Outlook:

Today’s headline data is Nov CPI, expected at 0.3% y/y from 0.2% the month before. Core CPI should be the same 1.9%. (although Bloomberg has 2%). This doesn’t set anyone’s hair on fire but the Fed is expected to announce a hike tomorrow all the same.

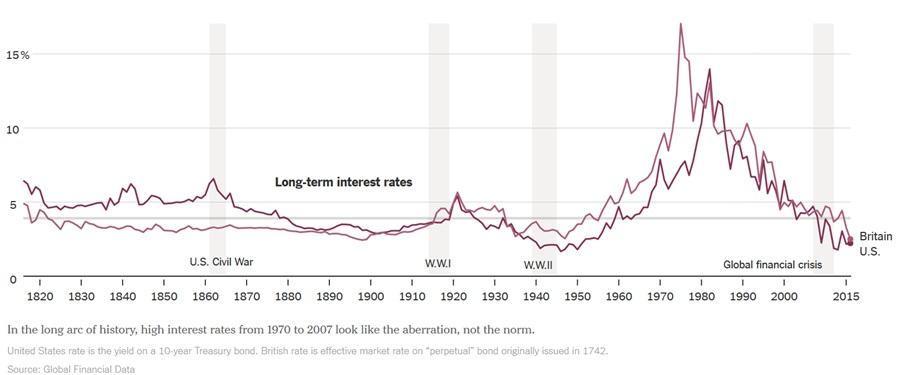

The Fed may be a little queasy about falling oil prices and Chinese currency changes, but it can’t back out now. Once the actual announcement is out of the way, we can turn to the new obsession of when the next one will be. We really dislike the phrase “dovish hike.” It’s an oxymoron. Why not just say the pro-cess of hiking will be more gradual than we have ever seen? Likewise, calling the hike “liftoff” implies an airplane-like steep trajectory from ground to 30,000 feet, and nobody imagines that is accurate. The commentary world is full of speculation about how many additional hikes and how widely spaced, something no one can possibly know, including the Fed. Data-dependence, remember. For all we know, some oil supply shock could come along and the price of oil rises to $80, which will accelerate the Fed’s timing no matter how much Fed economists say oil pricing is aberrant and temporary and should be ig-nored. In parallel, imagine oil falls to $20. Surely hikes will be more widely spaced. The New York Times has a dandy piece of reporting on the history of rates over centuries using data and analysis from the firm Global Financial Data. The “new normal” of slow growth and low inflation is actually the “old normal.” The reports says “Very low rates have often persisted for decades upon dec-ades, pretty much whenever inflation is quiescent, as it is now. The interest rate on a 10-year Treasury note was below 4 percent every year from 1876 to 1919, then again from 1924 to 1958. The record is even clearer in Britain, where long-term rates were under 4 percent for nearly a century straight, from 1820 until the onset of World War I…. The real aberration looks like the 7.3 percent average experi-enced in the United States from 1970 to 2007.” Rates could stay low for another few decades. This will make gloomsters like Soros and Laffer dead wrong—both had forecast a big jump in rates once the crisis was over. “In 2014, all 67 economists sur-veyed by Bloomberg predicted higher rates six months hence; they fell sharply instead.”

Inflation is the key. So far, “the pressures that normally generate inflation seem to have disap-peared in recent years.” Central banks in Japan, the US, the UK and now the ECB are straining to hit a 2% inflation target, but “Current Treasury bond prices predict annual inflation in the United States of only 1.7 percent a year over the next three decades.

“Still, starting with Japan in the 1990s and now across the advanced world, the predominant problems of the last several years have revolved around weak demand, plenty of supply, low inflation and resulting very low interest rates. The simple fact that the Fed is poised to raise rates a bit above zero doesn’t change that…. And just because many people are old enough to remember the high inflation and high rates of the 1970s and 1980s doesn’t mean that is the normal to which the economy will inevitably re-vert.”

This should make everyone feel better… unless we start to consider the ways in which the world really is different this time from those earlier centuries. The single most important difference is the speed of information flow and its wide and deep reach. Galbraith in his book on the Great Crash of 1929 says a critical component was the ticker getting overwhelmed and becoming delayed by many hours. Traders assumed the worst and entered even more sell orders.

