Outlook:

The first week of the year was studded with emotion, chiefly fear, like cloves on a ham. Within hours of the splendid payrolls report, US stock indices were falling again. This week begins the earnings season, with Alcoa the usual starter name. We have no idea whether Alcoa earnings will be bad or good, but even if they are well above expectations, earnings are not an antidote to fear. Financial and economic data have to be super-hot in order to overcome emotion.

Any why do we have so much emotion? The number one reason is China. The August crash last year could be excused as fairly unconnected to the overall economy, not least because equity market participants are a tiny fraction of the population and unlike the US, run by individuals, not by institutions. In August we had obvious trouble spots, but growth, while slowing, was still pretty good. Now the trouble spots have evolved into screaming danger signs, like the not-burst real estate bubble, excess industrial capacity, debt at about 300% of GDP, heaven knows how much nonperforming debt (zombie companies), and ridiculously bad management of the stock market rout last week.

The circuit breaker was too small but removing it altogether is hardly the right policy action. Letting the yuan depreciate for 8 days in a row and then reversing that on a Friday is not the smartest course of action, either, chiefly because nobody has a clue what the government thinks it is trying to achieve. The suspicion is easy to come to—the government doesn’t know what it is doing. Maybe it was trying to do something entirely different (perhaps drive a state-owned entity into bankruptcy to prove its free-market chops) and all this other stuff was collateral damage.

It is of some concern that the stock market really was overvalued (with a P/E at about 65 before last week, according to some sources) and when positions are funded by leverage, crashes are all too likely. Leverage is tightly connected to interest rates and despite China being a command economy, interest rates (and availability of leverage) is tightly connected to money supply. In 2008, China took the wise course of halting all its other plans and goosing the economy with liquidity. It worked—China did not go into recession. Last summer, when the market crashed, China enlarged M2 again, and big-time. See the chart. Cheap money and lots of it are always a precursor to a stock market crash.

We care because, according UBS quoted in the FT, a slowdown in Chinese growth to 4% this year would reduce US growth by 0.50%, European growth by 0.80% and 2.6% in Japan. In other words, Japan will go into recession and the rest of the world may teeter near it. Golly, we just emerged for sure from the last recession. That’s what the Fed rate hike was all about—“proof” of a return to normal.

Probably the most troublesome aspect of the China crash is that China thinks it can re-write the rules of capitalist free markets to suit its ideals. It claims to have a “stable and healthy” financial system but had to impose what the FT names ad hoc capital controls on Friday. Earlier last week, a top Chinese official complained that the “US world order is a suit that no longer fits.” The author was complaining about the US botching its leading role in geopolitical matters, but he might as well have been talking about the financial system. China just doesn’t like a world in which unjust enrichment can occur through speculation.

But speculation is necessary for liquidity. That’s the classic justification and we have never seen a decent rebuttal. Our current markets were conceived hundreds of years ago in London and Europe, and have been developing and evolving ever since. There is nothing specifically “American” about capitalist financial markets. Isaac Newton was present as the creation of paper money and fractional reserve banking in 1699 when the US didn’t even have a monetary system (we just finished, finally, Newton and the Counterfeiter).

Larry Summers writes, also in the FT, “It is conceivable that Chinese [stock market] developments reflect market psychology and clumsy policy responses, and that the response of world markets is an example of transient contagion. But I doubt it. Over the past year, about 20 per cent of China’s growth as reported in its official statistics has come from its financial services sector, which is now about as large relative to gross domestic product as in Britain, and Chinese debt levels are extraordinarily high. This is hardly a case of healthy or sustainable growth.

“In recent years, China’s growth has come heavily from massive infrastructure investment; China poured more cement and concrete between 2011 and 2013 than the US did in the whole of the 20th century. This, too, is unsustainable. Even if it is replaced by domestic services, China’s contribution to demand for global commodities will fall.

“Experience suggests that the best indicator of a country’s future economic prospects is the decisions its citizens make about keeping capital at home or exporting it abroad. The renminbi is under pressure because Chinese citizens are eager to move their money overseas. Were it not for the substantial recent depletion of China’s reserves, the renminbi would have fallen further.”

