Outlook:

The Fed has not raised rates since 2006 and rates have been effectively at zero since 2008, or 7 years. If the Fed raises rates in December, as now expected, it’s a “historic” event.

But it has been so long coming, and with more than one false start, that you have to wonder if the outcome will be a whimper and not a bang. The dollar is already over 15% higher than before the first taper announcement. It’s entirely plausible that the hike is priced in and further dollar gains are not likely. In fact, we could get “buy on the rumor, sell on the news.” FX analysts are pretending to be laid-back and appropriately skeptical, saying it will take a huge number (like 200,000) to drive the euro below 1.0800. Without it, though, any euro rallies will still meet sell orders, just at higher levels.

It’s futile to argue with the market, of course, but we don’t buy it. Maybe the most likely scenario is for the euro to resist a break of 1.0800, but the trend is our friend. A break is coming, and it could easily come today.

The WSJ has an estimate for payrolls of 180,000 and the unemployment rate falling to 5%, which is close to the multitude of other forecasts out there. Bloomberg has 185,000 and one whisper number is almost 200,000.

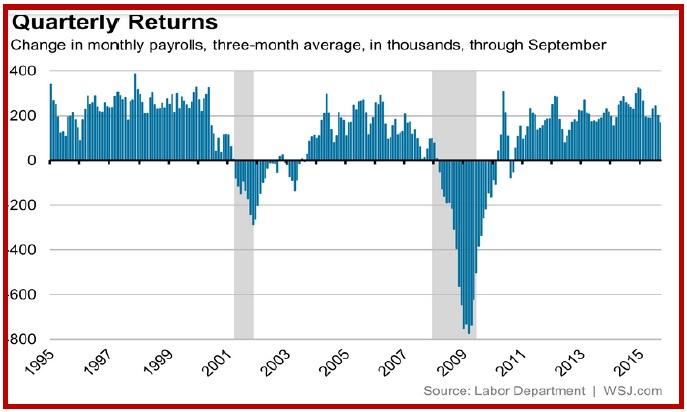

The important bit of data today is not the actual numbers, but the variance of the actual from the forecast. The 3-month average is 167,000, another benchmark against which to judge the October number. September had 142,000, so Oct can be lower if the Sept number wasn’t bad enough to scare the Fed, which accepts that deceleration in job growth is cyclically normal.

But we have data coming out of our ears. We also have a 2-month average of 139,000, a 6-month average of 199,000 and 12-month average of 229,000. Which one should we look at when evaluating the October number? How about a low number like 120,000 (but with some revisions) that initially tanks the dollar but then starts looking not so bad, giving us a two-way spike and leaving the dollar net higher by the end of the day? This is what we think will happen.

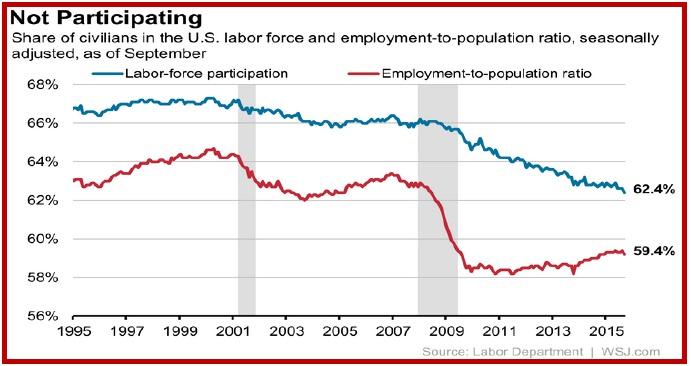

Wages come next. The Sept report had wages up 2.2% y/y and the ECI for Q3, 2%. The forecast this time is for a tepid 0.2% rise in wages, but that will be 2.3% y/y, a small gain but relatively high given past performance. An increase would be nice and could be sued to justify the Phillips Curve relationship with expected inflation. But anyone looking for a reason to delay has only to look at the participation rate, 62.4% in Sept and the lowest since 1977. See the charts.

But the participation rate has been falling for years, and besides, surely the Fed had considered it as well as the headlines numbers when Yellen named the Dec hike a “live possibility.” The jobs-created number would have to be closer to 100,000 than to 200,000 to scare the Fed.

In the real world, it’s what the fixed income gang does that counts. The US 10-year dipped a little overnight from 2.245% at the close to 2.228% this morning, but yesterday’s high was 2.261%, the highest in 7 weeks. The next high to watch is 2.303%, according to Market News, the high from the Sept 16 FOMC. One source told Market News we could get a double top at 2.30% that will be hard to break. After that, we might see resistance at 2.36% and 2.50%. But let’s not forget the downside. Yield support is way down at 2.17% and 2.05%. One ray of light is the 2-year, hovering near the high of 0.861%, the highest since April 2011.

