Outlook:

We get US CPI today, forecast at a tepid -0.1% for headline CPI and +0.1% for the core CPI. Larry Summers is out on another self-promotion tour, with an article in Foreign Affairs magazine that he reprises in the FT today. He writes “I would put the odds of a US recession at about one-third over the next year and more than 50 per cent over the next two years.”

Summers writes that world conditions are so bad that the Fed would have to step up its game—more QE, more forward guidance and possibly negative rates. But the Fed can’t take the steps “that are nearly the functional equivalent of the 400 basis point cut in Fed funds that is normally necessary to respond to an incipient recession.

“If I am right in these judgments, monetary policy should now be focused on avoiding an economic slowdown and preparations should be starting with respect to the rapid application of fiscal policy. The focus of global co-ordination should shift from clichés about structural reform and budget consolidation to assuring an adequate level of global demand. And policymakers should be considering the radical steps that may be necessary if the US or global economy goes into recession.”

Oh, dear. For one thing, the WSJ survey of forecasters puts the chances of a US recession at 21%, not 33%. And what makes Summers think he can see out another year, when he puts the odds at 50%? He may be a pretty good economist but he doesn’t have a crystal ball. If China is better off than we think, if oil stabilizes, if US employment continues to improve—who is to say recession is not staved off? We are at far greater risk next year if Trump wins the presidential election and starts a trade war with China, or pushes through a low tax on corporate repatriation as we had in 2003-04, or some other dramatic change in the US economic infrastructure.

As for the usual remedy of government fiscal spending to boost the economy, where has Summers been over the past decade as the Tea Party gathered strength? The core value is to cut back government spending, and to a large extent—including sequesters and shutting down the government for weeks—it has worked. The US deficit is shrinking and that’s what a very large portion of the US electorate wants. As for Europe expanding deficit spending, Germany just outright refuses and Mr. Draghi is getting no-where with his call for coordinated fiscal stimulus. Summers is acting like the proverbial ivory tower economist.

We are more at risk of financial markets going into turmoil than we are at risk of economic activity going into reverse gear from lack of demand. With US unemployment under 5%, demand can hardly be said to be on a downward slope. Commodity and stock market declines are toxic to confidence, and it’s not just psychological. The “wealth effect” is very real, and seemingly more powerful than the savings from low energy costs.

But we admit that sentiment remains vulnerable to the China effect. G20 meets next week in Shanghai. We are tempted to say “So What?” It seems unlikely we will get a reprise of the currency war theme and it remains to be seen whether the G-19 will find it appropriate to criticize the host. There is plenty to criticize, including the August blunders and the apparent retreat from free-market practices that got China the IMF’s “approved currency” status only in December.

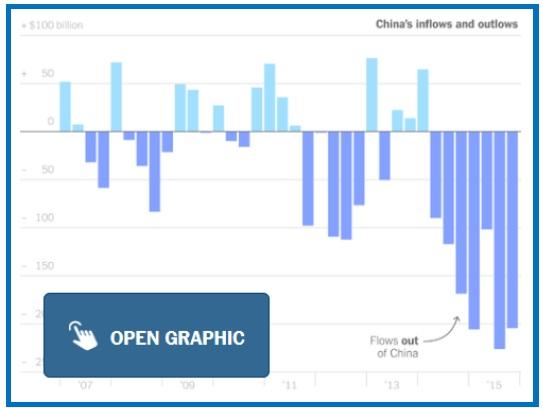

The South China Morning Post reports the government omitted an entry named “position for forex purchase” for all financial institutions from the latest “Sources and Uses of Credit Funds of Financial Institutions in Foreign Currencies” in the latest PBOC monthly report. The report specifies the central bank position—purchases of ¥24.2 trillion in January--but omits the private banks. Analysts will be able tofigure it out from SAFE data to be released later, but it looks like an effort to conceal the extent of capital outflows. The drop in reserves in Jan was about $100 billion (after $108 billion in Dec).

Also, the NYT has a story on Chinese reserves that meanders all over the place, saying reserves stand at $3.23 trillion at end-Jan (from $4 trillion in 2014) and the question is how far down reserves can go before it’s a problem. Some of the reserves are not available anyway because they are committed to long-term investment projects in places like Africa. We wonder if that doesn’t remove them from “reserves” in the first place.

