Outlook:

Canada and Australia both beat gloomy forecasts for Q4 GDP. Granted, Canada got only 1.2% y/y vs. 2.5% the year before, but a giant expected fiscal boost in the budget in late March will help. Australia, suffering from losses in the mining sector, managed a whopping 3% y/y. In the US, the Atlanta Fed GDPNow forecast for Q1 was 2.1% last week and 1.9% yesterday, but with five more weeks to go.

Focus on negative data really was overdone, as we suspected. And equities perked up on a rise in oil, continuing the correlation theme, even if so far today they are dipping along with the oil price dip. Still, the oil gang may be feeling less need for medication. Normally a giant rise in inventories as reported by the API (9.9 million barrels) would have trashed the oil price, but this time it was just a stumble. We get the EIA version today. This is not to say global growth worries are over, but we should marvel at how quickly traders grasp at hopeful straws. Moody’s downgrades the outlook for China and the Shanghai rallies 4.26%--huh? Japan auctions its first ever negative-yield note and the Nikkei rallies 4.11%. Go figure.

Sad to say, a fresh drop in oil could wipe out the equity gains. An on-going drop in oil could restore not only equity gloom, but also growth gloom. So it’s early days.

In the UK, uncertainty over Brexit overshadows everything and may even already be affecting data, like the construction PMI reported this morning. The other sore spot in the world economy is the eurozone. Yesterday ECB chief Draghi wrote to the EU Parliament that next week the bank will review conditions and its options. The staff will have delivered fresh forecasts for 2016-18, including presumably a downward revision in the inflation outlook. The letter is available on the ECB website. Draghi wrote “The review has to be seen against the background of increased downside risks to the earlier outlook amid heightened uncertainty about emerging market economies’ growth prospects, volatility in the financial and commodity markets, and geopolitical risks.”

He also says "there are no limits to how far we are willing to deploy our instruments within our man-date." Ah, but remember that the wily Mario likes to keep an arrow or two in his quiver. If the market expects two acts—a deeper negative rate plus an increase in QE—and he does only one of those, the euro will get a relief rally. It’s perverse—both actions would be better and offer actual relief—but anything less-negative than expected favors the currency.

Meanwhile, the US is not entirely asleep at the switch. Yesterday the Commerce Dept slapped a 266% tariff on Chinese steel imports, claiming they are being sold at unfairly low prices. Six other countries got a tariff, too, but of course it’s China we are watching. This is not the first action, either. It’s the second time in three months the US has imposed tariffs. We are not really sure where this fits into the “So What?” spectrum, but it’s not chopped liver. The US is not China’s ragdoll.

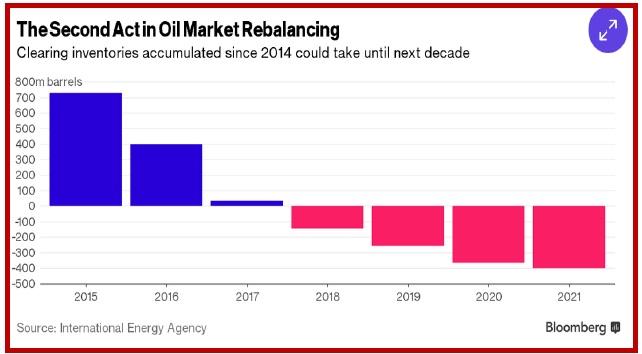

The re-emergence of diverging currency sets is a sign of health. Rises in the CAD/AUD/NZD and even MXN suggest commodities may be recovering. Bloomberg has a chart of three commodity indices showing a modest but steady improvement over the past month. But realistically, oil is central. And there Goldman and others point out that the supply overhang is the ruling factor. Even if Saudi Arabia were to get a freeze, the other nemesis is inventories. “Even when overproduction ends, a stockpile surplus of more than 1 billion barrels built up since 2014 will remain, weighing on prices. Inventories will keep accumulating until the end of 2017, the International Energy Agency forecasts, and clearing the glut could take years.” See the chart.

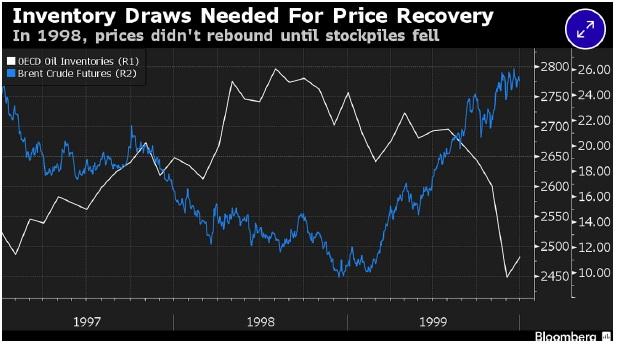

Bloomberg notes that the last time we had such a supply overhang, in 1998, prices didn’t fall until stock-piles fell. The second chart is a doozie. For one thing, China was just emerging in 1998 and while we know little about its stockpiles, we know they exist. The US was not as focused on stockpiles in 1998, either, and of course the renewal of US production came long after 1998. Nobody ever accused the fracking industry of caring about inventories. So, the lesson from the past must be heeded but with some modification for new conditions. Still, it’s likely that the new conditions don’t overwhelm the basics of supply and demand, and the inventory drawdown theory is correct.

