Outlook:

The shocking BoJ move to negative rates points up two important things—Japan can’t goose its economy no matter what the BoJ does. Japan has had QE since 2001 and still growth is spotty. While not technically in deflation, the economy is unable to get any price traction, either.

This should probably worry us. When the return on capital is zero or near zero, why would anyone bother to accumulate capital, least of all to put it to work in production capacity? This is the libertarian stance and sometimes it makes sense. It makes the most sense when we already have excess capacity and over-supply, and when demand is weak, to boot.

This is especially true in Japan, where banks can’t find worthy borrowers. The WSJ notes lending at Mitsubishi rose by 2.8% in the first 9 months of the fiscal year, but with an earnings margin of only 1% and net profit down by 8%, albeit also attributable to bad bond trading. Lack of lending opportunities will push the Japanese banks into lending to non-Japanese in foreign currencies as well as foreign bonds and real estate.

The second point is the familiar refrain of everybody counting on central banks to fix everything. In practice, central banks can fix very little. A lack of coordination with fiscal and tax policy is unhealthy, and when fiscal and tax policy is a muddle, as in the US, the central bank is doubly hobbled. Mr. Draghi speaks of fixing fiscal policy all the time, to deaf ears. Mr. Renzi might be listening, but he has his own worries of other sorts, including the expensive refugee crisis. Prioritizing the coordination of monetary and fiscal policy is just not happening.

On this front, ECB board member Couere proposed the European Commission act as a treasury for the eurozone. This would bolster the commitment to union (and offend the sovereign rights gang). "Another element will be to build up a genuine legislative capacity at euro area level and to make institutions acting in the euro area's interest, such as the European Stability Mechanism, accountable to it." Coeure aims for the melding of fiscal policy, however limited, with monetary policy. We should assume two things—Draghi is behind it and also the first order of business would be a pan-eurozone unemployment benefits plan. But efforts of this sort have always gotten shot down in the past.

Turning to the US, the excellent John Authers at the FT has a piece on the Fed probably having to retreat from the First Hike. He points out that Fed funds futures do not embody a forecast for more hikes this year. Inflation expectations are at 2009 levels. And growth in Q4 was a lousy 0.7%. “Others cannot bear the strong dollar that comes with higher US rates. The market is betting that the US economy also cannot bear it, and that the Fed will have to step back.

“The immediate response to the Bank of Japan and the poor US economic data was that bad news is good news, as it suggests that rates will be lower for longer. The strength of that reaction, and the efficacy of easy money in raising asset prices, is weakening over time. But even if central banks’ remaining weapons do not look strong, the pressure is on the Fed’s chair Janet Yellen to step back from the Fed’s hawkish stance when she answers questions from Congress next month. All eyes — including Asian eyes — will be on her.”

We usually like Authers but we think he is wrong this time. We may indeed get a long delay in the next Fed hike for various reasons, including oil and China, not to mention sub-par S&P earnings, but this is “lower for longer” and will not include a reversal of the one hike we do have. The reason is that the Fed has a Keynesian ideological slant. Complain about it all you like, but it’s the majority view among economists and it’s the only theory that has ever been put to use in actual policy measures, and on the whole, these measures have worked. That they are not working in Japan and are probably reaching the end of their useful life in the US does not invalidate them.

The alternative is “liquidate everything,” as TreasSec Mellon reportedly told Hoover (he may not have actually said it). Mellon liked von Mises and Hayek, who believed liquidation and austerity would restore (eventually) the re-allocation of investment capital into businesses where demand is rising. The rest can go hang. The problem is that liquidation does not always work.

We had a bubble in housing prices that led to the 2008-09 financial sector crisis. Once we had the “liquidation,” the housing sector should have recovered. But we have a stunning shortage of housing. The root cause of housing problems is lack of demand, and that lack of demand arises from wages having fallen or stayed flat for the whole period.

Somebody is sure to bring up the absence of productivity gains and other labor market factors, but let’s not get distracted. The housing “cycle,” if we can call it that, failed to resume after a liquidation because incomes failed to rise. Inflation/deflation has nothing to do with it. In fact, the Fed has (almost) nothing to do with it. Cheap money is nice but does not suffice to get a company to build a new factory if the goods are not in demand, and the goods may not be in demand chiefly or solely because buyers lack the income to buy them.

Let’s say this is how the Fed looks at it. Making money easier again would be the proverbial Keynesian pushing on string. Nor would it not work, i.e., goose activity, it would damage the Fed’s credibility in a dozen ways. Bottom line—ain’t gonna happen.

Where we might see “liquidate everything” is China. Additional central bank easing measures and a giant rise in the fiscal deficit, already in motion, can’t save companies with over-capacity and low demand. Reuters notes “China’s corporate debt has soared since the global financial crisis and is now equivalent to 160% of GDP, up from 98% in 2007, according to estimates from rating agency Standard & Poor’s Financial Services LLC. During the same period, companies in the U.S., Britain, Germany and India barely increased their debts, economists said.”

We don’t know what percentage of this debt is private vs. public, but it hardly matters. China has the ability to chop these companies down to size and to make up the losses (somehow) to the mostly stateowned banks. We doubt China would make up losses to bond investors and equity holders in these companies. This could easily become the source of a new financial crisis, depending on how contagious it gets. We would need to imagine how the failure of a Chinese brokerage that lent on margin to buyers of paper in a now-failing company would affect banks and brokers elsewhere, say Germany, the UK or the US.

It goes without saying that capital flight and pressure on the yuan come hard on the heels of company failures and financial institution stress that results from them. If China were going to do it—let companies fail—the upcoming Lunar Year holiday would be the ideal time. Markets will be closed for most the week starting Feb 8. At a guess, this is too early for China to bite the bullet. It might not be too early for another one-time devaluation. Everyone is waiting for another shoe to drop. We don’t know whether it’s a sandal or a whopping great work-boot.

