Outlook:

Yesterday’s disappointing drop in the US manufacturing index is unhappy but not fatal. As one analyst told Market News, manufacturing is not the key driver of the US econ-omy. What’s more worrisome is the drop in employment that may affect Friday’s pay-rolls. Market News has a forecast range of 180,000 to 225,000 with a median of 205,000. Unemploy-ment is likely to remain at 5% from a range of 4.8% to 5.1%. Average hourly earnings are also likely the same 0.2% and only 0.3% at the high end of the forecast range. We get the ADP estimate tomorrow. Also this week are the minutes of the Fed’s groundbreaking meeting on Dec 15-16.

Let’s keep some important points in mind, especially if today is a replay of yesterday. First, not every-thing is awful, it just looks that way. Good data tends to get lost when headline stories are screaming panic. If the world were really going to hell in a handbasket, we would have a rise in the Swissie, not a drop, even given all of the SNB’s thorny problems. Instead we look to the Japanese yen as our proxy for risk aversion, and sure enough, dollar/yen fell mightily yesterday, from a spike high at the opening of the new year at 120.46 to 118.67 early yesterday. But then we had a respite to 119.70 or about 100 points last evening in the early Asia session. Granted, it turned around and fell again later in Asia and in the European morning and nearly to the low yesterday, but the bounce shows that not everyone is con-vinced the world is coming to an end.

Also, the oil price drop by 30% over the past year puts an additional $1000 or so in each consumer’s pocket. It looks like Europeans are spending it more robustly than Americans, but never mind. In a world with stagnant wages, any increase in spending power is welcome.

And so far, not a whisper about any financial institution facing liquidity or credit problems. If any banks or brokers are in trouble, we are not hearing about it. Still, the Dow had the worst opening-day loss since 2008. Many European indices had the worst opening day ever, and the Shanghai had the biggest loss ever. See the chart at the end of the chart package—support was broken. On the S&P chart, we no longer have dueling channels—the downward sloping channel has won. At some point, some bank or broker has to have lent margin to the wrong party. Then we will see if the new capital rules and bail-in regulations actually work.

It’s hard to say what effect a global equity drop might have on other markets, including FX, let alone the “real” economies. We mustn’t sneer at animal spirits. But at the same time, we need to verify that specif-ic hot-spots are corralled and contained, including emerging market fails like Brazil and Venezuela. So far we have contamination but the fever is still under full-bore crisis levels. At a guess, fear of escalation will keep pressure on risk and thus favor the dollar and dollar assets.

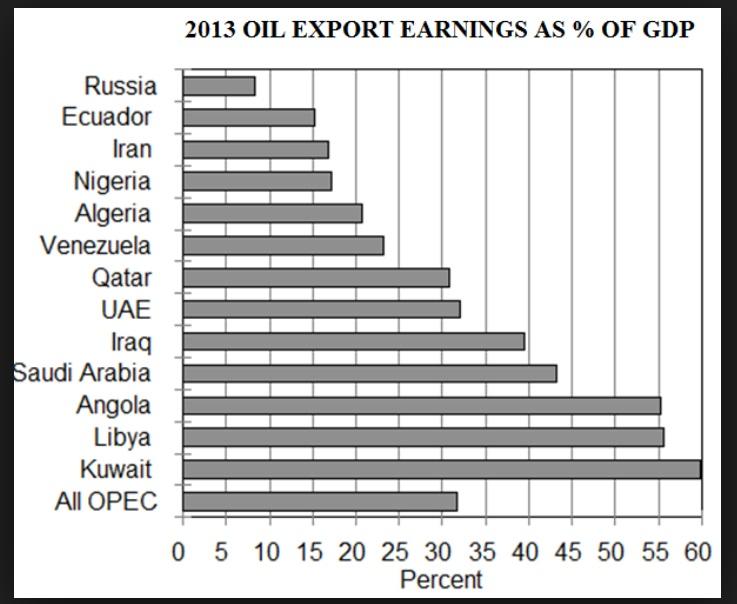

Something else we don’t know is how deeply political developments will affect economies. Worries over supply constraints arising from the Iran-Saudi Arabia tiff are almost certainly overdone. It’s not in either party’s self-interest to let a grievance go so far as to threaten economic survival. Iran has a more diversified economy and has managed without full oil exports since 2006. The website oilprice.com in-dicates it gets 15-20% of GDP from oil. See the chart below. Saudi Arabia gets about 43% of GDP from oil, which seems suspiciously low.

In fact, both numbers are too low. Something named the US Institute of Peace, a suspicious name if ever we saw one, has Iranian oil at 68% of exports (http://iranprimer.usip.org/frontpage; this site also has a lengthy primer on Iran, including the nuclear deal). As for oilprice.com’s estimate of Saudi oil exports as a percentage of GDP, the official OPEC website says “The oil and gas sector accounts for about 50 per cent of gross domestic product, and about 85 per cent of export earnings.”

That’s more like it (what is oilprice.com up to?). These two countries are oil-dependent and it would never be in their shared self-interest to let things get so bad that actual production is affected. The Saudis are already tightening the public belt and issuing bonds to make up for lost oil revenue. It would be nuts to let oilfields and other facilities be damaged or destroyed. There’s nothing like new poverty among those who previously enjoyed a social safety net to bring forth hidden ideas about overthrowing the government.

Single-commodity dependence is a terrible thing. Both supply and demand are at risk from competition and innovation, not to mention labor, weather, and depletion. Both Saudi Arabia and Iran are OPEC members, even if, as cartels go, OPEC has lost its moxie. From an economic point of view, it’s ridicu-lous and counter-productive for these two big oil producers to be at odds with one another, let alone over a religious difference that has been around for over 1000 years. Neither country wants to occupy the oth-ers’ territory, thank goodness, and seem to have no appetite for outright military confrontation, using Yemen and Iraq/Syria as what the news industry names “proxy wars.” Good thing neither one has nukes. It’s probably also a good thing for everybody else to stay out of the way, too. The experts on the region have been talking about a Iran-Saudi blowup for a couple of years now, one of the key reasons the US wants to stay out, something beyond the grasp of the political blowhards ruining the airwaves these days (Trump).

