Outlook:

We continue to fret that the 10-year yield does not show a picture of a robust economy or a hawkish central bank. This morning’s quote at 2.074% shows a retreat from 2.173% at year-end and 3.03% at year-end 2013. We had GDP in Q1 at a negative, revised to zero, and while Q2 was pretty good at 3.9%, it seems not to be sustained into Q3 and Q4. The Atlanta Fed GDPNow estimate indicates 1.1%, which is better than the last time out (0.9%), but not back to earlier estimates.

Meanwhile, the IMF lowered everyone’s growth forecast. Global growth will be 3.1% this year revised down from 3.3% in the July forecast. China will get 6.8%, the same as the July forecast but still a 25-year low. The eurozone will get 2% (better than 1.8% in 2014) but less than the July forecast of 2.2%. The US got revised up by 0.1% to 2.6% this year but revised down for next year from 3% to 2.8%. The IMF urges the US to stay its hand on raising rates.

We say that just as the IMF used to insist on austerity for devaluation crises (like the Asian crisis in 1997-98) but then got religion and saw the light, at some point in the future IMF economists will see that normalization brings benefits far greater than the tiny effect of a single hike and slow-motion action thereafter.

One of the big stories today that could get the fire-and-brimstone crowd huffing and puffing is the drop in China’s reserves fell by $43 billion in Sept, not as big as $94 billion in August but suggesting FX intervention. China now holds $3.514 trillion, the lowest since July 2013, according to the FT. The peak was almost $4 trillion in June 2014. “Reserves have fallen by an average $36.5bn a month this year, with April the only month they grew.” Actual outflows in Sept were probably worse—some analysts say $100 billion—and Oct could be worse once forward settlements get counted. Plus, Chinese are travelling abroad a lot and the bill will be coming due.

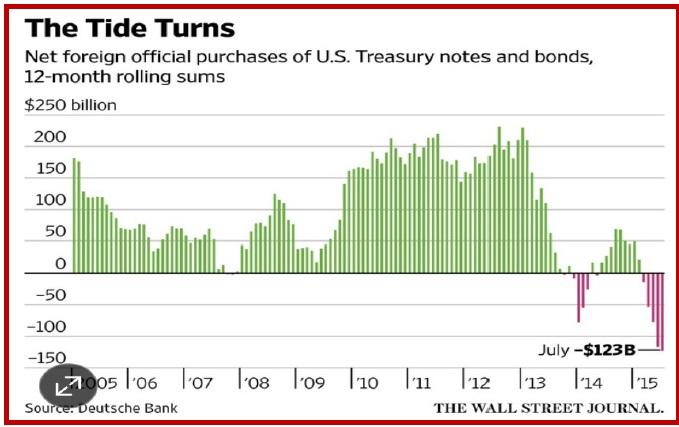

The WSJ features a story about many other central selling US government notes and bonds—“at the fastest pace on record, the most dramatic shift in the $12.8 trillion Treasury market since the financial crisis. Sales by China, Russia, Brazil and Taiwan are the latest sign of an emerging-markets slowdown that is threatening to spill over into the US economy. Previously, all four were large purchasers of U.S. debt.”

Deutsche Bank did an analysis showing foreign official net sales of US Treasury debt of over 1 year at $123 billion in the year ending July. “It’s the biggest drop since data started in 1978. A year earlier, foreign central banks purchased $27 billion of U.S. notes and bonds. Foreign official purchases rose as high as $230 billion in the year ended in January 2013, the Deutsche Bank data show.”

It’s not just China selling Treasuries. Russia shed $32.8 billion in the year ended in July, with Taiwan down $6.8 billion and Norway, down $18.3 billion. Offsetting is India, raising its holding from $79.7 billion to $116.3 billion at the end of July 2015. Another offset is foreign private investors buying Treasuries at the fastest pace in more than three years. “U.S. bond mutual funds and exchange-traded funds targeting U.S. government debt have attracted $20.4 billion net cash this year through the end of September, poised for the biggest calendar-year inflow since 2009, according to fund tracker Lipper.”

The WSJ chart is a little scary but shouldn’t set your shoes on fire. If the primary reason countries are using up reserves is to defend their currencies and if the dollar fails to rally into year-end, as now seems likely, devaluation pressure will be reduced. Bloomberg reports that already today, “Asian emerging market currencies jumped overnight with the Malaysian ringgit surging 3.5 percent to 4.2253 a dollar at the close in Kuala Lumpur, after the country reported its biggest trade surplus in nine months. Indonesia's rupiah closed 3.1 percent higher and the Thai baht advanced 1.3 percent as oil prices increased and expectations for a Fed rate rise in 2015 fell.”

Some fruitcakes are sure to say it’s about to be the end of the world and the dollar, but that’s simply not in the cards yet until something else comes along to replace the dollar. The dollar is more than symbolic—it’s used in transactions and to count wealth. With China now creeping up in the transaction score-card, as reported yesterday, it’s true the dollar is losing allure. But slowly, slowly. Still, we need to keep an eye on it.

More interesting is the idea that rising oil prices are so good for everybody and every other market. This is more than “miners” outpacing general equity indices on the oil price rise. People actually want higher oil and thus some inflation. The mood is brightening on the oil price story. In recent years, rising oil automatically meant a falling dollar, which lacks logic and is contrary to at least some history, but never mind. If the oil rally keeps going, everyone will cheer—and the dollar will fall.

We say the dollar is going to fall anyway, given a tepid recovery and a seemingly cowardly Fed, or at least a Hamlet-Fed.

And the politics are just awful. Today we get the Plub vote in the House on the next Speaker who will replace the hapless Boehner. He had the impossible task of herding Tea Party cats and actually gets a not-bad grade from pundits, who say we will look back fondly on him once we get the next guy, who is sure to be a great deal worse. The US voter likes a certain amount of gridlock but given the need for infrastructure spending and other top issues, the US government is dysfunctional. European governments have equivalent issues (think of poor Renzi and even Tsipras), but these are not the self-styled leaders of the free world. We imagine the euro will get over the recent bad twin German data and resume its rise, if not in a straight line.

| Current | Signal | Signal | Signal | |||

| Currency | Spot | Position | Strength | Date | Rate | Gain/Loss |

| USD/JPY | 120.01 | LONG USD | WEAK | 09/28/15 | 120.16 | -0.12% |

| GBP/USD | 1.5209 | SHORT GBP | WEAK | 09/22/15 | 1.531 | 0.66% |

| EUR/USD | 1.1242 | LONG EUR | STRONG | 09/29/15 | 1.1226 | 0.14% |

| EUR/JPY | 134.91 | SHORT EURO | WEAK | 09/22/15 | 133.8 | -0.83% |

| EUR/GBP | 0.7348 | LONG EURO | STRONG | 08/13/15 | 0.7117 | 3.25% |

| USD/CHF | 0.9673 | LONG USD | STRONG | 09/28/15 | 0.9792 | -1.22% |

| USD/CAD | 1.3028 | SHORT USD | STRONG | 10/06/15 | 1.3082 | 0.41% |

| NZD/USD | 0.6613 | LONG NZD | WEAK | 10/05/15 | 0.6523 | 1.38% |

| AUD/USD | 0.7296 | LONG AUD | NEW*WEAK | 10/07/15 | 0.7206 | 1.25% |

| AUD/JPY | 86.48 | SHORT AUD | WEAK | 06/29/15 | 94.04 | 8.04% |

| USD/MXN | 16.5874 | LONG USD | WEAK | 05/27/15 | 15.2944 | 8.45% |

This morning FX briefing is an information service, not a trading system. All trade recommendations are included in the afternoon report.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.