Outlook:

We did not get turmoil and volatility in any market on the Fed release, from which many commentators deduce that the porridge was not too hot and not too cold but just right. The Goldilocks hike speaks well of strategic thinking at the Fed. Heaven knows they had enough time to design it. It’s a good thing when nobody goes haywire; it’s not a good thing that the probability of somebody going haywire was not zero, especially given the long wait time.

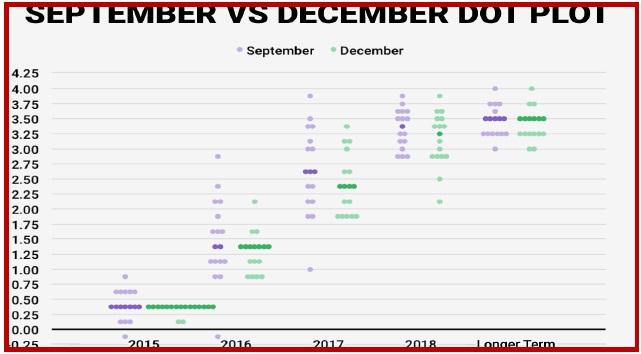

But a second look may be coming. It was nice that Yellen got a unanimous vote of the hike, but analysts are fretting about the new dot-plot. Yellen has worn the word “gradual” down to a nub, but the dot-plots don’t look gradual at all. In fact, they looks suspiciously like the ones we got in September, basically continuing to assume four hikes of 25 bp each during 2016. SocGen analyst Juckes points out the words are dovish but the dots are hawkish.

More importantly, the market is pricing in two hikes, not four. If the market comes to believe in four hikes next year, doesn’t that mean the entire yield curve shifts up? And yet the market is pricing in a Fed funds rate at 84.5% by year-end next year and the Fed has 1.375%. This divergence is what must get bridged for the Fed to be truly successful.

The dot-plot comparison below is from Business Insider. The newer dots are less widely distributed in 2016, although a set of outliers to the upside in 2017 switches to two really interesting outliers on the downside in 2018. It’s silly to spend much time on this unless your crystal ball tells you what the data will be that will sway the dots in one direction or another next time out. Probably the most interesting thing about the dot-plot, after the assumption of four hikes next year, is that it shows little change from Sept, meaning the Fed feels it has nothing to rectify or apologize for.

Yellen did not really define “gradual,” although she did point to median Fed forecast for next year at “nearly 1.5%.” She also said “gradual” does not mean evenly spaced and equally sized changes—that would be Greenspan’s “measured” hikes. Instead, gradual means changes will be slow enough that the Fed can be sure of the effect of the hikes on financial conditions and spending.

The Fed also changed its language about inflation, adding it will look to “actual” inflation in the incoming data. The statement reads “In light of the current shortfall of inflation from 2 percent, the Committee will carefully monitor actual and expected progress toward its inflation goal. The Committee expects that economic conditions will evolve in a manner that will warrant only gradual increases in the federal funds rate; the federal funds rate is likely to remain, for some time, below levels that are expected to prevail in the longer run. However, the actual path of the federal funds rate will depend on the economic outlook as informed by incoming data.”

Nobody knows what this means. On the surface, it may mean that the Fed will no longer imagine what inflation should be based on “reasonable expectations” (i.e., Phillips Curve) but what the numbers actually say each time. We should probably assume no change in backroom machinery of the econometric modelling, but we can pray for the Fed to report its reading of “actual” inflation, possibly in some new way. We’d vote for core CPI, running at 2% p.a., and rising. A shift from PCE to core CPI would suffice to justify a March hike. Actually, PCE alone may suffice. The Fed sees it at 1.6% next year, 1.9% in 2017 and 2% in 2018.

Let’s not forget that all our measures of inflation stink. CPI is wildly understated, including core CPI, as anyone who goes to supermarkets and drugstores can attest. Cost rises are not offset by cheaper gasoline and heating oil. Besides, the hedonic measures are dumb and unrealistic. You think you paid more this year for a PC, but the government says no, you didn’t--because it’s such a better PC with so many more features. Bah. And the PCE measure, which at least excludes food and energy, also includes "imputed" purchases. Imputed is not as bad as hedonic measures, but it’s scary. Bottom line, core CPI should be closer to PCE, but neither is even close to being accurate and thus not respected or trusted.

