Outlook:

You can be excused for wondering what planet we live on when Deutsche Bank is under severe pressure, the Bund is yielding 0.262% and yet the euro is rising. Why is the euro being treated like a safe-haven currency? Back in December, Market News reported European banks are not as healthy as they should be— of the 24 banks with a market cap over $5 billion, 21 of those with 5% or more non-performing loans are European.

The WSJ reports about Deutsche Bank “The German lender’s shares now have declined almost 50% since co-Chief Executive John Cryan made his first public appearances in his new role, in late October in Frankfurt and London. Monday was another brutal day for European bank shares, with Deutsche Bank posting a particularly steep decline. The German bank’s shares dropped 9.5%, to €13.82, in high-volume trading, while the Stoxx Europe 600 banks index fell 5.6%. Shares in Barclays PLC, BNP Paribas SA and UniCredit SpA fell more than 5%. Greek banks also took a beating, with the three biggest banks by assets all seeing share losses of nearly 30% for the day.”

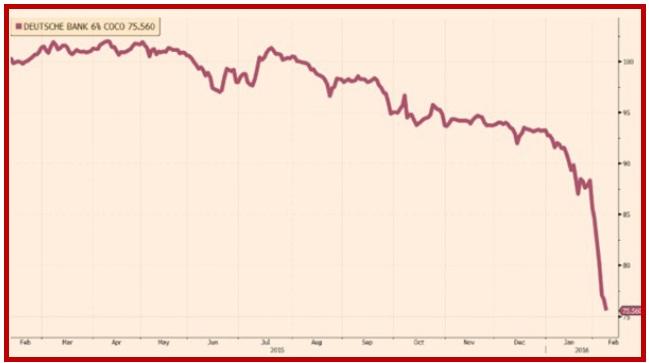

The FT has a series of articles on investors fleeing coco’s (see below) and other bank bonds as well as bank equities. Deutsche Bank saw its €1.75bn coco bond with a 6 per cent coupon start falling last week and it is now trading below 76 cents on the euro. “Another $1.5bn bond hit 81.5 cents on the dollar on Friday.” See the FT’s chart. Deutsche Bank already said the pool of funds to pay coco coupons is the same as the pool for bonuses and dividends but cocos will be prioritized. The FT notes “The market is also highly technical. The bonds are not included in major indices, weakening support when prices fall. The instruments are perpetual but market expectations that they will be called has also driven price activity. So far, no bank has actually defaulted on a coco bond and losses are limited to secondary markets. Uncertainty over what that process might look like has only added to the market’s woes.”

As we have noted to the point of being tiresome, the pivot point of all financial crises is institutional. Liquidity is the first place a crumbling institution sees stress. With investors fleeing both stocks and bonds in the European banking sector, Mr. Draghi must be getting mighty worried. After all, the ECB is in charge of regulation now as well as monetary policy per se. Blame for failures, assuming we get any, will fall on the ECB and not just the member’s central banks and regulators. Some analysts want to blame Portugal, where various problems are driving up yields generally, but you don’t get contagion from a sick party unless the second party is weak to begin with.

This morning Goldman denies there is a crisis, saying liquidity is just fine. According to Bloomberg, Goldman says “’So far, there is no evidence of strain’ in euro or dollar funding for European banks and rising deposits last year reinforced the liquidity of the region’s lenders… Use of European Central Bank cash is down from its 2012 peak and banks have added 800 billion euros ($894 million) in ‘external cap ital hikes’ since the start of the financial crisis.” In fact, Goldman is touting French bank BNP Paribas for its top pick. Despite everyone knowing Goldman has an axe to grind, it tends to have credibility. Maybe this flop is just a one-time thing and will vanish is puff of smoke.

Whatever the outcome of the European financial system brouhouha, it has to be one more worry in the bag of worries Fed chief Yellen is carrying around. At least we don’t have China this week adding to woes, but you can be sure the Fed staffers are cranking out scenarios and Beijing bureaucrats are burning the midnight oil.

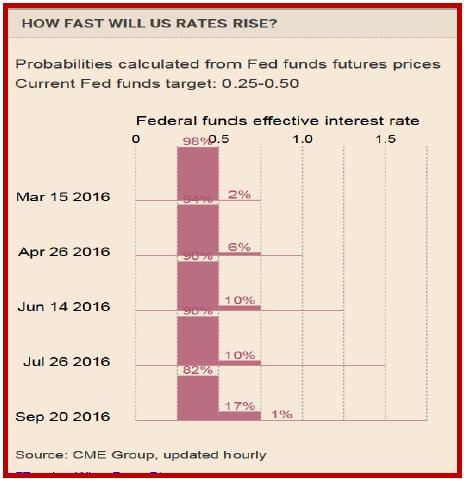

After payrolls, it seemed likely Yellen would not be dovish in tomorrow’s Congressional testimony. Maybe not hawkish, either, but perhaps preening a little that the jobs numbers, especially the rise in wages, point to no recession and the Fed justified in hanging on to the scenario of at least one more hike this year, if not all four. Does the European financial sector problem cut that justification down? We shall see. But the fixed income market, or at least the Fed funds futures market, certainly thinks so. See the FT’s chart on futures, updated hourly (wow). It shows the probability of another hike by September at only 17%. This is pretty scary. It will be interesting to see the chart late tomorrow.

