Outlook:

Yesterday Atlanta Fed Pres Lockhart was just the latest speaker to emphasize that hikes will be gradual. We get St. Louis’ Bullard today. Vice Chairman Fischer also named gradualism as the theme and also said “We’ve done everything we can to avoid surprising markets” and some central banks are advising the Fed to “just do it” already. This may be a push back against the IMF and others interfering with the Fed and asserting the hike will cause Shocks. Fischer also warned that the dip in commodity prices could persist for “quite some time.”

The dollar’s puzzling dip yesterday may be explained by the new focus on gradualism. We dread that this factor is likely going to be our main subject next year—it’s tiresome. After the first hike in December, the Fed’s Sept dots suggested four more hikes in 2016 with an ending point at 1.25%, assuming each hike is 25 bp. But now analysts see only one or two more hikes, which would leave the Fed funds rate at 0.75%. Any rate under 1% is still abnormal and smells of emergency measures.

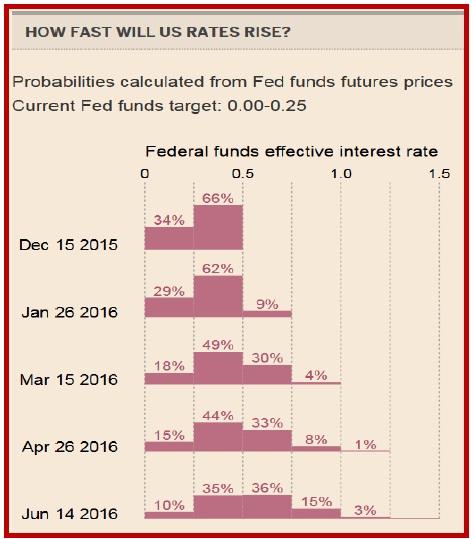

The FT chart shown below indicates only a 1-3% chance the Fed funds rate is above 1% by April-June next year. Eek.

The gradualism debate is seen in yesterday’s yield curve flattening. It might also be seen in the curious stock market rise, which followed hot on the heels of the Wednesday minutes. A Fed statement that seemingly affirms a rate hike does not usually drive an equity rally.

The bigger problem is, again, the disconnect between what the Fed thinks is “gradual” and what the market thinks it is. To be fair, the 2-year yield has moved up smartly to 0.92%, and that is especially prodollar in the context of the German 2-year at -0.375%. But the 10-year is wobbling. See the chart in the Chart Package. MACD suggests the 10-year yield has farther to fall.

Some analysts are making a lot out of the divergence between the US and Japanese yields. We say don’t waste your time. The yield differential has not been a consistent and reliable driver of USD/JPY. Besides, Japan is struggling mightily with a dual commitment—lower the debt burden, the highest among any major country and a rating near EM status—and stimulate the economy. The BoJ pretty much refuses to expand QE, which is not working, or at least not working as it does in the US, UK and Europe. That leaves fiscal stimulus, which Abe has suggested but not until after the end of this fiscal year (March 31). The yen is adrift without a yield anchor in this environment. In practice, the yen moves more in response to safe-haven consideration and to the implications of the China slowdown than to the yield diff.

US gradualism is the “nuance” in the divergent-policy thesis that is presumed to take the dollar higher. As noted earlier this week, some big banks have returned to their earlier forecasts of parity by year-end and even 0.8500. That might be true if the new debate over gradualism is not a major sticking point. We fear it is exactly that. It’s the “yeah, but” in the mix. We can note that European yields are falling and more are likely to go negative, but with US yields tepid and the curve flattening, where is the dollar driver? FX traders will go to great lengths to avoid the scenario in which the dollar is favored.

Having said that, a euro upside correction looks silly in light of the Draghi comments. And it has to be weak, not exceeding the last intermediate high at 1.0830 from Nov 12. We will not know the gradualism story has been beaten unless and until we see a lower low than 1.0615 from Wednesday noon.

| Current | Signal | Signal | Signal | |||

| Currency | Spot | Position | Strength | Date | Rate | Gain/Loss |

| USD/JPY | 122.80 | LONG USD | WEAK | 10/23/15 | 120.45 | 1.95% |

| GBP/USD | 1.5289 | SHORT GBP | WEAK | 11/06/15 | 1.5137 | -1.00% |

| EUR/USD | 1.0698 | SHORT EUR | STRONG | 10/23/15 | 1.1115 | 3.75% |

| EUR/JPY | 131.38 | SHORT EURO | STRONG | 10/23/15 | 133.88 | 1.87% |

| EUR/GBP | 0.6996 | SHORT EURO | STRONG | 10/23/15 | 0.7220 | 3.10% |

| USD/CHF | 1.0139 | LONG USD | WEAK | 10/23/15 | 0.9735 | 4.15% |

| USD/CAD | 1.3304 | LONG USD | STRONG | 10/28/15 | 1.3235 | 0.52% |

| NZD/USD | 0.6565 | SHORT NZD | WEAK | 10/05/15 | 0.6641 | 1.14% |

| AUD/USD | 0.7216 | SHORT AUD | STRONG | 10/29/15 | 0.7087 | -1.82% |

| AUD/JPY | 88.61 | LONG AUD | WEAK | 10/08/15 | 86.06 | 2.96% |

| USD/MXN | 16.5835 | LONG USD | WEAK | 11/06/15 | 16.6275 | -0.26% |

This morning FX briefing is an information service, not a trading system. All trade recommendations are included in the afternoon report.

Recommended Content

Editors’ Picks

AUD/USD rises to two-day high ahead of Aussie CPI

The Aussie Dollar recorded back-to-back positive days against the US Dollar and climbed more than 0.59% on Tuesday, as the US April S&P PMIs were weaker than expected. That spurred speculations that the Federal Reserve could put rate cuts back on the table. The AUD/USD trades at 0.6488 as Wednesday’s Asian session begins.

EUR/USD holds above 1.0700 on weaker US Dollar, upbeat Eurozone PMI

EUR/USD holds above the 1.0700 psychological barrier during the early Asian session on Wednesday. The weaker-than-expected US PMI data for April drags the Greenback lower and creates a tailwind for the pair.

Gold price cautious despite weaker US Dollar and falling US yields

Gold retreats modestly after failing to sustain gains despite fall in US Treasury yields, weaker US Dollar. XAU/USD struggles to capitalize following release of weaker-than-expected S&P Global PMIs, fueling speculation about potential Fed rate cuts.

Ethereum ETF issuers not giving up fight, expert says as Grayscale files S3 prospectus

Ethereum exchange-traded funds theme gained steam after the landmark approval of multiple BTC ETFs in January. However, the campaign for approval of this investment alternative continues, with evidence of ongoing back and forth between prospective issuers and the US SEC.

US versus the Eurozone: Inflation divergence causes monetary desynchronization

Historically there is a very close correlation between changes in US Treasury yields and German Bund yields. This is relevant at the current juncture, considering that the recent hawkish twist in the tone of the Fed might continue to push US long-term interest rates higher and put upward pressure on bond yields in the Eurozone.