Commentators often confuse cause and effect when it comes to currencies, but not Summers—he has the direction of causality right. BBH’s Chandler is quoted by CNBC as saying the latest yuan moves are not actually all that impressive. "The big picture here is the Chinese yuan strengthened 50 percent in its broad trade-weighted index since 2005. It has gained about 30 percent since early 2011 and has now recouped 4 percentage points." CNBC reports other currencies moved more last week than the yuan—the AUD and NZD lost over 4% each, and the SAR is down 8% this year. Well, let’s just note that the S. African rand has a lot more troubles than China, including political messes and a possible loss of investment grade status.

Perspective is always nice but falls into the “true but not useful” category this time. What’s more useful, as Summers points out, is the capital outflow accompanying a loss of confidence in the currency and possibly in the regime, too.

The faultlines and gaping holes in the Chinese economic system are worse than we thought and the fallout will be bigger and last longer than we thought. Stiglitz the China affair is not catastrophic. Tell that to the Japanese. We still have confidence China will get it right in the end, but not in short order and not, perhaps, before triggering catastrophes elsewhere. Poor Japan.

China’s equity market rout could be just the excuse Western equity traders need to drive a correction in their markets, too. Reuters reports S&P 500 earnings are forecast down 4.2% in Q4 for the second quarter in a row, meaning a “profit recession.” The year is likely to show zero profit gain, which will cut into the current forecast of profit growth of 7.5% this year. Events have already reduced the forecast from 10.3% in October.

The biggest losing sector will be energy, followed by materials. Last week Goldman Sachs predicted the energy sector will post a loss for 2015 for the first time since its data began in 1967. Even after last week’s 6% rout, the S&P 500 “trades at 15.7 times forward earnings, well above its 10-year median of 14.7, according to Thomson Reuters data.” Hope is pinned to a single sector, consumer discretionary, where Q4 profits will likely rise by 8.4% (already pared from 13.6% expected in October).

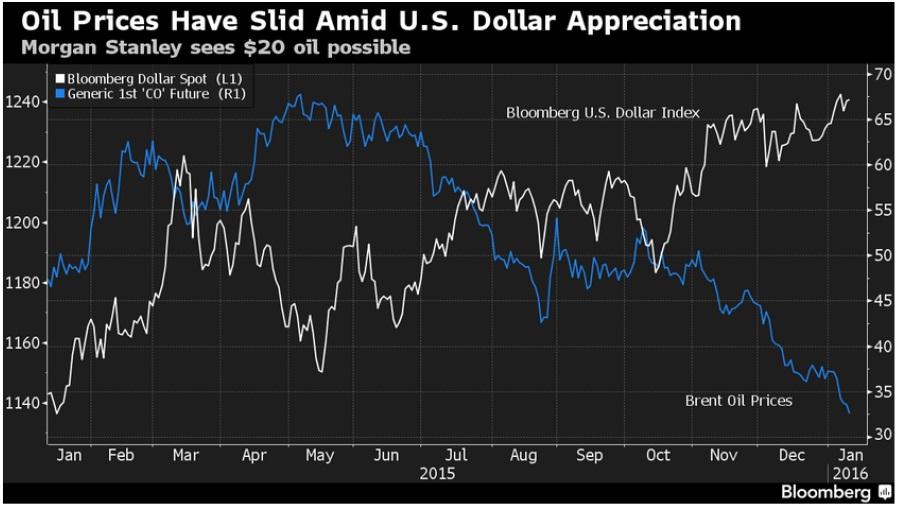

Now we can add another toxic ingredient to the mix—Morgan Stanley wants to blame the too-strong dollar for the excessive drop in oil prices. Bloomberg reports Morgan Stanley says “A rapid appreciation of the U.S. dollar may send Brent oil to as low as $20 a barrel… Oil is particularly leveraged to the dollar and may fall between 10 to 25 percent if the currency gains 5 percent, Morgan Stanley analysts including Adam Longson said in a research note dated Jan. 11. A global glut may have pushed oil prices under $60 a barrel, but the difference between $35 and $55 is primarily the U.S. dollar, according to the report.” The dollar and non-fundamentals are driving oil. Non-fundaments include running out of storage space. “Oil in the $20s is possible, but not for the reasons often cited. It’s not about deteriorating fundamentals.”

