Outlook:

This will be a horrendous week for data and news. The Big Event is the Fed policy meeting on Oct 27-28. The market has decided the Fed will take no action and only mumble about “maybe December.” There is no press conference.

Bloomberg tries for a fresh headline by suggesting the Fed will stop reinvesting maturing paper. This is so remote as to be laughable. Plenty of political types would like to cut down the $2.46 billion of Treasuries languishing on the Fed’s balance sheet, but just ahead of a debt-ceiling crisis is hardly the right timing for such an announcement. Remember, this Thursday (Oct 29) is the “deadline” for the debt ceiling bill to get presidential approval by the president before Nov 3, when we run out of money.

Lynne at Wall Street in Advance notes that Bernanke delayed the tapering announcement in September 2013 for the same reason, and Yellen is likely “to make the same choices Bernanke did—to do nothing until Congress gets its act together.”

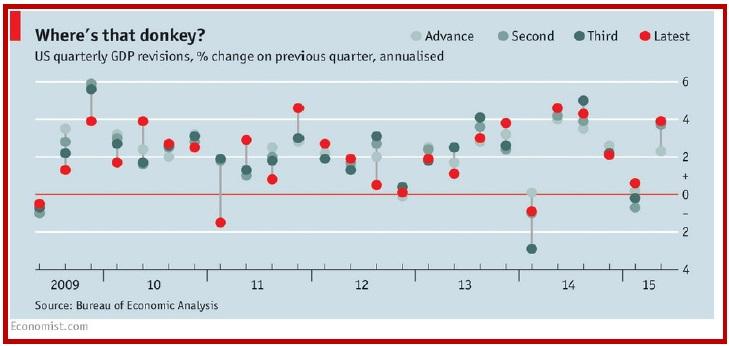

Economic releases include new home sales and the CaseShiller home price index, durables, two consumer sentiment indices and GDP. The UK also reports GDP this week and to celebrate, The Economist ran a nifty story on how bad our data really is. See the chart.

The Economist writes the Bureau of Economic Analysis Statistics gets it wrong all the time. “The BEA recently reviewed its data for 2012-14 and discovered that the American economy had grown more slowly than it had previously thought. At a stroke it removed $70 billion, equivalent to Sri Lanka’s en-tire output, from its figures. No one noticed. It is changes in the early estimates that move markets and influence policy. Alarmingly, though, the BEA appears to have become less accurate of late. The average revision from the first to the third estimate was 0.6 percentage points in 1993-2013, but has risen to 1.3 points since the beginning of 2014. That may reflect greater volatility in the economy itself. In the past six quarters growth has bounced around, rising to 3.9% or more three times and falling below zero twice.

“There may be other problems too. Between 2010 and 2014, first-quarter GDP averaged just 0.6%, a full two percentage points below the other quarters. The BEA has admitted that it may not have fully allowed for the seasonal effects of holidays and the weather. It has promised a “multi-pronged action plan” to fix the issue.” For what it’s worth, the UK has its own problems and is also conducting a review of statistical techniques.

The Economist proposes “An alternative would be to release more data in the hope that the overall picture this provides will be more accurate, if fuzzier. In addition to GDP, for instance, the BEA also publishes figures on gross domestic income. GDI, like GDP, is a broad measure of economic activity, but it tracks income instead of expenditure. GDP and GDI rarely match exactly, as in theory they should: in January-March of this year, America’s GDP fell by 0.2% but GDI rose by 1.9%. The BEA’s solution is to publish an average of GDP and GDI along with the quarterly GDP data. This average should reduce the influence of errors. It also gives investors another number to pore over.”