Just because it’s economically stupid for these two countries to be at odds with one another is no reason why they will not sacrifice self-interest to pursue conflict anyway. Religion is by definition something other than the exercise of reason. Or maybe it’s not religion, it’s “respect.” That makes them more like bad neighborhood gangs than the Thirty Years’ War.

Here’s the point—this is not going to end well, and it’s not going to end soon. What it is going to do is provide volatility to oil prices, and lots of it, and often—even when actual production is not threatened, let alone harmed. The oil crowd is notorious for finding “reasons” to move prices out of some geopoliti-cal concern or some other fad (for a while, the fad was rig count). Most commentary on oil prices is lu-dicrous, ill-founded and factually wrong (don’t neglect “oil is down because the dollar is up”).

Because our grasp of what’s actually happening in the Middle East is both feeble and sporadic, we will likely be at the mercy of the oil crowd for a very long time. Which leads us to China. The market some-times acts as though the only demand that matters is Chinese demand. If China is not growing as fast as we expected, demand for oil must fall. We pore over demand estimates from OPEC, from the IEA, from anyone who can put two sentences down on paper.

But here again our understanding of demand is wildly imperfect. Last fall we read that China has a stockpile of 30 days and plans for 90 days, with the build in 2015 at 124 million barrels for the year (Reuters). The goal by 2020 is 476 million barrels. Well, the US has about 700 million. Other countries (India) have strategic stockpiles, too. The IEA says the world has about 3 billion barrels stashed in stra-tegic stockpiles.

Why would anyone not want to keep adding to that? After all, oil is black gold, and arguably more use-ful than the real stuff. The US EIA estimates US consumption at 18.96 million bpd, with China at 10.12 and Japan next at 4.53. If China intends to catch up with the US in terms of barrels stockpiled, let alone barrels per capita, it ain’t done yet.

Bottom line, to assume a Chinese slowdown will cut demand for oil dramatically is not warranted. The slowdown may cut demand, but not by as much as feared.

That doesn’t mean we don’t have to worry about China. Needing to use the circuit breaker is not a happy outcome, although many analysts note that the circuit breaker is quite low (5%) when a ma-ture market like the US can have 20%. Forbidding big holders to sell was a shocker last August and now it appears it will be extended past the original deadline of Jan 8. This is a giant setback for the advertised embrace of free market mechanisms. The real reason for China to intervene and interfere in equities is the exchange rate. Ongoing equity losses are presumed to trigger capital outflows, as indeed they did last summer.

Active management is keeping the yuan relatively stable this time. Bloomberg reports the current quote (around 8 am ET) is 6.5168 from 6.5233 at the open and 6.5335 at the close the day before. Earlier the yuan had firmed 0.21% to 6.5199 at 4:30 pm in Shanghai today. This is a steadying of the 0.7% drop over the previous three days. But China still has the offshore yuan to worry about. There the yuan fell 0.28% to 6.6447. “The offshore yuan’s discount to the rate in Shanghai widened to more than 1,200 so-called pips, the most since August. That compares with an average of 304 pips in November and 706 in December.”

The widening spread is critical to China, not only as a symbol of bad pricing control but also because the IMF, which recently named the yuan a reserve currency, frowns on a dual system for the obvious rea-sons. The reserve currency status could be taken away, in theory, unless China cleans up its act. So, it’s not just equities we have to worry about and whether China will lead us all down a rabbit hole, but also the currency and whether some new machinery is in the works, including a one-time devaluation.

Where do we go from here? We are not sure where, but we do know how—on tip-toes. The dollar “should” benefit from safe-haven sentiment, but traders can sustain fear only just so long before they become, literally, exhausted. Bounces upward in risk appetite can easily be dollar-negative. We still see 1.0500 before we see 1.1500 again, but it won’t be a straight line.

| Current | Signal | Signal | Signal | |||

| Currency | Spot | Position | Strength | Date | Rate | Gain/Loss |

| USD/JPY | 119.03 | SHORT USD | STRONG | 12/28/15 | 120.48 | 1.20% |

| GBP/USD | 1.4675 | SHORT GBP | STRONG | 11/06/15 | 1.5137 | 3.05% |

| EUR/USD | 1.0772 | SHORT EURO | WEAK | 01/04/16 | 1.0905 | 1.22% |

| EUR/JPY | 128.22 | SHORT EURO | STRONG | 12/04/15 | 132.38 | 3.14% |

| EUR/GBP | 0.7340 | LONG EURO | WEAK | 10/23/15 | 0.7194 | 2.03% |

| USD/CHF | 1.0068 | LONG USD | STRONG | 01/04/16 | 0.9979 | 0.89% |

| USD/CAD | 1.3934 | LONG USD | STRONG | 10/28/15 | 1.3235 | 5.28% |

| NZD/USD | 0.6704 | LONG NZD | WEAK | 12/04/15 | 0.6641 | 0.95% |

| AUD/USD | 0.7172 | LONG AUD | WEAK | 01/04/16 | 0.7212 | -0.55% |

| AUD/JPY | 85.37 | SHORT AUD | STRONG | 12/10/15 | 88.80 | 3.86% |

| USD/MXN | 17.3438 | LONG USD | WEAK | 12/07/15 | 16.7258 | 3.69% |

This morning FX briefing is an information service, not a trading system. All trade recommendations are included in the afternoon report.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.