Still, if inflation is perceived to be rising faster than we now think, the upcoming hikes could be clustered near the beginning of the year, starting in March. But if the actual inflation number, whatever it is, falls, then the upcoming hikes would have to be clustered toward the end of the year and probably reduced in number. Oh, dear. We see a new obsession forming. If so, it’s probably a good thing in the end although it will make us miserable for a while. It’s probably too much to hope the Fed will invent a new measure of inflation, but after going through a year of the dual mandate being only half fulfilled and creating authentic tension, it would be nice to get another factor or a different way of looking at existing factors. Don’t hold your breath, though. “Actual” inflation has a long way to go before the public will understand what the Fed is up to.

And there could be a trick buried in here. Let’s say unemployment falls to some ridiculous level like 3.5%. Phillips Curve or not, you have to assume unemployment that low is driving inflation. Even in the absence of rising wages, you can’t just sit back and say “actual” inflation is not to be found. This would put the Fed in quite a pickle. It would either have to change its definition of unemployment or its definition of inflation in order to hike again. Maybe they would tell us that time.

But all this is frivolous. We can let Yellen rest on her laurels for a while (maybe a week). What is being called a “communications coup” needs to be followed up by the Fed keeping its promise of clear com-munication. Yellen said the market will be “well-prepared” for the next move and she had better be right.

We imagine the dollar will continue to improve over the next few days, but probably with a limit. A new range could develop bounded by 1.0750 and 1.0950—not all that different from recent weeks. Don’t bet the ranch.

| Current | Signal | Signal | Signal | |||

| Currency | Spot | Position | Strength | Date | Rate | Gain/Loss |

| USD/JPY | 122.41 | LONG USD | STRONG | 10/23/15 | 120.45 | 1.63% |

| GBP/USD | 1.4931 | SHORT GBP | STRONG | 11/06/15 | 1.5137 | 1.36% |

| EUR/USD | 1.0843 | LONG EURO | WEAK | 12/08/15 | 1.0858 | -0.14% |

| EUR/JPY | 132.74 | LONG EURO | WEAK | 12/04/15 | 133.59 | -0.64% |

| EUR/GBP | 0.7261 | LONG EURO | WEAK | 10/23/15 | 0.7194 | 0.93% |

| USD/CHF | 0.9973 | SHORT USD | WEAK | 12/08/15 | 0.9973 | 0.00% |

| USD/CAD | 1.3829 | LONG USD | STRONG | 10/28/15 | 1.3235 | 4.49% |

| NZD/USD | 0.6759 | LONG NZD | WEAK | 12/04/15 | 0.6641 | 1.78% |

| AUD/USD | 0.7199 | LONG AUD | WEAK | 11/23/15 | 0.7174 | 0.35% |

| AUD/JPY | 88.13 | SHORT AUD | WEAK | 12/10/15 | 88.80 | 0.75% |

| USD/MXN | 16.9906 | LONG USD | STRONG | 12/07/15 | 16.7258 | 1.58% |

This morning FX briefing is an information service, not a trading system. All trade recommendations are included in the afternoon report.

Recommended Content

Editors’ Picks

GBP/USD remains on the defensive below 1.2450 ahead of UK Retail Sales data

GBP/USD remains on the defensive near 1.2430 during the early Asian session on Friday. The downtick of the major pair is backed by the stronger US Dollar as the strong US economic data and hawkish remarks from the Fed officials have triggered the speculation that the US central bank will delay interest rate cuts to September.

EUR/USD extends its downside below 1.0650 on hawkish Fed remarks

The EUR/USD extends its downside around 1.0640 after retreating from weekly peaks of 1.0690 on Friday. The hawkish comments from Federal Reserve officials provide some support to the US Dollar.

Gold: Middle East war fears spark fresh XAU/USD rally, will it sustain?

Gold price is trading close to $2,400 early Friday, reversing from a fresh five-day high reached at $2,418 earlier in the Asian session. Despite the pullback, Gold price remains on track to book the fifth weekly gain in a row.

Dogwifhat price pumps 5% ahead of possible Coinbase effect

Dogwifhat price recorded an uptick on Thursday, going as far as to outperform its peers in the meme coins space. Second only to Bonk Inu, WIF token’s show of strength was not just influenced by Bitcoin price reclaiming above $63,000.

Israel vs. Iran: Fear of escalation grips risk markets

Recent reports of an Israeli aerial bombardment targeting a key nuclear facility in central Isfahan have sparked a significant shift out of risk assets and into safe-haven investments.