Outlook:

The payrolls report on Friday was confusing to some. Yes, the number of new jobs creat-ed disappointed on the downside, but average wages rose 2.5% y/y and that was the important number. We also got a drop in the unemployment rate from 5% to 4.9%, but we say that’s a dumb number no-body should pay attention to because the data collection process is haphazard, to be charitable.

The fixed income and FX market was the right place to look for the correct interpretation of the pay-rolls story. Market News wrote “The next Fed rate hike is back in play due to a good payrolls report. The US 10-year note yield shifted from 1.850% before the release to 1.880% by 10 am….” Granted, the yield slipped afterwards on other developments, including the self-same drop in equities that drove some to notes and bonds. And the USD rallied strongly.

The Market News fixed income analyst has the most relevant commentary: “The front-end and the 5-year note were forced to reconsider what this report could mean for Fed rate hikes down the road. The 2-year yield rose to a high of 0.762% vs. its close of 0.712% on Thursday and its 0.702% on screen bid heading into jobs. The 5-year yield hit a high of 1.295% vs. its close on Thursday of 1.250% and its pre-jobs bid of 1.22%. Later in the day, the market came off the worst levels as stocks turned deeply into the red even though oil held up pretty nicely during the session.

“The 10-year note initially held in better on jobs, then gave up the gains and then went to new highs heading into the weekend. All in all, the note traded at a high yield of 1.894% after jobs vs. its close of 1.865% and its pre-jobs bid of 1.837%. By the early afternoon, though, it was hovering closer to 1.83% on short-covering and safe-haven.”

Do we let the stock market—or the bond market, for that matter—determine the economic outlook? Af-ter all, they have both been wrong before, as in the case of the nine inverted yield curves that led to five recessions (the Samuelson joke).

The answer is yes, when we have weak faith in the theories the Fed is embracing. The Fed accepts the Phillips curve hypothesis that labor shortages lead to wage increases and to thus demand for goods. Assuming the supply of goods remains the same, rising demand leads to price increases, i.e., in-flation. It’s simple, it’s logical, and it has been refuted regularly and powerfully for decades, Sometime labor chooses to save instead of spend. Sometimes a surge in goods from abroad replaces demand for domestic goods. Sometimes a shift in the type of goods demanded leaves most prices unchanged. And so on.

Still, the January jobs report gives Yellen a leg to stand on, if only one. She will likely mention skilled labor shortages reported in the press, plus pay raises at some important employers like Wal-Mart. We will presumably get another dose of the Phillips curve this Wednesday when Fed chief Yellen speaks to the House Financial Services Committee. Somebody is sure to mention that over the past few months, economic data has been weakening—PMI’s, durables—and in no small part due to the strong dollar. She may get asked about Dudley’s mention of “tightening financial conditions,” even though the senior bank lending officer report on which that comment was based refers to only 20% on the responding banks. But at a guess, Yellen will try to keep the focus on jobs and be as careful as possible not to say the word “dollar.”

We can hardly expect Yellen to address that the fixed income market believes the Fed can do only one more hike this year, if that, when the Fed said only in December it expected four this year. The Barclays US economist now sees another two, starting in June. The JP Morgan analyst thinks “… the Fed impli-cations of today's data are hawkish, due to the move down in the unemployment rate and the move up in wages. Were the meeting held tomorrow we still think the Fed would stay on hold -- primarily because of concerns about inflation and inflation expectations -- but it would be an uncomfortable hold. While the financial press has buried the Phillips curve, Yellen and Fischer have been around long enough to have seen this in the past, and each time it's been a premature burial."

And SocGen analysts said "the recent pickup in wage pressures, although modest, confirms that labor slack has largely been eroded. The resilience of core inflation trends reinforces this point. It is troubling that the erosion of slack has continued with very subdued GDP growth - 1.8% in 2016 - which suggests that potential growth is currently running well below 1.5%. This means that the FOMC may have to con-tinue normalizing policy even as the economy continues to produce less-than-stellar GDP performance."

Market News notes that not everyone is on the same page and the Fed still has its detractors. A Morgan Stanley analyst is downright mean: "Unless you think there's a risk they bumble into a policy mistake by adding to the increasingly dubious December rate hike, these results probably don't realistically change March being off the table for the Fed given how poor the overall flow of data has been and rising risks from global weakness and tightening financial conditions. The extent of Chair Yellen's dovishness next week will likely be less, though, than if the report had been weaker."

