Outlook:

Today is an important data day. We get the ADP private sector payrolls forecast, EIA oil inventory report, July factor orders and the Beige Book. We hate to admit it, but ADP will be important. Bloomberg forecasts the ADP forecast will be 200,000 after 185,000 in July. Bloomberg also forecasts the overall payrolls up 218,000. And assuming the EIA report is another build, it’s another nail in the coffin for the false upside breakout.

As for the Beige Book, it’s possible there is something in the stories to influence opinion one way or the other, but we doubt it. Influential commentators seem to be running the show. Today it’s Bill Gross, who knows a thing or two about the Fed. Reuters reports that in his September outlook, Gross says that the Fed may have missed the “window of opportunity to hike rates earlier this year and normalizing them now could create "self-inflicted financial instability." Gross favors normalization but boy, the language has to be super-careful. The Fed should stress that it’s “one and done” to avoid spooking markets. Zero-bound rates have totally screwed up the global economy, and the giant global equity gyrations are the tip of that iceberg. (Gross also says governments should be spending rather than embracing destructive austerity.)

We admit that sentiment is growing that the Fed will indeed act in September if only to prove it is not intimidated by market events that it prefers to see as tangential or temporary. Notice that nobody is demonstrating inflation is on the way and we are stuck with believing Mr. Fischer when he says the Fed has confidence it is.

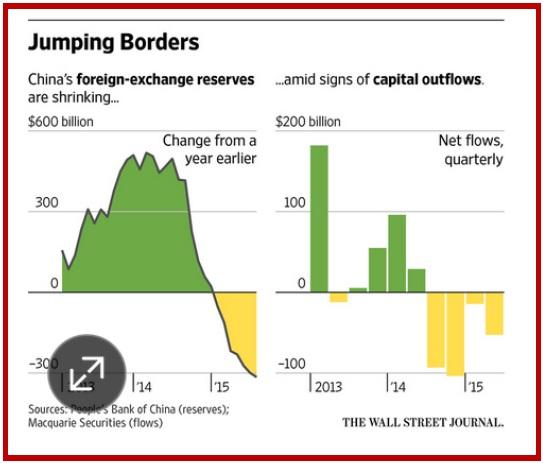

Aside from the Fed thorn-in-the-side, the big story remains China and the exaggerated response to the falling Shanghai market and the likely slowdown in growth. The WSJ notes that in August, Chinese imports fell 13.8% from Germany, 13.6% from Japan, 8.9% from the EU and 4.8% from the US. We already know imports of raw materials, including metals, are down. Falling imports are an excellent sign of slowdown and confirm the drop in PMI’s, but not the only one and it would be better to have more varied data. Of equal interest is yesterday’s yuan fixing higher for a net devaluation of less than 3%. When a government takes actions to stabilize a falling currency, it’s trying to rebuild confidence—and to prevent capital outflows.

Chinese regulators are now forbidding non-banks to lend to borrowers to buy equities (by the end of the month). But a large amount, ¥1 trillion or $157.1 billion, was bought this way, according to Quartz. In addition, the WSJ reports the big banks are being surveilled for proper documentation on FX transactions. This takes two forms—corporate transactions (imports or approved foreign investments) and individual transactions, with each person allowed $50,000 in outflow per year. There is a blacklist.

How big is the outflow? Nobody really knows, but the WSJ stresses that reserves are down $341 billion and a property service firm says “outbound residential investment, totaled $6.5 billion in the first half of this year, putting it in position to surpass 2014’s total of $10.5 billion. In a note to clients late Tuesday, economists at Goldman Sachs Group Inc. listed stability of the yuan and capital outflows as their biggest concerns and estimated the pace of money leaving China might have accelerated to ‘possibly between $150 billion and $200 billion’ since the Aug. 11 yuan devaluation.”

China is retreating fast from free market mechanisms and returning to the old-fashioned Commie “command economy” mode. This is a direct response to the equity market crisis and the government’s own devaluation timing. Devaluation was a brave initiative but clearly the government was not prepared for the fallout.

Let’s be careful not to assume one big blow-up will return China permanently to the conditions and mind-set it had before liberalization. The Chinese understand free markets just as well as anyone else (and without doubt better than the vast majority of Americans). They just don’t know how to cope with the downside. Nobody on this side of the Pacific can imagine a pitchfork-wielding mob uprising on a stock market crash, but perhaps it’s not so far-fetched in a population already annoyed at censorship, corruption and mismanagement.

IMF chief Lagarde makes a backdoor reference to China’s need to try again. Speaking at a conference in Jakarta, she said "We are certainly talking to the Chinese authorities about their transition to a more market-determined economy, to an internationalization of their currency. It's a very significant transition, one that hopefully can be managed in an orderly fashion."

Some commentators note that this week is still very thin, probably because traders are still out, given the late Labor Day weekend this time (starts Friday). With China closed for its WW II anniversary (when it won over Japan, according to the Chinese version), maybe nothing much will happen until payrolls on Friday. Remember that the dollar often rises on the Wednesday ahead of payrolls for some reason we have never discovered. Plus the ECB is meeting and may signal disapproval of the rising euro. So maybe the week will not be so dull, after all. We say it’s a good time to clean your desk and stay out of trading. The one currency we like remains the yen. After all, the bad news out of China is not over. In fact, the bad news out of Japan is not over, either.

Note to Readers: Next Monday, Sept 7, is a national holiday in the US. We will not publish any reports.

This morning FX briefing is an information service, not a trading system. All trade recommendations are included in the afternoon report.

Recommended Content

Editors’ Picks

AUD/USD pressures as Fed officials hold firm on rate policy

The Australian Dollar is on the defensive against the US Dollar, as Friday’s Asian session commences. On Thursday, the antipodean clocked losses of 0.21% against its counterpart, driven by Fed officials emphasizing they’re in no rush to ease policy. The AUD/USD trades around 0.6419.

EUR/USD extends its downside below 1.0650 on hawkish Fed remarks

The EUR/USD extends its downside around 1.0640 after retreating from weekly peaks of 1.0690 on Friday during the early Asian session. The hawkish comments from Federal Reserve officials provide some support to the US Dollar.

Gold price edges higher on risk-off mood hawkish Fed signals

Gold prices advanced late in the North American session on Thursday, underpinned by heightened geopolitical risks involving Iran and Israel. Federal Reserve officials delivered hawkish messages, triggering a jump in US Treasury yields, which boosted the Greenback.

Bitcoin Price Outlook: All eyes on BTC as CNN calls halving the ‘World Cup for Bitcoin’

Bitcoin price remains the focus of traders and investors ahead of the halving, which is an important event expected to kick off the next bull market. Amid conflicting forecasts from analysts, an international media site has lauded the halving and what it means for the industry.

Is the Biden administration trying to destroy the Dollar?

Confidence in Western financial markets has already been shaken enough by the 20% devaluation of the dollar over the last few years. But now the European Commission wants to hand Ukraine $300 billion seized from Russia.