But don’t get excited just yet. Developed countries have accumulated 3 trillion barrels. Bloomberg writes “Between late 2014, when developed-world stockpiles were at about average levels, and the end of this year, global inventories will have swelled by about 1.1 billion barrels, IEA data shows. Another 37 million will be added in 2017. Taking the agency’s projections for how quickly inventories will then fall, and estimates from Energy Aspects Ltd. that 290 million barrels will flow into China’s strategic reserves, it will take until 2021 to clear what’s accumulated.”

Considering that oil traders are flibbertigibbets—and often trade against supply-and-demand logic—we can’t take the move up yesterday that fueled a stock market rally as a new given. It’s not. Oil can drop back below $30 again at any time. And might. It’s a terrible thing for IRA savers to be in thrall to these silly people.

We would really like to know what the Fed thinks about the price of oil and the supply overhang and the stock indices everywhere taking their risk appetite from oil. We never get any commentary pertaining to these issues from the Fed. Instead the Fed speaks of the economy and where the economy stands in relation to targets, as though oil and equities are taking place on some other planet.

San Francisco Fed Williams is upbeat, saying the US economy is set to “power ahead” and push inflation back to target, despite hazards overseas, according to the FT. He downplayed fear of recession and talked up the risk of leaving rates too low for too long. Williams said the US economy is showing itself to be resilient. “I don’t see any signs in the data of any slackening of domestic demand.” Williams stands in stark contrast to the NY Fed Pres Dudley, who sees risks tilting to the downside. He also poohpoohed Summers’ “secular stagnation.” The US is not fragile. The US on the verge of collapse is not supported by the data. We need to watch housing, but over-indebtedness is China is not going to trash the US economy.

Bravo.

Now on to the next thing, which is the ADP private sector forecast of payrolls, expected to be 185,000.

This is the same number Market News has for the overall payrolls number on Friday. Now that unemployment has fallen under 5%, you’d think payrolls would be a lesser number. Not so. We are addicted to this awful thing and it will have just as much power to move markets as it always does. Usually the dollar goes up on the Wednesday before payrolls and spikes both ways on the release. In recent months the dollar has ended higher after the release, sometimes by a lot. Since the next week brings the ECB policy meeting, this is probably the way to imagine the outcome this time, too—but you can never count on it. The widening differential in favor of the dollar can vanish in a puff of smoke if the payrolls number is lousy.

About the presidential election: The only Republican who can remotely be seen as a fiscal conservative is Ohio Gov Kasich. He is also the only one who is open-minded about climate change. And he is the only one who is not an embarrassment to whatever prestige and dignity the US can still muster on the global stage. Analysts are starting to talk about an open convention in which Trump can be edged out, possibly in favor of Kasich. There are plenty of Dems who would prefer fiscal conservatism and might be persuaded to vote for a Republican who avoids the usual toxic “social conservatism” (i.e., against women, non-whites. gays, Muslims and generally anyone who is not white and male).

| Current | Signal | Signal | Signal | |||

| Currency | Spot | Position | Strength | Date | Rate | Gain/Loss |

| USD/JPY | 114.33 | SHORT USD | WEAK | 02/04/16 | 117.57 | 2.76% |

| GBP/USD | 1.3968 | SHORT GBP | STRONG | 02/17/16 | 1.4349 | 2.66% |

| EUR/USD | 1.0858 | SHORT EURO | STRONG | 02/23/16 | 1.1011 | 1.39% |

| EUR/JPY | 124.14 | SHORT EURO | WEAK | 02/11/16 | 126.19 | 1.62% |

| EUR/GBP | 0.7773 | LONG EURO | STRONG | 10/23/15 | 0.7194 | 8.05% |

| USD/CHF | 0.9983 | LONG USD | WEAK | 03/01/16 | 1.0002 | -0.19% |

| USD/CAD | 1.3460 | SHORT USD | WEAK | 02/01/16 | 1.4031 | 4.07% |

| AUD/USD | 0.7205 | LONG AUD | STRONG | 01/25/16 | 0.6980 | 3.22% |

| AUD/JPY | 82.37 | SHORT AUD | WEAK | 02/11/16 | 78.47 | -4.97% |

| USD/MXN | 17.9260 | SHORT USD | WEAK | 02/23/16 | 16.1208 | 1.08% |

This morning FX briefing is an information service, not a trading system. All trade recommendations are included in the afternoon report.

Recommended Content

Editors’ Picks

EUR/USD holds gains above 1.0700, as key US data loom

EUR/USD holds gains above 1.0700 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

GBP/USD extends recovery above 1.2500, awaits US GDP data

GBP/USD is catching a fresh bid wave, rising above 1.2500 in European trading on Thursday. The US Dollar resumes its corrective downside, as traders resort to repositioning ahead of the high-impact US advance GDP data for the first quarter.

Gold price edges higher amid weaker USD and softer risk tone, focus remains on US GDP

Gold price (XAU/USD) attracts some dip-buying in the vicinity of the $2,300 mark on Thursday and for now, seems to have snapped a three-day losing streak, though the upside potential seems limited.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.