Outlook:

This week we get Nov CPI, the Treasury’s capital flow report, Nov industrial production and capacity utilization, the Dec Philadelphia Fed index and Nov leading indicators.

CPI may be fleetingly interesting since we know gas and heating oil prices are lower.

Nothing can take away from the Event, though—the FOMC meeting on Tuesday and Wednesday.

As just about everyone is saying, the Fed’s rate hike this week will have very little effect on the financial markets or the economy. It has been long expected and it’s small. What matters more is the pace of increases afterwards. There the Fed and the market are at odds with one another. The Fed projects a series of hikes totaling 1.5% to end-2016, whereas the market sees only 0.85%, according to the FT. We need to see the new dot-plots after this week’s meeting to judge the distance between the Fed and the market.

Of immediate interest is whether the next move is March or April—or June. We will have to plough through acres of newsprint to figure it out. This is likely a market-mover for the dollar, at least on the announcement effect of the release. Longer term, however, don’t forget “data dependent.”

Criticism of the Fed for waiting too long or moving prematurely is easy to find. The Fed can’t do any-thing right, according to the critics. One of the harshest criticisms is that the Fed must act this week to preserve its reputation—backing out now would be worse than getting the timing wrong. We are not wild about the Fed’s behavior, especially the September postponement on “global market distress” grounds, but the very existence of a hike now indicates some smart people think the economy is robust and not fragile. Or at least robust enough. Backing up this idea is the Atlanta Fed's GDPNow tracker showing Q4 GDP at 1.9%, from 1.5% the week before (led by consumer spending).

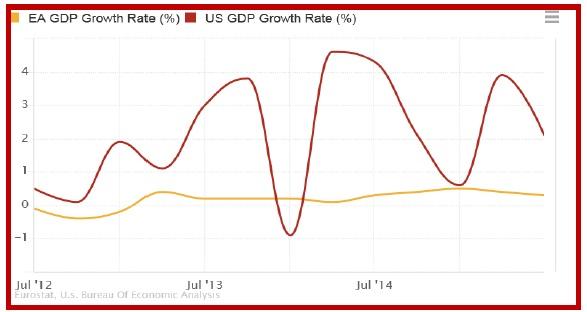

It’s not the 3.5-4.5% of yore, but it’s not chickenfeed, either. It also puts the US firmly ahead of the eurozone. See the chart from http://ieconomics.com/united-states-vs-euro-area. It’s a dandy chart—you place your cursor over a spot and the two piece of data pop up in a little box. It’s a weak argument and unreliable, but relatively higher growth leads to a relatively higher currency.

The other big effect of the Fed policy meeting this week was China’s pre-emptive move to decouple from the Fed. China has said for a long time that a basket makes more sense—the yuan should not be rising more or less in lockstep with the dollar when China is in easing mode. The implication is that China sees the dollar gaining more in the future and needs to stop the rot sooner rather than later—China doesn’t want to spend any more reserves on defending the yuan. From the Western point of view, China’s behavior seems awkward and cumbersome—announcing the basket but delaying the composition of the basket for a day, for example.

Bloomberg has a difficult and complicated explanation of how things are going to work, stuffed full of acronyms. First, CFETS means China Foreign Exchange Trade System, a unit of the PBOC. Next, RMB Index is the new gauge of the renminbi (= yuan) against the basket of 13 currencies, using trade for the weights and end-2014 as the base level of 100. Bloomberg complains that the PBOC doesn’t’ say how often it will publish the index.

“The dollar has the largest weighting with 26.4 percent, followed by the euro and the yen with 21.4 percent and 14.7 percent, respectively. The measure also includes the currencies of Hong Kong, the U.K., Australia, New Zealand, Singapore, Switzerland, Canada, Malaysia, Russia and Thailand. The U.S. accounted for 14.2 percent of China’s trade this year through November, while the European Union had a 14.3 percent share. About 95 percent of the yuan’s onshore spot transactions were against the dollar in 2014, according to a China International Capital Corp report.”