Market News cites the Atlanta Fed statement: "After this morning's employment report from the U.S. Bureau of Labor Statistics, the forecast for real consumer spending growth increased from 2.5 percent to 3.0 percent and the forecast for real gross private domestic investment growth increased from -0.4 per-cent to 2.1 percent.”

Most people find economic data tiresome, including economists, preferring sound bites like “Yellen hawkish.” Most of the time, stockbroker economics, i.e. ,the sound bite stuff, is good enough because that’s what the crowd likes… and following the crowd is generally the right idea. But this is one of those times when understanding the data may pay off even if it results in deductions contrary to current market interpretations. If we believe the 2.5% increase in pay is the most relevant of the payrolls numbers and if we assume the Fed clings to the Phillips curve, then we should assume the Fed is no-where close to buying into the Dec hike as a mistake. A hike in March is almost certainly off the table but June is a solid bet.

This means the divergent policy strong-dollar thesis is alive and well, especially with Mr .Draghi ex-pected to bring out some big guns in March.

That leaves us with two flies in the ointment—oil and China. The stock market’s correlation with oil is puzzling and irrational. Cheap oil is good for more players, both corporate and consumer, than it is bad for other players, including oil companies and the economy of North Dakota and Oklahoma. To be harsh, there is nothing in the demand side of oil that justifies stock market gloom. Demand continues to grow, if less than when China was roaring, and the real issue is over-supply. Equity markets “should” be responding to its own fundamentals like earnings and “should” pay a lot less attention to oil prices in order to come up with “fair value.” We put “fair value” in quotes because it’s an overused and ill-conceived idea, but never mind. There is no reason for businesses totally unrelated to oil prices to see their stock prices change because of oil prices. In both instances, it’s the herd mentality.

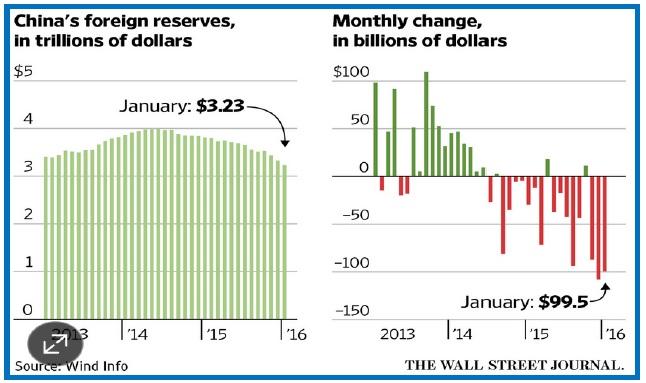

A little more troubling is China, which is on holiday for the next week. We are worried about the drop in reserves—defending the yuan and capital flight—but the real worry is the structure of the financial sec-tor.

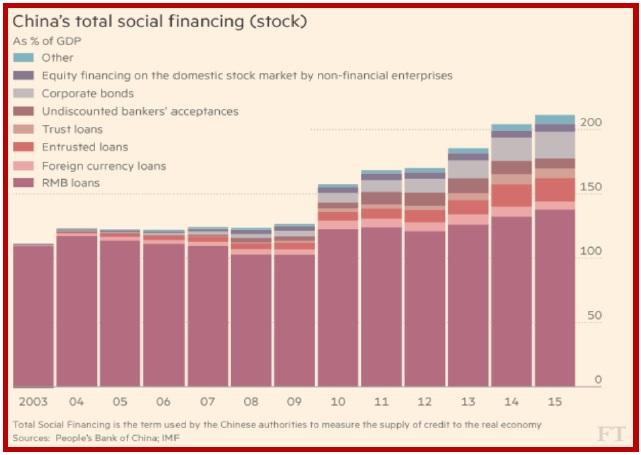

Again, why the rest of the world’s equity players choose to track the Shanghai is not justified. The Chi-nese stock market has very little public participation and in any case, is a minor player in the capital market. That role belongs to the banks, especially the Big Four, which fund about 70% of all activity. The FT notes “Yet this model is itself a problem. Policymakers know the economy needs other sources of finance. Ideally, companies would draw more from stock markets and bond markets, and rely less on bank lending. In the long run, the recent stock market panics will make it more difficult to achieve Chi-na’s goal of a more balanced financial system. The government has already delayed new IPOs, and the launch of an improved IPO system, in response to the turmoil.”

