Outlook:

A year ago, the Swiss National Bank unpegged the Swiss franc from the euro and set off an immediate and giant move. See below for a discussion. Spoiler alert: we learn almost nothing from the episode, or at least nothing useful about behavior of the SNB going forward, let alone anything about intervention by China.

FX is the only market in which governments intervene with any regularity, but it’s still rare and it’s still an act of desperation. And it hardly ever ends well.

In today’s environment, one important question is whether the US equity market deserves the beating it is taking from ordinary contagion from China, or the contagion opened a gap that is festering from its own diseases (such as an overheated P/E and looming bad earnings). Why should the US economy suddenly be seen as unhealthy and lame? We get some data today that may change that view—or not.

First up is retail sales, but alas, they are forecast to be flat, in part because gasoline prices fell. Then we get the University of Michigan consumer sentiment index, and there it should be a rise. Finally, US industrial production will likely have dipped by about 0.2% in December, again on energy, but manufacturing may do better by being flat. We also get the PPI and Empire State manufacturing survey.

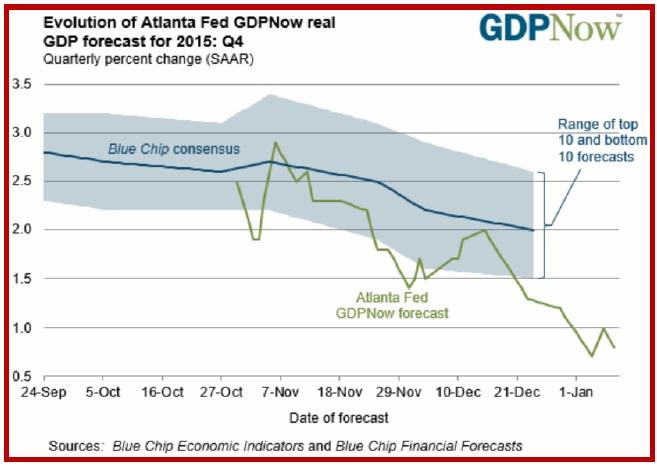

This is not to say a trio of fine data would overcome the China contagion, but good data is always to be preferred when the chips are down. But US Data has not been so hot of late. The latest GDPNow we have from the Atlanta Fed is from Jan 8, and it shows Q4 at a lousy 0.8% (down from 1.0% on Jan 6). See the chart. If we are reading the release dates right, we get another GDPNow after retail sales. Remember that yesterday Germany said it expects GDP to be up 1.7% for the year. Good grief, is German growth better than US growth? It happens rarely, but it does happen.

Market News notes another negative, from BNP Paribas. The analysts there point out that the U.S. corporate bond index yield (based on 6.5 year rated A-) has risen from 3.10% to 3.65% over the past year, even reaching 3.80% at year-end, compared to the 10-year government note, which has risen only about 25 bp. Rising earnings are an offset to higher borrowing costs, but as earnings are actually weakening these days, equities are offering less of a premium over corporate debt. For the equity premium to bounce back, "profits had to rise, borrowing costs had to ease or equity prices had to fall. With profits capped by the strength of the dollar, and with the prospect of tightening U.S. monetary policy and releveraging of U.S. corporates putting a floor under borrowing costs, the only adjustment possible was a drop in equity prices."

This is a clever analysis and probably true, but we say sheer panic is the more powerful reason for equities to take a nosedive. And we are getting tired of hearing the too-strong dollar is at fault. Having said that, Germany has no problem expanding production and exports no matter what the euro is doing, or almost. Given superior growth in Germany, is that a reason for the euro to be on the rise? Probably not.

We think the rising euro is a function of position adjustment, not fundamentals. But watch out.

We desperately need China to take some action over the weekend. A giant devaluation, maybe. Elimination of the onshore-offshore yuan divide. Restore equity circuit breakers at 30%. It has to be big, decisive, dramatic—in a word, macho. China is going to take relentless criticism no matter what it does, so it might as well Go Big. The important thing is transparency, a concept we never much liked or trusted, but it’s relevant here. Saying nothing is saying reams. We interpret silence as disapproval of normal market outcomes, outcomes in which years of growth can be unraveled in weeks. The error lies in imaging that the Shanghai index somehow represents “achievement.” It doesn’t. China buying big chunks of IMB and GE does.

As for China contaminating the rest of the world, that’s an excuse. China’s woes are just the catalyst, but the underlying true cause is overvaluation. The FT reports “Investors pulled billions of dollars from US equity funds for the second straight week as fears of a slowdown in China continued to reverberate through global financial markets. The pace of withdrawals accelerated to $12.4bn in the week to January 13, with stock funds suffering the largest two-week period of redemptions in 10 months, according to fund flows tracked by EPFR.