Finally, we have inflation, supposedly the root cause of all rate hikes. The FT reports that “After the markets closed on Wednesday, Fed vice-chair Stanley Fischer sang from the same hymn sheet, saying inflation could be nearer the central bank’s 2 per cent target than many had previously thought.” We scrambled around looking for the full statement and its context, but it was hidden deep in Fischer’s speech on Fed independence. What Fischer actually said was the expectations remain anchored around 2% even though inflation is currently much lower. He said “The anchoring of these expectations is due in great part, I suspect, to the continued credibility of the Fed’s independence from political interference, along with the adoption of the explicit inflation target of 2 per cent. To put this point clearly, the concern over the effects of political interference in monetary policy remains as valid in practice when inflation is too low as when inflation is too high.”

So, Fischer didn’t actually say “inflation is higher than we think.” The FT got something wrong, at least the way we read it. Fischer was trying to fend off government interference, not making a statement about inflation as a stand-alone subject. But never mind—the point is that the Fed knows perfectly well that a hike will control and constrain inflation expectations (while having very little effect on anything else). This is, possibly, a valuable clue.

Meanwhile, ECB economist Peter Praet said the ECB does not shape its monetary policy based on surveys of economic activity and will continue to print money until inflation picks up, according to Reuters. “You don't conduct monetary policy based on changes in PMI.” The ECB will buy assets until there is a sustained pick-up in inflation (or Sept 2016).

So, at least two central bankers haven their heads screwed on straight. We see the dollar rally continuing, although today will be the usual spiky nightmare.

| Current | Signal | Signal | Signal | |||

| Currency | Spot | Position | Strength | Date | Rate | Gain/Loss |

| USD/JPY | 121.86 | LONG USD | STRONG | 10/23/15 | 120.45 | 1.17% |

| GBP/USD | 1.5137 | SHORT GBP | NEW*STRONG | 11/06/15 | 1.5137 | 0.00% |

| EUR/USD | 1.0879 | SHORT EUR | STRONG | 10/23/15 | 1.1115 | 2.12% |

| EUR/JPY | 132.58 | SHORT EURO | STRONG | 10/23/15 | 133.88 | 0.97% |

| EUR/GBP | 0.7186 | SHORT EURO | STRONG | 10/23/15 | 0.7220 | 0.47% |

| USD/CHF | 0.9950 | LONG USD | WEAK | 10/23/15 | 0.9735 | 2.21% |

| USD/CAD | 1.3183 | LONG USD | STRONG | 10/28/15 | 1.3235 | -0.39% |

| NZD/USD | 0.6608 | SHORT NZD | WEAK | 10/05/15 | 0.6641 | 0.50% |

| AUD/USD | 0.7154 | SHORT AUD | STRONG | 10/29/15 | 0.7087 | -0.95% |

| AUD/JPY | 87.18 | LONG AUD | WEAK | 10/08/15 | 86.06 | 1.30% |

| USD/MXN | 16.6275 | LONG USD | NEW*WEAK | 11/06/15 | 16.6275 | 0.00% |

This morning FX briefing is an information service, not a trading system. All trade recommendations are included in the afternoon report.

Recommended Content

Editors’ Picks

AUD/USD posts gain, yet dive below 0.6500 amid Aussie CPI, ahead of US GDP

The Aussie Dollar finished Wednesday’s session with decent gains of 0.15% against the US Dollar, yet it retreated from weekly highs of 0.6529, which it hit after a hotter-than-expected inflation report. As the Asian session begins, the AUD/USD trades around 0.6495.

USD/JPY finds its highest bids since 1990, approaches 156.00

USD/JPY broke into its highest chart territory since June of 1990 on Wednesday, peaking near 155.40 for the first time in 34 years as the Japanese Yen continues to tumble across the broad FX market.

Gold stays firm amid higher US yields as traders await US GDP data

Gold recovers from recent losses, buoyed by market interest despite a stronger US Dollar and higher US Treasury yields. De-escalation of Middle East tensions contributed to increased market stability, denting the appetite for Gold buying.

Ethereum suffers slight pullback, Hong Kong spot ETH ETFs to begin trading on April 30

Ethereum suffered a brief decline on Wednesday afternoon despite increased accumulation from whales. This follows Ethereum restaking protocol Renzo restaked ETH crashing from its 1:1 peg with ETH and increased activities surrounding spot Ethereum ETFs.

Dow Jones Industrial Average hesitates on Wednesday as markets wait for key US data

The DJIA stumbled on Wednesday, falling from recent highs near 38,550.00 as investors ease off of Tuesday’s risk appetite. The index recovered as US data continues to vex financial markets that remain overwhelmingly focused on rate cuts from the US Fed.