Just about everyone thinks the yuan will now fall. Daiwa sees a 14% devaluation to 7.50 against the dollar by yearend 2016. Goldman has a drop to 6.60, “which compares with the current spot rate of 6.4585 in Shanghai.” Weirdly, “Referencing the yuan to several currencies doesn’t mean the exchange rate is pegged to that basket, according to an article on the PBOC website written by an unidentified commentator at CFETS.” China justifies this practice by pointing to the Fed’s own trade-weighted dollar index, which nobody ever looks at. The ECB and BoE have their own versions, too. And “The Monetary Authority of Singapore manages its currency against an undisclosed basket of exchange rates.”

Whew. So far today, Reuters reports spot yuan fell to the lowest since mid-2011, or about 4% year-to-date. There is a fair amount of under-the-breath muttering about currency wars. But remember the 3% devaluation last August, which set off a round of equity-selling that led in the end to the Fed deferring the First Rate Hike in September. This time we have a more orderly response

We have far too much to worry about—equity price volatility, a junk bond rout, the 10-year yield possibly falling under 2%, the oil glut driving the price down to $20, and the unknown effects of normalization. We have Draghi saying inflation will be coming back fast because of central bank policy and a BoE policy member saying UK rate hikes could be coming sooner than we think.

More than various big-picture changes, they are coming very fast. We already saw European equities flip-flop from positive to negative in two hours this morning, not to mention US equity futures. A giant shake-out is all too possible.

Again, both the Fed and China will get the blame, when the blame really lies in a market that has had a free lunch for nine years. Normalization must include re-pricing a lot of assets. We “should” be favoring the dollar on growth and yield differential, but it looks like the risk-averse are favoring the euro. Get ready.

| Current | Signal | Signal | Signal | |||

| Currency | Spot | Position | Strength | Date | Rate | Gain/Loss |

| USD/JPY | 121.15 | LONG USD | WEAK | 10/23/15 | 120.45 | 0.58% |

| GBP/USD | 1.5165 | SHORT GBP | WEAK | 11/06/15 | 1.5137 | -0.18% |

| EUR/USD | 1.0959 | LONG EURO | STRONG | 12/08/15 | 1.0858 | 0.93% |

| EUR/JPY | 132.77 | LONG EURO | WEAK | 12/04/15 | 133.59 | -0.61% |

| EUR/GBP | 0.7226 | LONG EURO | WEAK | 10/23/15 | 0.7194 | 0.44% |

| USD/CHF | 0.9842 | SHORT USD | STRONG | 12/08/15 | 0.9973 | 1.31% |

| USD/CAD | 1.3721 | LONG USD | STRONG | 10/28/15 | 1.3235 | 3.67% |

| NZD/USD | 0.6733 | LONG NZD | WEAK | 12/04/15 | 0.6641 | 1.39% |

| AUD/USD | 0.7212 | LONG AUD | WEAK | 11/23/15 | 0.7174 | 0.53% |

| AUD/JPY | 87.37 | SHORT AUD | NEW*WEAK | 12/10/15 | 88.80 | 1.61% |

| USD/MXN | 17.3541 | LONG USD | STRONG | 12/07/15 | 16.7258 | 3.76% |

This morning FX briefing is an information service, not a trading system. All trade recommendations are included in the afternoon report.

Recommended Content

Editors’ Picks

EUR/USD rises toward 1.0700 after Germany and EU PMI data

EUR/USD gains traction and rises toward 1.0700 in the European session on Monday. HCOB Composite PMI data from Germany and the Eurozone came in better than expected, providing a boost to the Euro. Focus shifts US PMI readings.

GBP/USD holds above 1.2350 after UK PMIs

GBP/USD clings to modest daily gains above 1.2350 in the European session on Tuesday. The data from the UK showed that the private sector continued to grow at an accelerating pace in April, helping Pound Sterling gather strength.

Gold price flirts with $2,300 amid receding safe-haven demand, reduced Fed rate cut bets

Gold price (XAU/USD) remains under heavy selling pressure for the second straight day on Tuesday and languishes near its lowest level in over two weeks, around the $2,300 mark heading into the European session.

Here’s why Ondo price hit new ATH amid bearish market outlook Premium

Ondo price shows no signs of slowing down after setting up an all-time high (ATH) at $1.05 on March 31. This development is likely to be followed by a correction and ATH but not necessarily in that order.

US S&P Global PMIs Preview: Economic expansion set to keep momentum in April

S&P Global Manufacturing PMI and Services PMI are both expected to come in at 52 in April’s flash estimate, highlighting an ongoing expansion in the private sector’s economic activity.