“Investors raced into the haven of the US dollar, with money market funds counting $24bn of inflows. Figures from Lipper showed funds investing in US government debt attracted $1.9bn — the highest level since October — in the latest week. ‘Doubts about global growth and the ability of US companies to maintain profitability in the face of rising domestic interest rates helped to chase’ money out of stocks, said Cameron Brandt, director of research for EPFR.”

Bottom line, it’s not China’s fault, but China holds the key to lowering the temperature of panic from red-hot to something more analysis-based and real.

Assuming we do get something from China over the weekend and it meets the macho standard, risk appetite can come creeping back, which will be nice for the AUD and JPY. If China doesn’t deliver, look for more flows out of equities and into dollars.

Swiss Franc Story

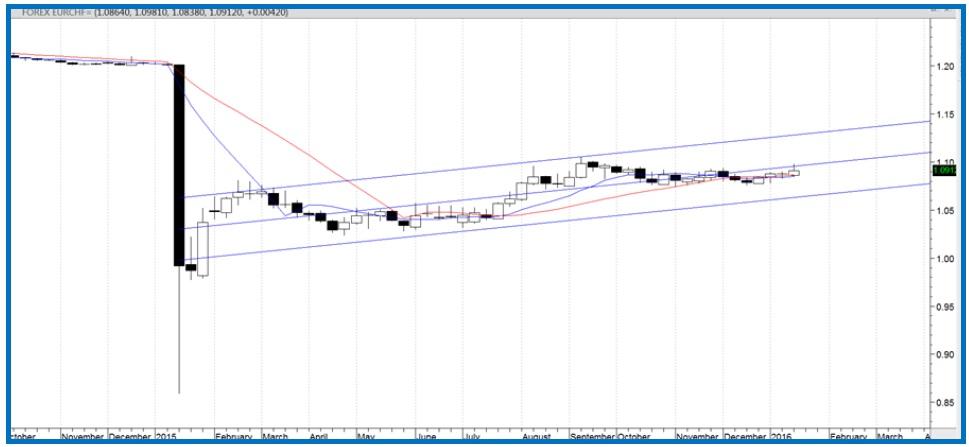

It was a year ago that the Swiss National Bank decided the EUR/CHF needed to be taken down a peg. Actually, the SNB had been warning (and intervening) for many months before then, but the Jan 15 announcement was still a Shock. The announcement was to the effect that the SNB would no longer hold the “peg” to the euro at 1.20 determined in Sept 2011. The wording of the message is the embodiment of determined: the SNB told the ECB governing council it would “no longer tolerate a EUR/CHF exchange rate below the minimum rate of CHF 1.20.”

But by Jan 15, 2015, it was clear that the ECB would be easing at some point soon—expected on Jan 22—and the resulting flow into Swiss francs would make it even more overvalued. To help prevent that outcome, the SNB also cut the deposit rate by another 50 bp to -0.75%. SNB chief Jordan told the press, "If you decide to exit such a policy, you have to take the markets by surprise."

Surprise is an understatement. Reuters reported “the exchange rate leapt as high as 0.80 francs per euro within minutes after the 1.20 peg was removed, before falling back to around 1.02 - a rise of about 15 percent - setting off wider global currency tremors.” See the charts. Bloomberg reported at the time that the announcement a year ago pushed the euro down 41%, before recovering a bit. The EUR/CHF high a year ago was 1.2013 and the high yesterday was 1.0108. The post-announcement low of 0.8588 is long gone.

The first obvious effect was to do great damage to Swiss companies exporting to the eurozone, about 40% of Swiss exports. Exporter stocks fell and the benchmark SMI index fell 9% on the first day. UBS estimated the new export cost would be the equivalent of 0.70% of GDP and stifle capital investment. Tourists would say away in droves, even if foreign holders of Swiss bank accounts would have a windfall they might take away. FX traders literally could not get out fast enough and losses were enormous, causing several retail FX brokers to fail. Having already spent billions to defend the cap, the cost of intervening to make sure the Swissie didn’t get too strong again might be horrendous, and indeed, the SNB automatically took huge losses on its euro reserves on Day 1.

But interventions over the three years of the peg had already swollen Swiss reserves to about Chf 500 billion by end-2014, which is about 80% of GDP. The FT reported “Relative to the size of its economy, Switzerland’s central bank had a balance sheet about three times larger than those of the US Federal Reserve and the Bank of England.” In other words, Switzerland was doing things other than control its currency—prop up the euro by buying euros (at a time of sovereign debt crisis, no less) and ballooning its balance sheet. Moreover, the reserves are even higher now--at year-end 2015 (CHF 559.68 billion) than at end-2014 (Chf 510.1 billion).