This time traders will know the worst and enter even more sell orders—exactly what happened in the junk bond market over the past week, with companies failing left and right. The Fed can’t hold a candle to the speed and reach of market prices. This is why we have automatic stock market stabilizers but re-member, we don’t have any stabilizers in fixed income and foreign exchange. Information flow may have changed, but human nature has not. Sell-off routs are just as likely today as at any time in history, and illiquid year-ends are more prone to sell-offs than non-holiday periods. And the market is still long the dollar by a large amount.

Larry Summers has a humble brag op-ed piece in the FT today pretending to trumpet praise for a new study on “neutral real rates” that also looks back in time at historical rates and how they relate to the economy. It’s not growth that drives rates but a bunch of other factors, including income inequality. The point is a broad-based decline in real rates by 450 bp over the past 25 years. Summers says the current institutional structure and policy stance is not the least prepared for a disruption. “It is possible that neu-tral real rates will rise over the next several years. But there is a high enough chance that they will not to make contingency planning an urgent priority.”

If enough people read articles like these, it’s likely the Fed hike will have almost no effect on any-thing of importance. This is not to say junk bonds are unimportant—they had gone from 5% to 25% and more of total issuance in recent years—but it is to say that if the junk bond managers didn’t see the flood of sell orders coming, they had to have their heads in the sand. This is a take on the old saw “stupid people deserve to lose money.” One manager even tried to refuse sell orders!

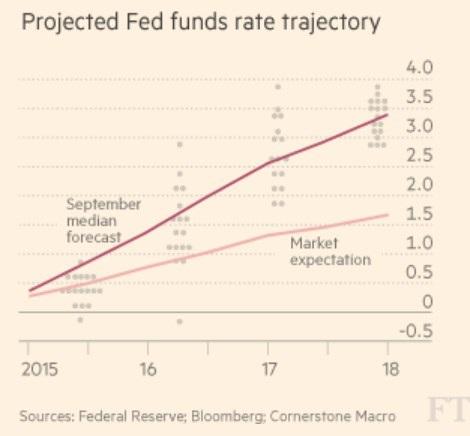

In our little corner of the market world, we need to imagine into what sand we are burying our own heads. It’s all too likely we have priced in to the dollar too robust a Fed rate hike trajectory. See the chart from the FT. The Sept dot-plots show the Fed sees rates at 3-3.5% by 2018, whereas the market sees a far lower number, a little over 1.5%.

A divergence like this needs not be catastrophic, but the newest dot-plots from this week’s meeting had better match the market more closely or we could be in the soup.

We don’t have a comparable chart for the ECB, but we don’t need one—the discrepancy in the two US outlooks can suffice, and may well mean the dollar is way overbought. This is so whether the discrepan-cy remains (loss of confidence in the Fed) or the spread is narrowed (less yield advantage). But nothing proves a thesis like an actual price move. We need to see the euro not only hold above support, but also make a new series of higher highs for this theory to be valid.

| Current | Signal | Signal | Signal | |||

| Currency | Spot | Position | Strength | Date | Rate | Gain/Loss |

| USD/JPY | 121.06 | LONG USD | WEAK | 10/23/15 | 120.45 | 0.51% |

| GBP/USD | 1.5161 | SHORT GBP | WEAK | 11/06/15 | 1.5137 | -0.16% |

| EUR/USD | 1.1008 | LONG EURO | STRONG | 12/08/15 | 1.0858 | 1.38% |

| EUR/JPY | 133.27 | LONG EURO | WEAK | 12/04/15 | 133.59 | -0.24% |

| EUR/GBP | 0.7260 | LONG EURO | WEAK | 10/23/15 | 0.7194 | 0.92% |

| USD/CHF | 0.9835 | SHORT USD | STRONG | 12/08/15 | 0.9973 | 1.38% |

| USD/CAD | 1.3692 | LONG USD | STRONG | 10/28/15 | 1.3235 | 3.45% |

| NZD/USD | 0.6801 | LONG NZD | WEAK | 12/04/15 | 0.6641 | 2.41% |

| AUD/USD | 0.7254 | LONG AUD | WEAK | 11/23/15 | 0.7174 | 1.12% |

| AUD/JPY | 87.82 | SHORT AUD | NEW*WEAK | 12/10/15 | 88.80 | 1.10% |

| USD/MXN | 17.2672 | LONG USD | STRONG | 12/07/15 | 16.7258 | 3.24% |

This morning FX briefing is an information service, not a trading system. All trade recommendations are included in the afternoon report.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.