Outlook:

We get so much data and have so many openings for an important speaker that it’s hard to know what to watch. Sometimes when there is too much material, we get a surprise FX move on what seems a secondary factor. Which is more important, eurozone PMI’s—already reported so now in the revision phase from the flashes—or inflation? And where does Greece come into it? Some analysts say they expect Mr. Draghi to speak of Greece at the press conference on Wednesday, but we guess he will be silent unless something new has occurred. He has already positioned himself as not wanting to steal any thunder or “make” any news. Instead he may trumpet that deflation is behind us, even if it’s only a tepid 0.2%, as forecast. Better than zero and certainly better than a negative.

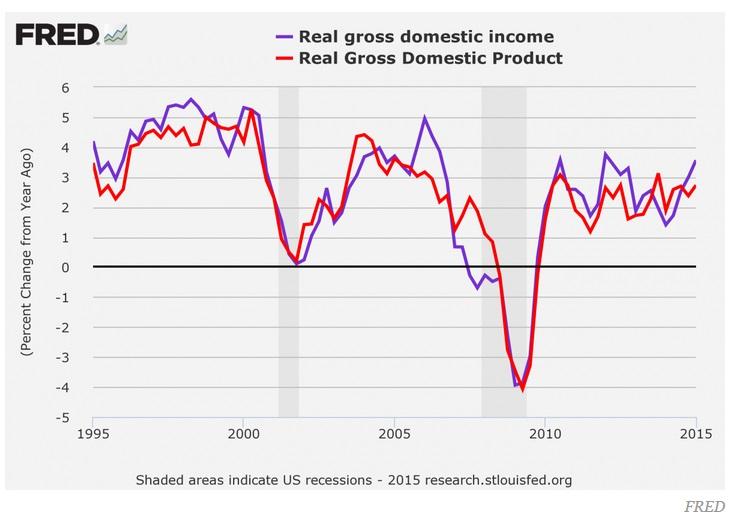

In the US, today we get the Chicago activity index and existing home sales. We also get personal in-come and spending for April, income forecast up a measly 0.3% and spending, 0.2%. The Institute for Supply Management reports the manufacturing PMI for May, expected at 51.8 from 51.5 in April. These are important numbers, to be sure, but we see two other issues: GDP and payrolls on Friday. Is the GDP revision behind us now? On Friday the Commerce Dept reported a Q1 contraction of 0.7% annualized, from the initial +0.2%. One way to get rid of troublesome data is to change the basis on which data is reported. This is exactly what the Commerce Dept intends to do. Starting in July, it will calculate GDP as an average of the old GDP, which measures spending, and Gross Domestic Income, or GDI, which includes wages, profits, etc. Theoretically, spending should equal income in the first place, but it doesn’t. GDI in Q4 was up 1.4% and 3.6% y/y, following a lovely 1.7% in Q4. On the year-over-year basis, Q1 would have been 3.1% if the new methodology had been in place. It looks like economists are embracing the new averaging process. See the chart from the Federal Reserve. The process is not as rad-ical as it sounds at first glance.

As for payrolls, we could just copy&paste the same sentences as last time and the time before. The fore-cast is now on the order of 220,000—ahead of the ADP private sector component forecast on Wednes-day—and the dollar will respond according to how close or far away from forecast the actual turns out to be. Remember that the dollar usually rises on the Wednesday ahead of payrolls, but not always (and not last month, either).

Traders are grinding their teeth over Greece, trying not to react much and not to over-react, either. This is not some new kind of self-control, just a realistic assessment of the situation. Greece keeps promising a deal, and officials on the other side keep saying the Greeks are blowing smoke. Poor Mr. Thomsen, the IMF’s European desk guy, who has to have a bodyguard. A payment of €300 million is due to the IMF on Friday, and funny, there is no talk today about combining the three IMF payments into one bundle that would be due on June 19, as LaGarde offered. Greece appears to be courting default with the inten-tion of blaming the institutions for being unfair, unreasonable and not respectful of democracy. In other words, there has been no progress at all since Syriza took power in January. Tspiras’ remarks in Le Monde are incendiary. Unless something new comes along, default is all but certain. Why this is not more euro-negative is a mystery. The absence of contagion to other countries, notably Spain and Italy, is well-accepted by now but default is still a very big deal. Perhaps the actual Event itself—outright default—will get a rise out of traders. It can’t be euro-favorable, at least not initially.

So, bottom line, it’s ours to lose—i.e., the market doesn’t cut the dollar any slack when it comes to data. It has to be good, or at least not too bad.

This morning FX briefing is an information service, not a trading system. All trade recommendations are included in the afternoon report.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.