See the FT’s chart below. The FT article ends with this scary thought: “Moving from debt-funded growth to equity-funded growth could put China’s economy on more stable ground. Equity investors accept that share prices change, whereas bond investors or bankers making loans systematically overes-timate how safe their assets are. This leads to economies shouldering too much debt because creditors underestimate risk. China, with debt totalling more than 240 per cent of its GDP, is no exception.”

So, while we still need to worry about a big one-time devaluation and other shocks, the real issue in Chi-na is the risk from big banks and the risk that the transition to a more balanced financial structure is de-layed too long. If we get some reforms cooked up over the long holiday, they might pertain to reform of the equity market or the banking sector rather than the currency.

To conclude—the euro upside breakout, big though it was, may be another false breakout. If the rest of the world comes to the conclusion the US economy is okay and Yellen will be hawkish on Wednesday, the recovery could proceed and PDQ. But never forget the dollar remains vulnerable to any number of threats, including bad data. As of today, we like the Atlanta GDPNow that shows the economy resilient, if not robust. It’s a little interesting that the US might get the same growth rate, 2.2%, as the UK is ex-pected to get. The US doesn’t have Brexit, but the UK doesn’t have Trump. (With any luck tomorrow night, we won’t have him much longer, either.)

| Current | Signal | Signal | Signal | |||

| Currency | Spot | Position | Strength | Date | Rate | Gain/Loss |

| USD/JPY | 116.73 | SHORT USD | NEW*STRONG | 02/04/16 | 117.57 | 0.71% |

| GBP/USD | 1.4457 | LONG GBP | WEAK | 02/02/16 | 1.4386 | 0.49% |

| EUR/USD | 1.1167 | LONG EURO | NEW*WEAK | 02/04/16 | 1.1182 | -0.13% |

| EUR/JPY | 130.37 | LONG EURO | STRONG | 02/01/16 | 131.83 | -1.11% |

| EUR/GBP | 0.7724 | LONG EURO | WEAK | 10/23/15 | 0.7194 | 7.37% |

| USD/CHF | 0.9913 | LONG USD | WEAK | 01/04/16 | 0.9979 | 0.66% |

| USD/CAD | 1.3882 | SHORT USD | STRONG | 02/01/16 | 1.4031 | 1.06% |

| NZD/USD | 0.6637 | LONG NZD | WEAK | 02/02/16 | 0.6486 | 2.33% |

| AUD/USD | 0.7098 | LONG AUD | STRONG | 01/25/16 | 0.6980 | 1.69% |

| AUD/JPY | 82.86 | LONG AUD | STRONG | 01/25/16 | 82.66 | 0.24% |

| USD/MXN | 18.4867 | LONG USD | WEAK | 12/07/15 | 16.7258 | 10.53% |

This morning FX briefing is an information service, not a trading system. All trade recommendations are included in the afternoon report.

Recommended Content

Editors’ Picks

AUD/USD pressures as Fed officials hold firm on rate policy

The Australian Dollar is on the defensive against the US Dollar, as Friday’s Asian session commences. On Thursday, the antipodean clocked losses of 0.21% against its counterpart, driven by Fed officials emphasizing they’re in no rush to ease policy. The AUD/USD trades around 0.6419.

EUR/USD extends its downside below 1.0650 on hawkish Fed remarks

The EUR/USD extends its downside around 1.0640 after retreating from weekly peaks of 1.0690 on Friday during the early Asian session. The hawkish comments from Federal Reserve officials provide some support to the US Dollar.

Gold price edges higher on risk-off mood hawkish Fed signals

Gold prices advanced late in the North American session on Thursday, underpinned by heightened geopolitical risks involving Iran and Israel. Federal Reserve officials delivered hawkish messages, triggering a jump in US Treasury yields, which boosted the Greenback.

Runes likely to have massive support after BRC-20 and Ordinals frenzy

With all eyes peeled on the halving, Bitcoin is the center of attention in the market. The pioneer cryptocurrency has had three narratives this year already, starting with the spot BTC exchange-traded funds, the recent all-time high of $73,777, and now the halving.

Billowing clouds of apprehension

Thursday marked the fifth consecutive session of decline for US stocks as optimism regarding multiple interest rate cuts by the Federal Reserve waned. The downturn in sentiment can be attributed to robust economic data releases, prompting traders to adjust their expectations for multiple rate cuts this year.