In the meanwhile, we have to accept that the euro is a safe-haven currency even when troubles are European. This is illogical and perverse, but there it is.

About Coco’s: Like most people, we had to go look up the definition of a “contingent convertible” bond, or coco. Here is a precis of a report from The Economist from Sept 2014. Cocos are a hybrid of equity and debt mostly issued after 2010 by big banks like Credit Suisse and HSBC. “Issuance went from nearly nothing in 2010 to $64 billion so far this year [late 2014].

The idea was that banks needed more equity to avoid government bailouts and cocos filled the need. “Cocos take multiple forms, but all are intended to behave like bonds when times are good, yet absorb losses, equity-like, in a crisis. At a given trigger point, when equity levels are so low that bankruptcy threatens, cocos either lose some or all of their value, or get exchanged for shares. Regulators have allowed them to be used in limited quantities to meet increased equity requirements. Banks promise the coco bondholders will get ‘bailed in’, to use the regulatory argot, in lieu of taxpayers.”

In good times, coco’s yield little and in bad times, like now, a lot. One analyst said in The Economist piece that in bad times, coco’s will be equivalent to “picking up pennies in front of a bullet train.” Besides, “The triggering of one coco will frighten investors away from all of them. Lawsuits will undoubtedly ensue, injecting panic at the most awkward time. Given recent experience, the watchdogs are right to be wary of anything banks are keen on.”

| Current | Signal | Signal | Signal | |||

| Currency | Spot | Position | Strength | Date | Rate | Gain/Loss |

| USD/JPY | 115.28 | SHORT USD | STRONG | 02/04/16 | 117.57 | 1.95% |

| GBP/USD | 1.4454 | LONG GBP | STRONG | 02/02/16 | 1.4386 | 0.47% |

| EUR/USD | 1.1214 | LONG EURO | WEAK | 02/04/16 | 1.1182 | 0.29% |

| EUR/JPY | 129.29 | LONG EURO | STRONG | 02/01/16 | 131.83 | -1.93% |

| EUR/GBP | 0.7758 | LONG EURO | WEAK | 10/23/15 | 0.7194 | 7.84% |

| USD/CHF | 0.9806 | SHORT USD | WEAK | 01/04/16 | 0.9979 | 1.73% |

| USD/CAD | 1.3863 | SHORT USD | STRONG | 02/01/16 | 1.4031 | 1.20% |

| NZD/USD | 0.6608 | LONG NZD | WEAK | 02/02/16 | 0.6486 | 1.88% |

| AUD/USD | 0.7034 | LONG AUD | STRONG | 01/25/16 | 0.6980 | 0.77% |

| AUD/JPY | 81.15 | LONG AUD | STRONG | 01/25/16 | 82.66 | -1.83% |

| USD/MXN | 18.6795 | LONG USD | WEAK | 12/07/15 | 16.7258 | 11.68% |

This morning FX briefing is an information service, not a trading system. All trade recommendations are included in the afternoon report.

Recommended Content

Editors’ Picks

EUR/USD climbs to 10-day highs above 1.0700

EUR/USD gained traction and rose to its highest level in over a week above 1.0700 in the American session on Tuesday. The renewed US Dollar weakness following the disappointing PMI data helps the pair stretch higher.

GBP/USD extends recovery beyond 1.2400 on broad USD weakness

GBP/USD gathered bullish momentum and extended its daily rebound toward 1.2450 in the second half of the day. The US Dollar came under heavy selling pressure after weaker-than-forecast PMI data and fueled the pair's rally.

Gold rebounds to $2,320 as US yields turn south

Gold reversed its direction and rose to the $2,320 area, erasing a large portion of its daily losses in the process. The benchmark 10-year US Treasury bond yield stays in the red below 4.6% following the weak US PMI data and supports XAU/USD.

Here’s why Ondo price hit new ATH amid bearish market outlook Premium

Ondo price shows no signs of slowing down after setting up an all-time high (ATH) at $1.05 on March 31. This development is likely to be followed by a correction and ATH but not necessarily in that order.

Germany’s economic come back

Germany is the sick man of Europe no more. Thanks to its service sector, it now appears that it will exit recession, and the economic future could be bright. The PMI data for April surprised on the upside for Germany, led by the service sector.