Outlook:

Canada votes today for a new PM—Harper again or back to Trudeau? (Egypt votes, too.) It’s not likely the election outcome will affect the CAD. Something that could affect FX is the Treasury rejecting the idea of delayed payments instead of Congress raising the debt limit by Nov 3. The idea is to fund the government off cash flow, with bondholders and Social Security getting paid first and everybody else—air traffic controllers, the FBI, et al., getting paid when the tax receipts come in. The Treasury could borrow only to pay that first tier of recipients and everyone else has to wait. The Treasury says it just won’t work, not least because the Treasury’s payment process is automated and very, very complicated. TreasSec Lew is tearing his hair out and worried about a debt limit “accident.”

Markets are not paying the slightest attention to this problem for reasons we don’t understand. Maybe they think the Republican extremists behind this utter stupidity will get out-maneuvered somehow. House Speaker John Boehner might disagree. At some point we might get another ratings agency down-grade, but again, this is not on the radar screen yet.

As for the state of the world, we continue to think oil is central. And oil has been uncommonly volatile, with some seeing $20 ahead but others saying the low is in and we are headed for the $70-80 that Iran wants. Hardly anyone wants to go out on a limb with a strong forecast. Just when it looks like OPEC has succeeded in cutting US production down to size—rig count down, etc.—those wild and crazy guys keep pumping. This is, historically, what they always do. Deep analysis of various spreads, starting with Brent vs. WTI but also the contango, gasoline and heating oil vs. crude, etc.—are no help at all. Iran is a very big wild card but if a number of moving parts come together as designed, Iran will start flooding the oil market early next year. It’s hard to see the current rise in oil prices as having lasting power.

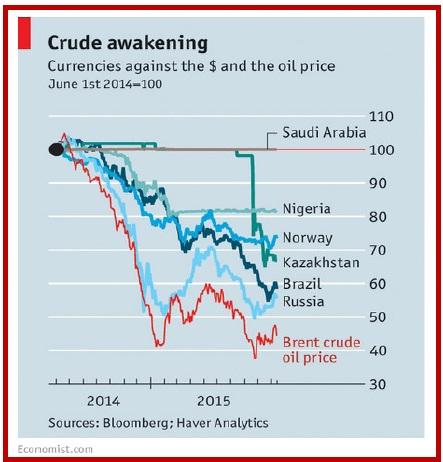

This is bad news for emerging markets. The Economist chart below shows a direct correlation between the oil price and various emerging market currencies. A lot depends on whether the currency floats or not. “The IMF’s annual review of currency regimes, published this month, revealed that at the beginning of 2015 only 35% of member countries let their currencies float, and only 16% intervened rarely enough for the IMF to classify them as “free floating”. The rest, from Hong Kong’s iron-clad peg to the dollar to the stumbling Nigerian naira, are managed with a tighter grip.

“This penchant for pegs can make sense. Many big oil exporters peg their exchange rates to the dollar because oil is priced in that currency. Anchoring a country’s exchange rate to another, stable currency allows a weak central bank to latch on to the credibility of a stronger institutions, and so keep inflation expectations steady. Just ask a Zimbabwean whether they prefer the old regime (when 175 quadrillion Zimbabwean dollars exchanged for five American dollars) or the new, hard-currency one.

“But pegs come with strings attached. In a free market, a shock such as a collapse in the value of exports would boost relative demand for foreign exchange, which in turn would cause the domestic currency to depreciate. The danger of a peg is that rather than allowing the exchange rate to adjust gradually, imbalances build up. Speculators spot the problem and attack the currency; if the country has to push up interest rates to defend the peg that hurts the underlying economy, but devaluing brings potential ruin to companies that have borrowed in foreign currency.”

This brings us back to last week’s IFF forecast of imminent disaster. We do not know to what degree the Fed looks at factors like this. The bigger factor is the supposed correlation between oil and the dollar. If the Fed is aiming to hold the dollar down or push it down further—unlikely—that means it is also aiming to manage the price of oil. The mind boggles.

If the Fed has no such ambitions, then it needs to get over itself. The cost of energy is far more important than some lousy little rate hike that will change hardly anything.

To finish off, we don’t see the ECB getting suddenly more dovish this week but the market does see it and is trading accordingly. Keep the faith. Policy divergence is not going to re-emerge and favor the dollar anytime soon.

| Current | Signal | Signal | Signal | |||

| Currency | Spot | Position | Strength | Date | Rate | Gain/Loss |

| USD/JPY | 119.44 | SHORT USD | WEAK | 10/15/15 | 118.41 | -0.87% |

| GBP/USD | 1.5477 | LONG GBP | WEAK | 10/08/15 | 1.5346 | 0.85% |

| EUR/USD | 1.1314 | LONG EUR | WEAK | 09/29/15 | 1.1226 | 0.78% |

| EUR/JPY | 135.14 | LONG EURO | STRONG | 10/13/15 | 136.32 | -0.87% |

| EUR/GBP | 0.7310 | LONG EURO | STRONG | 08/13/15 | 0.7117 | 2.71% |

| USD/CHF | 0.9573 | SHORT USD | STRONG | 10/09/15 | 0.9612 | 0.41% |

| USD/CAD | 1.2917 | SHORT USD | STRONG | 10/06/15 | 1.3082 | 1.26% |

| NZD/USD | 0.6806 | LONG NZD | STRONG | 10/05/15 | 0.6523 | 4.34% |

| AUD/USD | 0.7295 | LONG AUD | STRONG | 10/07/15 | 0.7206 | 1.24% |

| AUD/JPY | 87.13 | LONG AUD | STRONG | 10/08/15 | 86.06 | 1.24% |

| USD/MXN | 16.3881 | SHORT USD | WEAK | 10/08/15 | 16.6283 | 1.44% |

This morning FX briefing is an information service, not a trading system. All trade recommendations are included in the afternoon report.

Recommended Content

Editors’ Picks

EUR/USD hovers around 1.0700, eyes on US first-quarter GDP data

EUR/USD hovers around the 1.0700 psychological level on Thursday during the early Thursday. The modest uptick of the major pair is supported by the softer US Dollar. Later in the day, Germany’s GfK Consumer Confidence Survey for April will be released.

USD/JPY finds its highest bids since 1990, near 155.50

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, testing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming Japanese intervention risks. Focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold price lacks firm intraday direction, holds steady above $2,300 ahead of US data

Gold price remains confined in a narrow band for the second straight day on Thursday. Reduced Fed rate cut bets and a positive risk tone cap the upside for the commodity. Traders now await key US macro data before positioning for the near-term trajectory.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price. Coupled with broader market gloom, INJ token’s doomed days may not be over yet.

Meta Platforms Earnings: META sinks 10% on lower Q2 revenue guidance Premium

This must be "opposites" week. While Doppelganger Tesla rode horrible misses on Tuesday to a double-digit rally, Meta Platforms produced impressive beats above Wall Street consensus after the close on Wednesday, only to watch the share price collapse by nearly 10%.