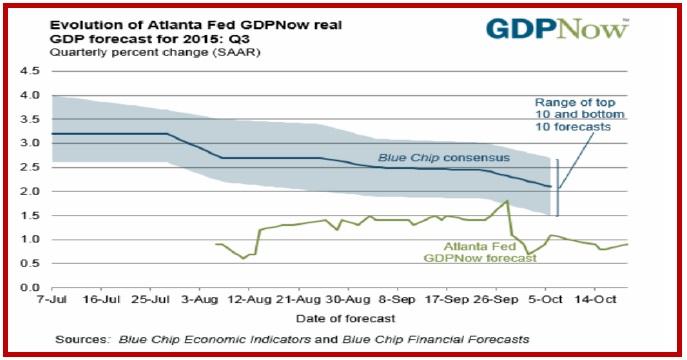

Well, maybe, but so far it looks like the Atlanta Fed’s GDP Now has the influence. See the second chart. The Atlanta Fed reports “The GDPNow model nowcast for real GDP growth (seasonally adjusted annual rate) in the third quarter of 2015 is 0.9 percent on October 20, unchanged from October 14.” Note that the GDP Now was 1.4% as recently as Sept 24. Aside from the distracting effect of that stupid word “now cast,” we will be befuddled by a revision in the BEA’s official GDP from 3.9% to something lower but probably higher than the Atlanta Fed’s 0.9%. You simply can’t reconcile such numbers. That doesn’t mean we will ignore GDP altogether. It means confidence will nosedive and the dollar likely fall.

One strong influence on perception of GDP is corporate earnings. The WSJ asserts earnings show the economy sliding back into recession. One-third of the S&P has reported and another one-third comes this week.

For the just-ended quarter, “Profit and revenue are falling in tandem for the first time in six years… Analysts expect the index’s companies to book a 2.8% decline in per-share earnings from last year’s third quarter, according to Thomson Reuters. Sales are on pace to fall 4%—the third straight quarterly decline. The last time sales and profits fell in the same quarter was in the third period of 2009.” Moreover, “U.S. manufacturing production rose in September at its slowest pace in more than two years, the Institute for Supply Management reported earlier this month. Economic activity at 11 industries tracked by the group contracted during the month, while just seven reported growth. Meantime, manufacturers told ISM that customer inventories remained high, contributing to a slowdown in new orders.

“Some investors and analysts worry that companies accustomed to boosting earnings by cutting costs, repurchasing shares and refinancing debt will soon have to face the reality of worsening sales. ‘The ability of corporations to take a 1% to 2% revenue line [gain] and turn it into 5% to 6% profit growth is waning,’ said Charlie Smith, chief investment officer of Fort Pitt Capital Group. ‘They’ve run out of rabbits to pull out.’” And cost-cutting continues, mostly in the form of job cuts. It’s possible the unemployment rate rises. Talk about missing the window of opportunity!

Note that we get the GDP revision on Thursday but Personal Income and Spending, with the Fed’s preferred inflation measure, PCE, on Friday. This is backwards. We should get PCE first and then GDP, ahead of the Fed. It’s worse to think the Fed will have this information in advance—analysts will be im-agining what the data must be. And poor Japan. The BoJ policy meeting on Friday is likely to be eclipsed by all the stuff happening or thought to be happening in the US.

Turning to Europe, we are not the only one dazzled by Draghi. Several observers liken the influence of his comments at the press conference last week to the powerful “whatever it takes,” Draghi’s response to the European sovereign debt crisis on July 26, 2012. The Spanish 10-year yield fell 45 bp immediately (to 6.93%) and Italy’s 10-year, 39 bp to 6.05%, with shorter-term yields falling by more. The euro rallied 1% in a single day. The “whatever it takes” promise was the precursor not only of QE, but also uni-fication measures like the ECB taking over regulation of the big banks. The ECB had already asserted itself in 2009 as an equal partner in the troika dealing with Greece.

Kissinger has an answer to his question “Who do I call when I call Europe?” It’s Draghi. Central bank involvement in very big political issues is justified on the grounds that many institutional problems have money at their very heart. The supply of it, the cost of it, the distribution of it, the taxation of it—all critical to the well-being and even the ongoing existence of the Union. It is named, after all, the European Monetary Union.

From an economist’s point of view, we may be getting the worst case scenario. Europe sees inflation and inflation expectations falling, justifying bigger and longer-lasting QE. The US sees the recovery faltering and maybe even a dropping back into recession (with rising unemployment). It seems there is no way the Fed can raise rates this year at all—and Fed funds futures agree. The WSJ reports that on Fri-day, futures showed only an 8% likelihood for the Oct hike, with 37% for December. This is down from 44% in Sept and over 50% earlier this year.

