Outlook:

Markets are in recovery mode on the idea that growth fears were overstated. This is a headline in the Financial Times so it must be true, right? We have a recovery in oil and other commodity prices after a “wobble” yesterday, yields tanked but came back, and gold is sliding downward. Risk appetite is okay.

But the IMF does not accept the market verdict and threw a hysterical fit over China’s exports falling 25% (note that the IMF accepts Chinese numbers as accurate). The IMF says the world is at a delicate juncture and faces “a rising risk of economic derailment.” Governments need to take action now to boost demand, the top IMF economist told the National Association of Business Economists. But Blanchard, the former IMF chief economist, says pessimism about the global economy doesn’t pass the reality test. “The probability of another 2008 [financial crisis] is inconceivable. The banks are clearly much stronger than they were.” The US economy is recovering. Low oil prices favor growth. The Chinese economy is not collapsing. And so on.

A tiff between the economists at the IMF and the IMF’s former chief economist is not exactly news, but we see an age-old conflict bubbling to the surface again. The IMF wants to have some power over sover-eigns, and if not power, then influence, specifically on the matter of fiscal spending. Sovereigns generally ignore the IMF unless and until they need a bailout. Just about every proposal the IMF is trying to shove down government throats entails interference with the political process that got the governments to their budgets and budget priorities in the first place. And in addition, the IMF dislikes the horribly messy process by which free and mostly free markets arrive at prices. If the commodity market over-reacts to some data out of China, it’s the commodity market that needs fixing. The IMF lacks a basic understanding of how markets work, including overreactions and the length of time a market can be out of balance, i.e., overbought or oversold.

To be fair, Blanchard is now with the Peterson Institute, which has its own agendas. Be careful what you read. This particular debate is not going anywhere—yet.

The US is not the only country with a large population of credulous idiots endlessly seeking titillation. In the US, the tabloid Sun newspapers claims the Queen favors Brexit. The source is anonymous and the Palace insists it never happened—the Queen is always politically neutral. More reasonable papers like The Guardian refute the charge but also note the Queen would deny it even if it were true.

In the US, Trump won Michigan and Mississippi. His delegate count is 458 of 1237 needed, although the big TV and newspapers, including the NYT, and the Republican party itself, all have different Trump numbers. Pundit Chris Matthews is fond of quoting Nixon—“If there is a movement to ‘Stop Mr.X,’ bet on Mr. X.” Dems think a Trump win is a fine thing—Clinton can almost certainly beat him in the general election. When women are at the top, we are spared the juvenile and exclusively male comparison of body parts. Note that if the UK does vote for Brexit, the pound will drop like a rock, or so say the majority of observers. If the US does elect Trump and if Trump follows through on imposing giant tariffs on China, the dollar will drop like a rock in anticipation of China re-denominating its reserves in some other currency. Probably neither will happen but you never know.

If it seems like we have little to report and talk about today except the vagaries of markets, it’s because nothing much is happening until the ECB announcement tomorrow morning and then again when Mr. Draghi speaks at the press conference. We like the divergent policy trade that favors the dollar because it’s logical and conforms to economic history, but as noted before, there’s many a slip between cup and lip. The ECB can withhold measures and that alone would suffice to drive the euro up. Today is a good day to get square.

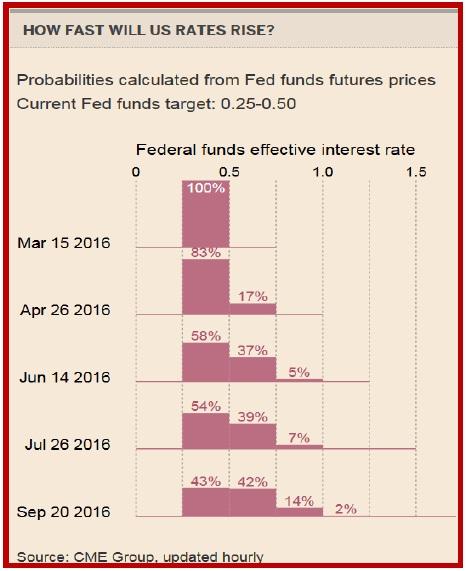

Don’t forget to take note of the Fed funds futures “forecast” of Fed policy. A month ago, there was zero probability of another hike this year. Now we see a rise in the bets on exactly that. Bloomberg reports the probability is now 50%, which differs a bit from the CME table but never mind. It’s not zero.

| Current | Signal | Signal | Signal | |||

| Currency | Spot | Position | Strength | Date | Rate | Gain/Loss |

| USD/JPY | 112.38 | SHORT USD | WEAK | 02/04/16 | 117.57 | 4.41% |

| GBP/USD | 1.4225 | SHORT GBP | WEAK | 02/17/16 | 1.4349 | 0.86% |

| EUR/USD | 1.0965 | SHORT EURO | WEAK | 02/23/16 | 1.1011 | 0.42% |

| EUR/JPY | 123.22 | SHORT EURO | WEAK | 02/11/16 | 126.19 | 2.35% |

| EUR/GBP | 0.7708 | SHORT EURO | WEAK | 03/07/16 | 0.7743 | 0.45% |

| USD/CHF | 1.0028 | LONG USD | WEAK | 03/01/16 | 1.0002 | 0.26% |

| USD/CAD | 1.3396 | SHORT USD | WEAK | 02/01/16 | 1.4031 | 4.53% |

| NZD/USD | 0.6782 | LONG AUD | STRONG | 02/01/16 | 0.6478 | 4.69% |

| AUD/USD | 0.7485 | LONG AUD | STRONG | 01/25/16 | 0.6980 | 7.23% |

| AUD/JPY | 84.12 | LONG AUD | STRONG | 03/03/16 | 83.57 | 0.66% |

| USD/MXN | 17.8647 | SHORT USD | WEAK | 02/23/16 | 18.1208 | 1.41% |

This morning FX briefing is an information service, not a trading system. All trade recommendations are included in the afternoon report.

Recommended Content

Editors’ Picks

EUR/USD rises toward 1.0700 after Germany PMI data

EUR/USD gains traction and rises toward 1.0700 in the early European session on Monday. HCOB Composite PMI in Germany improved to 50.5 in April from 47.7 in March, providing a boost to the Euro. Focus shifts Eurozone and US PMI readings.

GBP/USD eases below 1.2350, UK PMIs eyed

GBP/USD is dropping below 1.2350 in the European session, as the US Dollar sees fresh buying interest on tepid risk sentiment. The further downside in the pair could remain capped, as traders await the UK PMI reports for fresh trading impetus.

Gold price flirts with $2,300 amid receding safe-haven demand, reduced Fed rate cut bets

Gold price (XAU/USD) remains under heavy selling pressure for the second straight day on Tuesday and languishes near its lowest level in over two weeks, around the $2,300 mark heading into the European session.

PENDLE price soars 10% after Arthur Hayes’ optimism on Pendle derivative exchange

Pendle is among the top performers in the cryptocurrency market today, posting double-digit gains. Its peers in the altcoin space are not as forthcoming even as the market enjoys bullish sentiment inspired by Bitcoin price.

Focus on April PMIs today

In the euro area, focus today will be on the euro area PMIs for April. The previous months' PMIs have shown a return of the two-speed economy with the service sector in expansionary territory and manufacturing sector stuck in contraction.