What can we take away from this story? Moralists like to wag their finger and say central banks shouldn’t play with the citizens’ savings—reserves—even if their hearts are pure and they have only the best intentions. FX economists are bemused that intervention, which so often fails to get the job done, actually worked pretty well for the three years the SNB was maintaining the peg, even if it was costly—the economy could have done a lot worse if the Swiss franc had suffered more capital inflow. All the same, market forces can’t be denied forever.

The biggest lesson, and one that other countries are loathe to admit, is that a single big state-dictated currency move can achieve what a thousand other initiatives cannot. Years ago the BIS determined that interventions don’t work, but that was before the epic Bank of Japan intervention in 2003-04 of some ¥56 trillion. That one worked, as did the March 2011 intervention (helped by G7) to lift the yen off the ridiculously too strong level of 76.25. G7 has long held that intervention is naughty and its members won’t do it, with the unspoken exception of utter desperation. Switzerland doesn’t belong to G7. The 2011 peg and then the abandonment of the peg were both outside the rules the Inner Circle Club claims to live by. The Swiss are civilized; they must have been desperate.

We might note that the FX market is the only one where governments intervene with any regularity. In most markets, governments rely on regulations, including things like the US’ 40-year ban on oil exports. (Just for kicks, we went to the SNB website and did a search for “intervention.” The yield was 681 articles. We didn’t see any titles that looked compelling.) One of the reasons we know so little about intervention is that central banks keep their mouths shut about it. We don’t know what final catalyst inspired the peg and we don’t know what inspired the removal of the peg. Analysts assume it was looming QE by the ECB and thus capital flows to the franc, but in truth, we don’t know. We do know that deflation is the automatic, mechanical consequence of a revaluation. We also know that some citizens are really scared by an outsized central bank balance sheet. Finally, we know that no one doubts the resolve of the SNB. That peg at 1.20 held very well for three years.

As for what it all means for the future, nobody knows. The SNB probably doesn’t know, either, but it must have some smart economists with Plan A, Plan B and so on, dependent on various possible scenarios. Switzerland is stuck with its economic relationship to the eurozone and its safe-haven status (depositors are safe from the Russian state, if not the American one).

Presumably Switzerland would prefer Mr. Draghi get his way and preside over a gently falling euro so the Swiss franc could follow it, also gently. But let’s not forget that the SNB has a despotic side to its nature—it will reinstate a peg if it deems a peg in its best interests, or intervene with its trove of euros. For all we know, it’s busily managing the franc behind the scenes all the time against various currencies, not just the euro. We should probably start following the EUR/CHF more closely, while being careful not to attribute too many imaginary decisions and motives.

| Current | Signal | Signal | Signal | |||

| Currency | Spot | Position | Strength | Date | Rate | Gain/Loss |

| USD/JPY | 117.34 | SHORT USD | STRONG | 12/28/15 | 120.48 | 2.61% |

| GBP/USD | 1.4351 | SHORT GBP | STRONG | 11/06/15 | 1.5137 | 5.19% |

| EUR/USD | 1.0907 | SHORT EURO | WEAK | 01/04/16 | 1.0905 | -0.02% |

| EUR/JPY | 128.02 | SHORT EURO | STRONG | 12/04/15 | 132.38 | 3.29% |

| EUR/GBP | 0.7599 | LONG EURO | WEAK | 10/23/15 | 0.7194 | 5.63% |

| USD/CHF | 1.0045 | LONG USD | STRONG | 01/04/16 | 0.9979 | 0.66% |

| USD/CAD | 1.4498 | LONG USD | STRONG | 10/28/15 | 1.3235 | 9.54% |

| NZD/USD | 0.6397 | LONG NZD | WEAK | 12/11/16 | 0.6560 | -2.48% |

| AUD/USD | 0.6883 | SHORT AUD | STRONG | 01/08/16 | 0.7020 | 1.95% |

| AUD/JPY | 80.79 | SHORT AUD | STRONG | 12/10/15 | 88.80 | 9.02% |

| USD/MXN | 18.0459 | LONG USD | WEAK | 12/07/15 | 16.7258 | 7.89% |

This morning FX briefing is an information service, not a trading system. All trade recommendations are included in the afternoon report.

Recommended Content

Editors’ Picks

EUR/USD regains traction, recovers above 1.0700

EUR/USD regained its traction and turned positive on the day above 1.0700 in the American session. The US Dollar struggles to preserve its strength after the data from the US showed that the economy grew at a softer pace than expected in Q1.

GBP/USD returns to 1.2500 area in volatile session

GBP/USD reversed its direction and recovered to 1.2500 after falling to the 1.2450 area earlier in the day. Although markets remain risk-averse, the US Dollar struggles to find demand following the disappointing GDP data.

Gold climbs above $2,340 following earlier drop

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.