Outlook:

The China-driven global rout is not over, just taking a rest. It’s likely that the appearance of stability in China, including better data, plus a seeming stabilization in oil prices, will deliver a respite, i.e., a min-rally in equities. But it will be short-lived.

The economy needs real repair, not just band-aids. Morgan Stanley, according to the FT, asserts “China and its currency are driving markets. This is not just about the world’s second-largest economy. The dynamics of CNY [the renminbi] mean weakness can beget more weakness. We think risk markets will struggle to bottom without more clarity on China’s policy strategy.”

The Telegraph features RBS going to an extreme, saying “China has set off a major correction and it is going to snowball. Equities and credit have become very dangerous, and we have hardly even begun to retrace the 'Goldilocks love-in' of the last two years.” We are about to get massive declines in commodities and equities leading to a deflationary recession. RBS forecasts the Bund yield down to 0.16% and possibly zero, with the deposit rate down to -0.70%. US Treasuries will do the same, killing any funds short the note in the “reflation trade.” The Fed’s tightening will be reversed and the BoE will not make it out of the starting gate. Global growth will continue to fall.

RBS says it is advising “sell equities, buy bonds” as a precaution against China not being willing or able to fix its problems, chief among them an overvalued currency. As for the rest of the world, an excess of debt everywhere is a potential crisis-maker on a par with 2008. RBS does not name institutional failures as a trigger, although that’s the usual spark.

The RBS stance may be an extreme one, but it’s consistent with the Larry Summers viewpoint. And we find it plausible. The interesting factor is that Chinese officials probably find it plausible, too. As we wrote during the August brouhouha, China has a big credibility stake in not being named the party that sets off a global recession. The motivation is high and rising to avoid the charge that it is mismanaging China’s integration into the rest of the modern world. And it’s more than charges of mismanagement—it’s that failure to get the job done right implies that the Chinese idea of modifying capitalism and capitalism’s free markets with Communist principles is a fool’s errand.

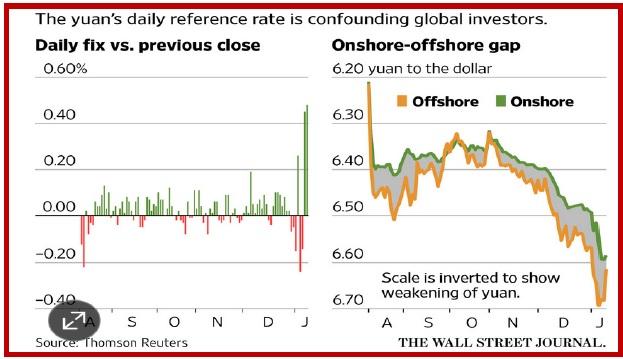

High motivation is always a good thing but doesn’t mean China will succeed. We wonder if the PBOC forcing the two yuan rates to converge might be the first step. The WSJ has been running a series of charts showing the divergence, which reached a record high last week (see below). But today the PBOC fixed the yuan nearly the same as the day before for the third day, if at the cost of setting fire to the Hong Kong overnight rate, which went from 13.4% yesterday to a whopping 66.8% today. The FT reports “The onshore and offshore renminbi rates then converged to parity for the first time since October.”

The very existence of a two-tier currency is, in our view, a symbol of mismanagement. The real issue is capital flight and the way to end that risk is to end the motivation to flee, which is expected devaluation. So just bite the bullet and do a proper one-time devaluation. If you have to keep a dual currency for capital controls purposes, okay, but the rate cannot differ from the internal rate. It’s that simple.

Whether the rest of the world is contaminated by China remains to be seen but the one place that can’t avoid serious fallout is Japan. Returning from a holiday yesterday, the Nikkei caught up with the rest of the world, tanking 2.71%. The yen was actually a tad weaker, reaching 118.03 from 116.70 the day before, but we probably shouldn’t doubt that the dollar/yen has peaked. See the monthly chart below. The range is 76.03 in Feb 2012 to 125.86 in June last year. Is it possible that flight-to-home will carry dollar/yen back to 76? The possibility is real, along with the corollary—the Nikkei, studded with exporters, is toast. Monthly dollar/yen chart below.

When the problem is institutional—ham-fisted, clumsy efforts to control markets—you’d think the solution would be institutional, too. We need officials to stand up and say something, but so far, an unhappy silence. Actions speak louder than words, of course, and short-squeezing the Hong Kong market to the tune of a 66.8% overnight rate is pretty loud.