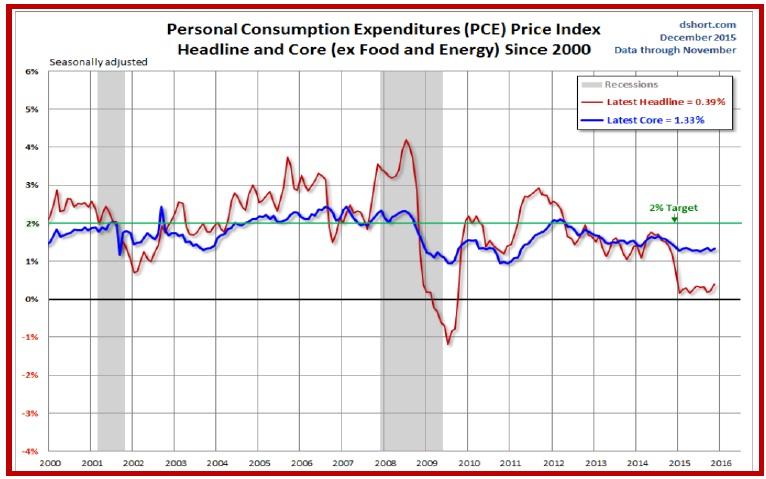

Turning back to the US, this week is so full of data our heads will spin, especially after the disappointing GDP at only 0.7% (when 08% was the forecast). We get January data for the PMI’s, personal income and spending (including the infamous PCE inflation measure), vehicle sales, chain store sales, and the biggie, payrolls of Friday, with the usual punctuation of the ADP private sector forecast on Wednesday. Oh, yes, and oil inventories and rig count. We may think payrolls will run the show but cool heads are noting that the core PCE deflator is forecast at 1.4% in Dec from 1.3% in Nov. See the chart. The recent improvement is very small and we shouldn’t put too much faith in something measured to the second decimal point, but it’s not chopped liver, either.

As we said, too much data and too many things to think about without a coherent theoretical underpinning. But bottom line, unless the US delivers just awful data this week, the Fed remains on track to be the only central bank taking away the punchbowl. As long as we assume the Fed doesn’t act on the toostrong dollar—or say anything about it, either—we see no reason for the divergent policy thesis not to be the dominant theme and thus the dollar to maintain firmness, if not get at least a little stronger. If China takes extreme action over the next week or two or is thought to be planning extreme action, the euro can regain some of its safe-haven moxie (as can the Swissie and yen). This is a bad environment to be making big bets.

| Current | Signal | Signal | Signal | |||

| Currency | Spot | Position | Strength | Date | Rate | Gain/Loss |

| USD/JPY | 121.33 | LONG USD | STRONG | 01/29/16 | 120.91 | 0.35% |

| GBP/USD | 1.4286 | SHORT GBP | STRONG | 11/06/15 | 1.5137 | 5.62% |

| EUR/USD | 1.0864 | SHORT EURO | WEAK | 01/04/16 | 1.0905 | 0.38% |

| EUR/JPY | 131.83 | LONG EURO | NEW*STRONG | 02/01/16 | 131.83 | 0.00% |

| EUR/GBP | 0.7604 | LONG EURO | WEAK | 10/23/15 | 0.7194 | 5.70% |

| USD/CHF | 1.0216 | LONG USD | WEAK | 01/04/16 | 0.9979 | 2.37% |

| USD/CAD | 1.4031 | SHORT USD | NEW*WEAK | 02/01/16 | 1.4031 | 0.00% |

| NZD/USD | 0.6468 | LONG NZD | WEAK | 12/11/16 | 0.6560 | -1.40% |

| AUD/USD | 0.7070 | LONG AUD | WEAK | 01/25/16 | 0.6980 | 1.29% |

| AUD/JPY | 85.79 | LONG AUD | STRONG | 01/25/16 | 82.66 | 3.79% |

| USD/MXN | 18.1819 | LONG USD | WEAK | 12/07/15 | 16.7258 | 8.71% |

This morning FX briefing is an information service, not a trading system. All trade recommendations are included in the afternoon report.

Recommended Content

Editors’ Picks

GBP/USD stays weak near 1.2400 after UK Retail Sales data

GBP/USD stays vulnerable near 1.2400 early Friday, sitting at five-month troughs. The UK Retail Sales data came in mixed and added to the weakness in the pair. Risk-aversion on the Middle East escalation keeps the pair on the back foot.

EUR/USD extends its downside below 1.0650 on hawkish Fed remarks

The EUR/USD extends its downside around 1.0640 after retreating from weekly peaks of 1.0690 on Friday. The hawkish comments from Federal Reserve officials provide some support to the US Dollar.

Gold: Middle East war fears spark fresh XAU/USD rally, will it sustain?

Gold price is trading close to $2,400 early Friday, reversing from a fresh five-day high reached at $2,418 earlier in the Asian session. Despite the pullback, Gold price remains on track to book the fifth weekly gain in a row.

Bitcoin Price Outlook: All eyes on BTC as CNN calls halving the ‘World Cup for Bitcoin’

Bitcoin price remains the focus of traders and investors ahead of the halving, which is an important event expected to kick off the next bull market. Amid conflicting forecasts from analysts, an international media site has lauded the halving and what it means for the industry.

Israel vs. Iran: Fear of escalation grips risk markets

Recent reports of an Israeli aerial bombardment targeting a key nuclear facility in central Isfahan have sparked a significant shift out of risk assets and into safe-haven investments.