Accordingly, we will not get the divergent policies that were supposed to support the dollar endlessly. Not everyone is willing to let go of the divergent model, and prefer to imagine that the Fed on hold while the ECB expands QE is a form of divergence. And besides, maybe the Fed will act in December, after all, and to hell with what other central banks are doing. This is nearly a “when pigs fly” moment. We continue to think that raising rates will have minimal real effect and because it signals “normalization,” could go a long way to offsetting the sense of dread growing on the US horizon by leaps and bounds (viz., the expectation of faltering S&P company sales and revenues when we have only one-third of companies reporting so far).

So, we should probably assume the Fed does and says nothing useful while the Draghi comments are as powerful as any central bank can make them. Three guesses which currency gets a boost from this comparison, even if the content of the Draghi statements is euro-negative. This is why we are doubtful the euro keeps going south. Just as in every big downside breakout, we have to worry about a counter-moving bounce…. Perhaps to 1.1250, the midpoint of the breakout bar on the hourly chart last week. That would make 1.0950 the new downside target.

Some analysts think the Draghi remarks were designed specifically to trash the euro—after all, Draghi could have chosen to speak of positive developments, like the rise in bank lending. And some analysts imagine the Fed will hold its fire because the dollar is too strong already and a hike would only make it stronger. After all, the Fed has been talking more about the dollar in recent meetings than in a dozen meetings before, possibly as far back as Greenspan’s conundrum speech in early 2005.

Only the central bank policy committee participants know how much the euro or dollar factors in to their decision-making, and they are not telling. A few years ago we would have said the Fed would put the dollar last on a list of ten things, but now we admit it’s probably higher—maybe 5th or 6th—but not first.

Our best advice is to stand back and see if the euro bounce develops. We sometimes get a clue from the Sunday openings…. Does Asia want a piece of the same action? This time it didn’t, and took the euro up. But when Europe came around 3-4 am ET, the selling started again. New York usually follows Eu-rope, so the right way to bet so far today is with the trend. Just remember that price never move in one direction for long.

| Current | Signal | Signal | Signal | |||

| Currency | Spot | Position | Strength | Date | Rate | Gain/Loss |

| USD/JPY | 121.02 | LONG USD | WEAK | 10/23/15 | 120.45 | 0.47% |

| GBP/USD | 1.5334 | LONG GBP | WEAK | 10/08/15 | 1.5346 | -0.08% |

| EUR/USD | 1.1032 | SHORT EUR | STRONG | 10/23/15 | 1.1115 | 0.75% |

| EUR/JPY | 133.54 | SHORT EURO | WEAK | 10/23/15 | 133.88 | 0.25% |

| EUR/GBP | 0.7194 | SHORT EURO | STRONG | 10/23/15 | 0.7220 | 0.36% |

| USD/CHF | 0.9795 | LONG USD | WEAK | 10/23/15 | 0.9735 | 0.62% |

| USD/CAD | 1.3143 | SHORT USD | STRONG | 10/06/15 | 1.3082 | -0.47% |

| NZD/USD | 0.6760 | LONG NZD | STRONG | 10/05/15 | 0.6523 | 3.63% |

| AUD/USD | 0.7254 | LONG AUD | STRONG | 10/07/15 | 0.7206 | 0.67% |

| AUD/JPY | 87.81 | LONG AUD | STRONG | 10/08/15 | 86.06 | 2.03% |

| USD/MXN | 16.5510 | SHORT USD | WEAK | 10/08/15 | 16.6283 | 0.46% |

This morning FX briefing is an information service, not a trading system. All trade recommendations are included in the afternoon report.

Recommended Content

Editors’ Picks

EUR/USD regains traction, recovers above 1.0700

EUR/USD regained its traction and turned positive on the day above 1.0700 in the American session. The US Dollar struggles to preserve its strength after the data from the US showed that the economy grew at a softer pace than expected in Q1.

GBP/USD returns to 1.2500 area in volatile session

GBP/USD reversed its direction and recovered to 1.2500 after falling to the 1.2450 area earlier in the day. Although markets remain risk-averse, the US Dollar struggles to find demand following the disappointing GDP data.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.