Oh, dear and told you so. The oil gang often comes up with ideas like this having to do with non-fundamentals running the show rather than supply and demand. One non-fundamental not named in this story but featured elsewhere is hedge funds pulling in their horns after a losing year and an expected flood of redemptions. To be fair, there are always non-fundamentals in the mix of every price-setting. But to blame the dollar as the key reason for new oil price declines is to hark back to the supposed correlation that exists only when some market leaders say it exist. Logically, weaker oil should reduce demand for dollars. In earlier decades, it did, too. Oil prices and the dollar “should” be positively correlated, not negatively correlated. We have a real problem with this one.

So, we have China possibly running off the rails, equity markets everywhere falling from overvaluation plus herd mentality, and oil prices crashing amid confusion over cause-and-effect when it comes to currencies. All of this should point to gains for a safe-haven dollar, right?

Not so fast. Just when you think there is a reasonable scenario for a stronger dollar, something comes along to splash cold water.

We can think of several sources of cold water in the current environment, but the topmost on the list is probably the Fed running away from a rate hike in March, possibly naming the same “global instability” issues it used in September. The other reason will be the absence of inflation, but that’s old hat. When the Fed names global instability for a historic second time, people will sit up and take notice. We could easily see the euro start to become the new safe haven, a role Mr. Draghi might not like for one set of reasons but embrace for the credibility reason. Bottom line—be careful and trade small going long the dollar/euro. It’s not a dead cert.

| Current | Signal | Signal | Signal | |||

| Currency | Spot | Position | Strength | Date | Rate | Gain/Loss |

| USD/JPY | 117.66 | SHORT USD | STRONG | 12/28/15 | 120.48 | 2.34% |

| GBP/USD | 1.4565 | SHORT GBP | STRONG | 11/06/15 | 1.5137 | 3.78% |

| EUR/USD | 1.0898 | SHORT EURO | WEAK | 01/04/16 | 1.0905 | 0.06% |

| EUR/JPY | 128.23 | SHORT EURO | STRONG | 12/04/15 | 132.38 | 3.13% |

| EUR/GBP | 0.7481 | LONG EURO | WEAK | 10/23/15 | 0.7194 | 3.99% |

| USD/CHF | 0.9960 | LONG USD | WEAK | 01/04/16 | 0.9979 | -0.19% |

| USD/CAD | 1.4118 | LONG USD | STRONG | 10/28/15 | 1.3235 | 6.67% |

| NZD/USD | 0.6560 | LONG NZD | NEW*WEAK | 12/11/16 | 0.6560 | 0.00% |

| AUD/USD | 0.7002 | SHORT AUD | STRONG | 01/08/16 | 0.7020 | 0.26% |

| AUD/JPY | 82.39 | SHORT AUD | STRONG | 12/10/15 | 88.80 | 7.22% |

| USD/MXN | 17.8666 | LONG USD | WEAK | 12/07/15 | 16.7258 | 6.82% |

This morning FX briefing is an information service, not a trading system. All trade recommendations are included in the afternoon report.

Recommended Content

Editors’ Picks

EUR/USD holds steady near 1.0650 amid risk reset

EUR/USD is holding onto its recovery mode near 1.0650 in European trading on Friday. A recovery in risk sentiment is helping the pair, as the safe-haven US Dollar pares gains. Earlier today, reports of an Israeli strike inside Iran spooked markets.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD is rebounding toward 1.2450 in early Europe on Friday, having tested 1.2400 after the UK Retail Sales volumes stagnated again in March, The pair recovers in tandem with risk sentiment, as traders take account of the likely Israel's missile strikes on Iran.

Gold: Middle East war fears spark fresh XAU/USD rally, will it sustain?

Gold price is trading close to $2,400 early Friday, reversing from a fresh five-day high reached at $2,418 earlier in the Asian session. Despite the pullback, Gold price remains on track to book the fifth weekly gain in a row.

Bitcoin Price Outlook: All eyes on BTC as CNN calls halving the ‘World Cup for Bitcoin’

Bitcoin price remains the focus of traders and investors ahead of the halving, which is an important event expected to kick off the next bull market. Amid conflicting forecasts from analysts, an international media site has lauded the halving and what it means for the industry.

Geopolitics once again take centre stage, as UK Retail Sales wither

Nearly a week to the day when Iran sent drones and missiles into Israel, Israel has retaliated and sent a missile into Iran. The initial reports caused a large uptick in the oil price.