But it would be better to hear something before a ton of data hits us over the head next week (Tuesday, Jan 19). We get GDP, factory output, retail sales and a bunch of other thing, with trade the next day, Reuters reports GDP will likely be 6.8% y/y in Q4 from 6.9% in Q3, the weakest since Q1 2009 (6.2%). The forecast range is 5.3% to 7.1%. The full year 2015 will likely be 6.9% from 7.3% in 2014, which will be the slowest in 25 years. The official target is “about” 7%. Next year the target will likely be 6.5%.

China is expected to goose the economy with additional rate cuts (50 bp) and cuts in reserve ratios (100 bp)—in the first half. But maybe not. Yesterday a Chinese official, saying a 10% devaluation is “ridiculous and impossible,” pledged a commitment to defeat efforts to sell short the yuan. At a briefing at the NY consulate, the official said “The expectations of markets can be changed.” He also “ruled out any short-term stimulus or further monetary easing by the government to boost growth. He said China’s money supply is already higher than in the U.S., relative to the size of their economies. ‘If we continue to flood the system with money, it’ll take us to a dead end which will lead us to a real economic crisis.’” (WSJ).

Former IMF China hand Prasad, who knows a hawk from a handsaw, said “These interventions work well only if they’re undertaken in the context of much broader reforms.”

Bottom line, we may be getting a recovery rally and the seeming retreat of China fear, and it could even last a week or more. But the crisis mentality can come back very quickly, especially if we get nothing but silence and market manipulation from Beijing. The world is now clamoring for real reform in China, starting with the two-tier currency. So far the Chinese party line is “no.” It would be interesting to hear the phone calls between China and the US Treasury or China and the IMF.

Nobody knows where the China saga will lead currencies. Last time, in August 2015, the euro soared from 1.0848 (sound familiar?) to 1.1714. We had plenty of other factors at the time, so it probably doesn’t pay to imagine a complete parallel, but an ever-rising dollar on risk aversion is not a done deal, either.

Note to Readers: Next Monday, Jan 18, is a national holiday in the US and markets are closed. We will produce reports as usual for the benefit of non-US readers but note that the FX market should be thin.

| Current | Signal | Signal | Signal | |||

| Currency | Spot | Position | Strength | Date | Rate | Gain/Loss |

| USD/JPY | 117.81 | SHORT USD | STRONG | 12/28/15 | 120.48 | 2.22% |

| GBP/USD | 1.4439 | SHORT GBP | STRONG | 11/06/15 | 1.5137 | 4.61% |

| EUR/USD | 1.0854 | SHORT EURO | WEAK | 01/04/16 | 1.0905 | 0.47% |

| EUR/JPY | 127.87 | SHORT EURO | STRONG | 12/04/15 | 132.38 | 3.41% |

| EUR/GBP | 0.7516 | LONG EURO | WEAK | 10/23/15 | 0.7194 | 4.48% |

| USD/CHF | 1.0005 | LONG USD | WEAK | 01/04/16 | 0.9979 | 0.26% |

| USD/CAD | 1.4222 | LONG USD | STRONG | 10/28/15 | 1.3235 | 7.46% |

| NZD/USD | 0.6536 | LONG NZD | WEAK | 12/11/16 | 0.6560 | -0.37% |

| AUD/USD | 0.6987 | SHORT AUD | STRONG | 01/08/16 | 0.7020 | 0.47% |

| AUD/JPY | 82.32 | SHORT AUD | STRONG | 12/10/15 | 88.80 | 7.30% |

| USD/MXN | 17.8245 | LONG USD | WEAK | 12/07/15 | 16.7258 | 6.57% |

This morning FX briefing is an information service, not a trading system. All trade recommendations are included in the afternoon report.

Recommended Content

Editors’ Picks

EUR/USD holds gains above 1.0700, as key US data loom

EUR/USD holds gains above 1.0700 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

GBP/USD extends recovery above 1.2500, awaits US GDP data

GBP/USD is catching a fresh bid wave, rising above 1.2500 in European trading on Thursday. The US Dollar resumes its corrective downside, as traders resort to repositioning ahead of the high-impact US advance GDP data for the first quarter.

Gold price edges higher amid weaker USD and softer risk tone, focus remains on US GDP

Gold price (XAU/USD) attracts some dip-buying in the vicinity of the $2,300 mark on Thursday and for now, seems to have snapped a three-day losing streak, though the upside potential seems limited.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.