Outlook:

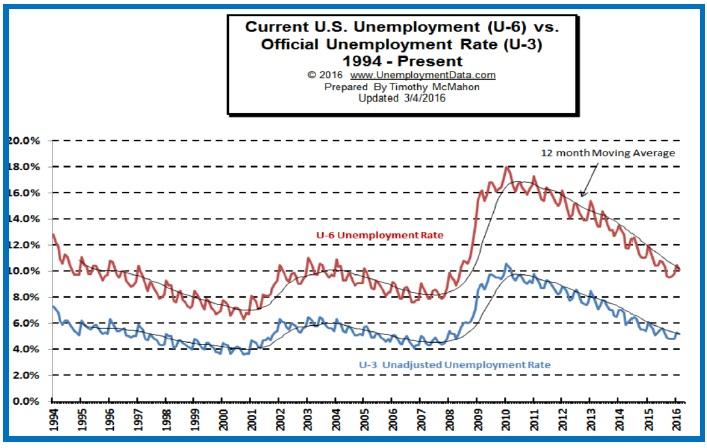

Payrolls was pretty good, beating forecasts by a mile and generating the euro spike low that it should, but pro-dollar cheeriness didn’t last past the half-hour mark. The report had only one negative but it was a critical one—after a 0.5% rise in average hourly earnings in Jan, Feb delivered a drop by 0.1%. You can’t get the Phillips Curve to work to generate inflation unless wages rise, no matter how shallow the pile of unemployed seeking work. Note that U-6, the “real” unemployment rate, fell from 10.5% in Jan to 10.1% in Feb. Critics note that the Gallup “underemployment” rate actually rose from 14.0% in Dec and in Jan to 14.7%. It’s supposed to be the same measure but differs by 4.6%.

But see the chart (from unemploymentdata.com). The downward slope of the two measures is unmistakable and shows a steady recovery.

All the same, we have nothing you could call escape velocity. Wall Street analyst Lynne writes this week that if oil prices had not been falling, household spending would not have been rising, one of our only green shoots. This is the context in which the correlation of oil and the S&P makes some sense. Assuming oil keeps rising on short-covering (if nothing else), the consumer gets hosed but the rich, or at least those who have equity positions, get richer.

The doom-and-gloom crowd faces a new metric today—inflation expectations are, indeed, rising. The FT reports the 5-year breakeven is at its highest since August. “Known as an imperfect gauge of real world activity, it is nonetheless the latest sign of a growing optimism ahead of a key Fed meeting this month. Laurence Mutkin, global head of rates strategy for BNP Paribas, said: ‘When you look at the US inflation picture it’s increasingly difficult to find an inflation index which is not already at 2 per cent, or above the Fed’s target.’” See the chart. In addition, the 2-year note divergence between Germany and the US is rising and has hit 1.45%, according to BBH’s Chandler. The two-year is a better indicator than the 10-year for this purpose.

This is not to say the Fed will act in March and possibly not even in June, but it does affirm the overall picture of divergence in growth and inflation between the US and the eurozone, and divergence in monetary policy that “should” favor the dollar.

The big factor this week is the ECB policy meeting on Thursday. Judging from the resilience of the euro after payrolls, the preponderance of opinion about the ECB’s policy choices lies with the lesser options—only a 10 bp cut and a €10 increase in QE, if any at all. Market News reports just about everybody sees a deposit rate cut by 10 to 20 bp. Some say a tiered structure of deposit rates is in the cards. But as for raising the amount of QE, opinions differ. Some say no increase at all (Barclays), while others see a rise in bond buys by €10 billion (Goldman) or as much as €20 billion (Commerzbank, Credit Suisse, Capital Economics).

A “tiered structure” means charging big banks more and smaller banks less, and also insulating house-holds from negative rates at all. When consumers have to pay a bank to hold their deposits, thoughts turn to gold. Somewhere some smart person has figured out a breakeven between negative returns and the cost of storing and insuring gold. The ECB doesn’t much care about gold but it does care, like all central banks, that the price of gold not rise too much because a rising gold price is a direct vote on central bank credibility.

We shouldn’t forget that the Bank of Canada meets Wednesday (no change expected) and the Reserve Bank of New Zealand on March 10, but ahead of the ECB. The RBNZ is more likely to lower rates, but probably not this time. We guess either or both governors may mention the currency level and sometimes that has equal power to a rate change.

We are always reluctant to predict a dollar rally. It has been the wrong way to bet in a majority of situations—for decades. But it’s hard to see how an activist ECB engaging in policy loosening (in the face of 0.7% inflation) can lift the euro against the dollar (in the face of inflation expectations over the Fed’s target). Let’s not even joke about contentious elections in Europe being better than the embarrassing political sideshow in the US. As a rule, politics doesn’t affect currencies. Let’s keep it that way. The one factor that can drive the dollar down in this situation is an on-going rally in oil.

| Current | Signal | Signal | Signal | |||

| Currency | Spot | Position | Strength | Date | Rate | Gain/Loss |

| USD/JPY | 113.50 | SHORT USD | WEAK | 02/04/16 | 117.57 | 3.46% |

| GBP/USD | 1.4146 | SHORT GBP | WEAK | 02/17/16 | 1.4349 | 1.41% |

| EUR/USD | 1.0953 | SHORT EURO | WEAK | 02/23/16 | 1.1011 | 0.53% |

| EUR/JPY | 124.32 | SHORT EURO | WEAK | 02/11/16 | 126.19 | 1.48% |

| EUR/GBP | 0.7743 | SHORT EURO | NEW*WEAK | 03/07/16 | 0.7743 | 0.00% |

| USD/CHF | 0.9994 | LONG USD | WEAK | 03/01/16 | 1.0002 | -0.08% |

| USD/CAD | 1.3364 | SHORT USD | WEAK | 02/01/16 | 1.4031 | 4.75% |

| NZD/USD | 0.6751 | LONG AUD | STRONG | 02/01/16 | 0.6478 | 4.21% |

| AUD/USD | 0.7399 | LONG AUD | STRONG | 01/25/16 | 0.6980 | 6.00% |

| AUD/JPY | 83.98 | LONG AUD | STRONG | 03/03/16 | 83.57 | 0.49% |

| USD/MXN | 17.8361 | SHORT USD | WEAK | 02/23/16 | 18.1208 | 1.57% |

This morning FX briefing is an information service, not a trading system. All trade recommendations are included in the afternoon report.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.