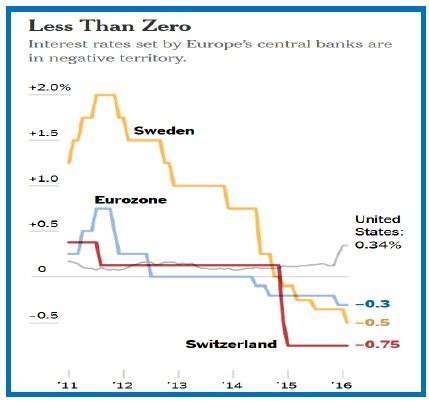

But it’s premature to draw conclusions about how the world is going to judge the new ECB plan and thus the euro. The first-tier speculators have spoken. Now it’s time for investors, including sovereign reserve and sovereign fund managers, to vote with their money. The FT reports hedge funds are on the sidelines (how does it know?). Not to beat a dead horse, but longer run, yield differentials do matter. See the relative short-term rate chart (from the NYT). It’s a small mystery why the dollar is not getting the short-term flows, except maybe it already got as much as the global market can stomach. This was Greenspan’s explanation and it’s not a preposterous one.

And also of longer-run importance is whether a rising euro erases the inflation gains from higher oil and commodity prices. Mr. Draghi doesn’t actually want a strong euro. He wants a weak one to boost ex-ports and raise the price of imports. But maybe getting banks to lend trumps everything.

And now on to China. This weekend, PBOC Gov Zhou will hold a press conference, followed by brief-ings by the heads of the SAFE, China Insurance Regulatory Commission, China Banking Regulatory Commission and the China Securities Regulatory Commission. We also get data on retail sales, probably up 10.9% y/y, according to Bloomberg, and industrial production and fixed asset investment, both ex-pected to dip. “Industrial production probably expanded 5.6 percent in the January-February period from a year earlier, according to economists’ projections as at late Thursday. That would be the weakest start to the year since 2009. Fixed-asset investment for the two-month period slumped to 9.5 percent, estimates show, down from a 2015 reading of 10 percent, which was already the slowest pace since 2000.”

We are still at risk of contagion from worries about China spreading to western equity markets and cast-ing a general pall of gloom over commodities.

| Current | Signal | Signal | Signal | |||

| Currency | Spot | Position | Strength | Date | Rate | Gain/Loss |

| USD/JPY | 113.78 | SHORT USD | WEAK | 02/04/16 | 117.57 | 3.22% |

| GBP/USD | 1.4296 | LONG GBP | NEW*WEAK | 03/11/16 | 1.4296 | 0.00% |

| EUR/USD | 1.1094 | LONG EURO | NEW*STRONG | 03/11/16 | 1.1094 | 0.00% |

| EUR/JPY | 126.23 | SHORT EURO | WEAK | 02/11/16 | 126.19 | -0.03% |

| EUR/GBP | 0.7759 | LONG EURO | NEW*WEAK | 03/11/16 | 0.7759 | 0.00% |

| USD/CHF | 0.9877 | SHORT USD | NEW*STRONG | 03/11/16 | 0.9877 | 0.00% |

| USD/CAD | 1.3236 | SHORT USD | STRONG | 02/01/16 | 1.4031 | 5.67% |

| NZD/USD | 0.6697 | LONG AUD | STRONG | 02/01/16 | 0.6478 | 3.38% |

| AUD/USD | 0.7512 | LONG AUD | STRONG | 01/25/16 | 0.6980 | 7.62% |

| AUD/JPY | 85.47 | LONG AUD | STRONG | 03/03/16 | 83.57 | 2.27% |

| USD/MXN | 17.6829 | SHORT USD | WEAK | 02/23/16 | 18.1208 | 2.42% |

This morning FX briefing is an information service, not a trading system. All trade recommendations are included in the afternoon report.

Recommended Content

Editors’ Picks

AUD/USD could extend the recovery to 0.6500 and above

The enhanced risk appetite and the weakening of the Greenback enabled AUD/USD to build on the promising start to the week and trade closer to the key barrier at 0.6500 the figure ahead of key inflation figures in Australia.

EUR/USD now refocuses on the 200-day SMA

EUR/USD extended its positive momentum and rose above the 1.0700 yardstick, driven by the intense PMI-led retracement in the US Dollar as well as a prevailing risk-friendly environment in the FX universe.

Gold struggles around $2,325 despite broad US Dollar’s weakness

Gold reversed its direction and rose to the $2,320 area, erasing a large portion of its daily losses in the process. The benchmark 10-year US Treasury bond yield stays in the red below 4.6% following the weak US PMI data and supports XAU/USD.

Bitcoin price makes run for previous cycle highs as Morgan Stanley pushes BTC ETF exposure

Bitcoin (BTC) price strength continues to grow, three days after the fourth halving. Optimism continues to abound in the market as Bitcoiners envision a reclamation of previous cycle highs.

US versus the Eurozone: Inflation divergence causes monetary desynchronization

Historically there is a very close correlation between changes in US Treasury yields and German Bund yields. This is relevant at the current juncture, considering that the recent hawkish twist in the tone of the Federal Reserve might continue to push US long-term interest rates higher and put upward pressure on bond yields in the Eurozone.