Outlook:

At a conference in Israel, Fed Vice-Chairman Fischer said it’s “misleading” to em-phasize the Fed’s first rate hike, because normalization is going to take years and years. This is the equivalent of Fischer saying “Calm down, dummies.” He is probably right that traders get overly emotional but as an old hand at the central bank business, he should know that traders are like the scorpion that cannot resist stinging the frog ferrying it to safety on the other shore.

We think the Fed is botching “communications” with the market. Maybe it’s their ivory-tower perspec-tive that assumes self-interested rationality when markets so often display anything but. Fischer said (again) that the hike will be determined by data and not by date, missing entirely the point that Yell had to say a second time that the hike is coming this year before the market believed her.

This is a heavy week for data, starting with today’s durables, the Case-Shiller home price index, PMI services flash, new home sales, consumer confidence, and the Dallas and Richmond Fed surveys—all before noon. See the calendar on the last page. We wonder if Friday’s first revision of GDP is not a big-gie, especially now that the San Francisco Fed asserted Q1’s seasonal adjustments were wrong over the past few years.

The point to be made about the flood of data is the context into which it pours. The markets may not be-lieve it can put Q1 behind us just yet, but traders seem willing to accept good data and not brush it off. They do not exaggerate good US data the way they do with European data (in which zero inflation is “good” because it’s no longer negative), but at least bad or ambiguous data is not overwhelmingly nega-tive. On the whole, unless we get a wildly negative US release, the environment is conducive to continu-ation of the dollar rally.

And if various press reports are correct that the euro is stumbling at least in part because of the impasse with Greece, this week could be a game-changer. Presumably on-going uncertainty—the 11th hour is nearly two weeks away—is euro-negative and gets more euro-negative as each hour ticks away. Every-one has said for years that Greece is only 2% of eurozone GDP, it’s an anomaly, it doesn’t really matter if Greece defaults, etc. In fact, there’s a strong school of thought that holds the euro should rally on de-fault. At least it would have become a known known. But we don’t buy it. Default by any OECD coun-try is a big deal. In fact, Greece can get the €7.2 billion leftover money and still default later on this summer. Maybe default on various European institutions is not a terribly harmful in the grand scheme of things, but symbolically it’s a giant. Until we have some kind of resolution, Greece has to be a drag on the euro.

The bigger picture remains divergence in monetary policy, with the Fed poised to raise rates (and cost the US taxpayer more) while Europe and Japan continue with QE. This should favor the US economy, although we need to worry about Mr. Summer’s “secular stagnation.” Where, for example, is the con-sumer splash-out that lower energy costs should have generated? We are still waiting.

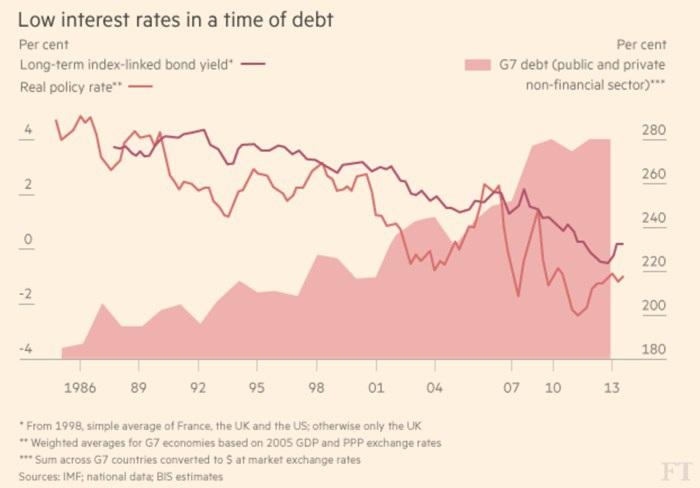

And UBS economic advisor Magnus writes in the FT that we have a major disconnect between falling yields and rising debt. See the chart below. You can look at this chart for a long time before any insights arrive. Magnus writes “The Bank for International Settlements has mapped a 50 per cent rise in debt out-standing in the world’s 12 largest economies since 2007 to more than $125tn at the end of 2014. A re-cently published McKinsey report on debt, covering 47 countries, highlighted an increase over the same period of $57tn to about $200bn, or a rise of about 20 per cent of GDP to just under 290 per cent of GDP.” Golly, maybe the tea party is on to something.

Magnus’ point is that we are now in “greater fool” territory. “Should investors throw in the towel? It is a conundrum. Institutions are still buying European debt on negative yields. Investors who have missed the doubling of the Chinese stock market since mid-2014 wonder if they can afford to stay out. Emerg-ing market currencies are down but asset returns have barely moved despite a steady deterioration in currency reserves, capital flows and growth.” In a nutshell, there is nothing worth buying. Maybe it ends with a bang and not a whimper—investors just go to cash.

Ah, but whose cash? Likely US dollars. It’s always risky to favor a forecast of a rising dollar—we have been disappointed too many times in the past when the dollar “should” be favored and is not. But maybe it’s different this time. Just don’t look for big dollar gains today. The market needs a breather after hit-ting new lows under 1.1000 and also the Fib 62% retracement. We are already seeing a pullback from the overnight low at 1.0883 to the high so far at 1.0940 just after 8 am. If you like consistent trajectory projections and resistance lines, we estimate the high today could get to 1.1035 or so. But we would not expect a breakout above the midpoint of the breakout bar from last week, and that leis at around 1.1102. Dollar buyers need to be content with something less than that.

This morning FX briefing is an information service, not a trading system. All trade recommendations are included in the afternoon report.

Recommended Content

Editors’ Picks

EUR/USD rises toward 1.0700 after Germany and EU PMI data

EUR/USD gains traction and rises toward 1.0700 in the European session on Monday. HCOB Composite PMI data from Germany and the Eurozone came in better than expected, providing a boost to the Euro. Focus shifts US PMI readings.

GBP/USD holds above 1.2350 after UK PMIs

GBP/USD clings to modest daily gains above 1.2350 in the European session on Tuesday. The data from the UK showed that the private sector continued to grow at an accelerating pace in April, helping Pound Sterling gather strength.

Gold price flirts with $2,300 amid receding safe-haven demand, reduced Fed rate cut bets

Gold price (XAU/USD) remains under heavy selling pressure for the second straight day on Tuesday and languishes near its lowest level in over two weeks, around the $2,300 mark heading into the European session.

Here’s why Ondo price hit new ATH amid bearish market outlook Premium

Ondo price shows no signs of slowing down after setting up an all-time high (ATH) at $1.05 on March 31. This development is likely to be followed by a correction and ATH but not necessarily in that order.

US S&P Global PMIs Preview: Economic expansion set to keep momentum in April

S&P Global Manufacturing PMI and Services PMI are both expected to come in at 52 in April’s flash estimate, highlighting an ongoing expansion in the private sector’s economic activity.