“Economists inside and outside China are increasingly trying to guess how far reserves must fall before China might consider a sharp devaluation of the currency. An International Monetary Fund model suggests that an economy of China’s size needs $1.5 trillion with strict capital controls and $2.7 trillion without them. Brad Setser, a former United States Treasury official now at the Council on Foreign Relations, said that China could manage with smaller reserves because the model exaggerates the need for reserves in a country like China with very large domestic banking deposits.”

Separately, Bloomberg reports the PBOC will raise reserve requirements for some banks next week if their capital ratios and other metrics indicate they are lending too wildly. About 60% of the surge in lending in January is due not to the Big Four but to smaller banks.

In a nutshell, we can set aside worries about China for only a day or two at a time. China may still be the source of new volatility that spreads to other markets. And it’s the seeming connectedness of markets that is the real threat—the fear of contagion is worse than the disease, so to speak. The world can live with slower growth. What it can’t live with is high uncertainty.

Back in the FX world, we believe in charts. The charts are showing the dollar overbought against nearly everything, including the benchmark euro and even more so against the Swiss franc. A correction is coming. It may not be volcanic, but it won’t be negligible, either.

| Current | Signal | Signal | Signal | |||

| Currency | Spot | Position | Strength | Date | Rate | Gain/Loss |

| USD/JPY | 112.82 | SHORT USD | STRONG | 02/04/16 | 117.57 | 4.04% |

| GBP/USD | 1.4304 | SHORT GBP | WEAK | 02/17/16 | 1.4349 | 0.31% |

| EUR/USD | 1.1099 | LONG EURO | WEAK | 02/04/16 | 1.1182 | -0.74% |

| EUR/JPY | 125.22 | SHORT EURO | WEAK | 02/11/16 | 126.19 | 0.77% |

| EUR/GBP | 0.7759 | LONG EURO | WEAK | 10/23/15 | 0.7194 | 7.85% |

| USD/CHF | 0.9947 | SHORT USD | STRONG | 01/04/16 | 0.9979 | 0.32% |

| USD/CAD | 1.3783 | SHORT USD | STRONG | 02/01/16 | 1.4031 | 1.77% |

| NZD/USD | 0.6613 | LONG NZD | WEAK | 02/02/16 | 0.6486 | 1.96% |

| AUD/USD | 0.7105 | LONG AUD | STRONG | 01/25/16 | 0.6980 | 1.79% |

| AUD/JPY | 80.16 | SHORT AUD | WEAK | 02/17/16 | 81.62 | -2.15% |

| USD/MXN | 18.3251 | LONG USD | WEAK | 12/07/15 | 16.7258 | 9.56% |

This morning FX briefing is an information service, not a trading system. All trade recommendations are included in the afternoon report.

Recommended Content

Editors’ Picks

AUD/USD stands firm above 0.6500 with markets bracing for Aussie PPI, US inflation

The Aussie Dollar begins Friday’s Asian session on the right foot against the Greenback after posting gains of 0.33% on Thursday. The AUD/USD advance was sponsored by a United States report showing the economy is growing below estimates while inflation picked up. The pair traded at 0.6518.

EUR/USD mired near 1.0730 after choppy Thursday market session

EUR/USD whipsawed somewhat on Thursday, and the pair is heading into Friday's early session near 1.0730 after a back-and-forth session and complicated US data that vexed rate cut hopes.

Gold soars as US economic woes and inflation fears grip investors

Gold prices advanced modestly during Thursday’s North American session, gaining more than 0.5% following the release of crucial economic data from the United States. GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the US Fed could lower borrowing costs.

Bitcoin price continues to get rejected from $65K resistance as SEC delays decision on spot BTC ETF options

Bitcoin (BTC) price has markets in disarray, provoking a broader market crash as it slumped to the $62,000 range on Thursday. Meanwhile, reverberations from spot BTC exchange-traded funds (ETFs) continue to influence the market.

US economy: Slower growth with stronger inflation

The dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.