Outlook:

The important information today will be US Q4 GDP. The data comes out at 8:30 am, so you will have the number (if you are watching) before you get this Briefing.

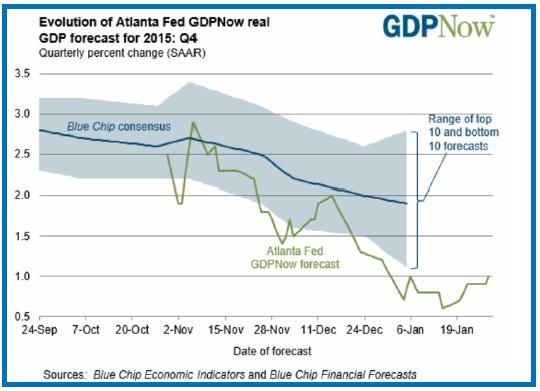

The Fed seemed to feel growth is moderate but both the WSJ and Bloomberg estimate a measly 0.8% (following 2% in Q3). Some big bank economists see zero. The Atlanta Fed GDPNow, out yesterday, shows an uptick to 1% from 0.7% on Jan 20. See the chart. The Atlanta Fed credits “real residential in-vestment growth.” We get the next one on Monday, Feb 1. We also get the Q4 employment cost index today, expected flat at 0.6%, the same as Q3.

Let’s note a thing or two about GDP. First, it’s a lousy number to begin with. The data collection pro-cess is a nightmare. It’s a very big economy with thousands of moving parts, and the process is more than just adding columns. It entails weighting and other statistical shenanigans. Aberrant numbers—like the oil industry and its related parts—can affect the bottom line more than they should.

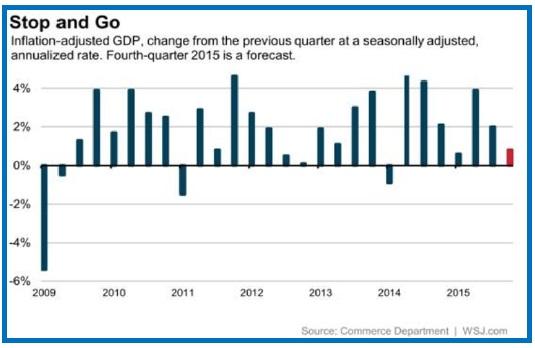

Also, GDP varies a lot more than you would expect. The numbers look unstable but this doesn’t mean the economy is unstable, although it’s hard not to draw that conclusion. In fact, the GDP chart alone is pretty scary. See the WSJ version below. Finally, GDP is reported on an inflation-adjusted basis. Oh, dear. We know all too well that our inflation data stinks. It’s not representative of what indus-try sees, what Main Street businesses see, and what the average consumer sees, let along demographic segments like retired people (who do, indeed, have their own CPI, which is rising far faster than the usu-al CPI due to the cost of medicine).

Bottom line, GDP is a critically important number for influencing sentiment toward the US and the dol-lar, but it’s inherently such bad information in the first place that we really ought not to make any deci-sions based on it. Markets, especially equities, are sure to draw the wrong conclusions, too. This is not really their fault—we want clear data with obvious implications and the modern world just doesn’t work that way. So whatever happens, don’t believe it, or rather, don’t believe it longer than 10 minutes, be-cause that’s how long it will take for analysts to come up with critiques.

Wither the dollar? We continue to think the dollar is fixing to rise again after this corrective period. An-swering our question yesterday about the mysteriously rising euro, one Reader said it’s still short-covering. On the Big-Picture basis, the ECB is still set to ease some more on March 10, and on that same day, Yellen offers Congressional testimony. She may well continue to see the US economy and robust and resilient (if the creek don’t rise.) March 10 is impossibly far away! Even so, we expect some stabili-zation in the dollar’s favor (bad news for options traders, except maybe in the CAD). Here is the daily chart:

| Current | Signal | Signal | Signal | |||

| Currency | Spot | Position | Strength | Date | Rate | Gain/Loss |

| USD/JPY | 120.91 | LONG USD | NEW*WEAK | 01/29/16 | 120.91 | 0.00% |

| GBP/USD | 1.4310 | SHORT GBP | STRONG | 11/06/15 | 1.5137 | 5.46% |

| EUR/USD | 1.0915 | SHORT EURO | WEAK | 01/04/16 | 1.0905 | -0.09% |

| EUR/JPY | 131.97 | SHORT EURO | STRONG | 12/04/15 | 132.38 | 0.31% |

| EUR/GBP | 0.7627 | LONG EURO | WEAK | 10/23/15 | 0.7194 | 6.02% |

| USD/CHF | 1.0198 | LONG USD | WEAK | 01/04/16 | 0.9979 | 2.19% |

| USD/CAD | 1.4075 | LONG USD | WEAK | 10/28/15 | 1.3235 | 6.35% |

| NZD/USD | 0.6495 | LONG NZD | WEAK | 12/11/16 | 0.6560 | -0.99% |

| AUD/USD | 0.7084 | LONG AUD | WEAK | 01/25/16 | 0.6980 | 1.49% |

| AUD/JPY | 85.66 | LONG AUD | WEAK | 01/25/16 | 82.66 | 3.63% |

| USD/MXN | 18.3012 | LONG USD | WEAK | 12/07/15 | 16.7258 | 9.42% |

This morning FX briefing is an information service, not a trading system. All trade recommendations are included in the afternoon report.

Recommended Content

Editors’ Picks

AUD/USD failed just ahead of the 200-day SMA

Finally, AUD/USD managed to break above the 0.6500 barrier on Wednesday, extending the weekly recovery, although its advance faltered just ahead of the 0.6530 region, where the key 200-day SMA sits.

EUR/USD met some decent resistance above 1.0700

EUR/USD remained unable to gather extra upside traction and surpass the 1.0700 hurdle in a convincing fashion on Wednesday, instead giving away part of the weekly gains against the backdrop of a decent bounce in the Dollar.

Gold keeps consolidating ahead of US first-tier figures

Gold finds it difficult to stage a rebound midweek following Monday's sharp decline but manages to hold above $2,300. The benchmark 10-year US Treasury bond yield stays in the green above 4.6% after US data, not allowing the pair to turn north.

Bitcoin price could be primed for correction as bearish activity grows near $66K area

Bitcoin (BTC) price managed to maintain a northbound trajectory after the April 20 halving, despite bold assertions by analysts that the event would be a “sell the news” situation. However, after four days of strength, the tables could be turning as a dark cloud now hovers above BTC price.

Bank of Japan's predicament: The BOJ is trapped

In this special edition of TradeGATEHub Live Trading, we're joined by guest speaker Tavi @TaviCosta, who shares his insights on the Bank of Japan's current predicament, stating, 'The BOJ is Trapped.'