Outlook:

US equity index futures point to a higher opening ahead of Yellen’s speech this afternoon, suggesting they expect a dovish statement. In practice, they will probably get no such thing, but never mind—if they were fearful, we would be talking about profit-taking ahead of the long weekend.

The data today is US CPI (with Mexico and Canada also reporting CPI). The current expectation is for CPI to slip back to -0.2% from -0.1% on the monthly and core CPI to slip from 1.8% to 1.7%. Other forecasts give more weight to gasoline prices and expect CPI top rise 0.1%, but these numbers are too small to have any real meaning. In any case, it’s not CPI or core CPI that counts at the Fed, but rather the core PCE deflator, which comes out only quarterly and was 1.3% in March. Next week (June 1) we get the update. So, traders may try to make hay out of the CPI data, but honestly, there’s no there, there.

There’s also not much there in Draghi’s appeal to European governments at the ECB conference in Portugal to stop counting on monetary policy and start engaging in more reform in labor, competitiveness, tax policy. He has said it before and he will say it again, but he lacks authority in these matters and it’s not clear anyone is listening. It’s a lot like the US infrastructure crumbling all around us but Congress fixated on not raising spending. You can see the next crisis coming.

Because of the holiday starting today, the FX market is already quite thin and prices are moving in slow-motion. It’s one of the slowest news days we can remember in a long while. It’s likely to get worse as the day progresses, and with Asia the primary market open on Monday, we can’t expect much action there, either. A price move in motion tends to stay in motion until something comes along to deflect it in another direction, and we don’t see that happening before next week. So, while we may want to accept the falling dollar is our fate, it won’t pay to target much of a gain and illiquid conditions can deliver unhappy surprises if some big player decides to change a big position. It can be hard to accept if you are

usually trigger-happy, but the best tactic is to exit by noon today and not come back until late Monday.

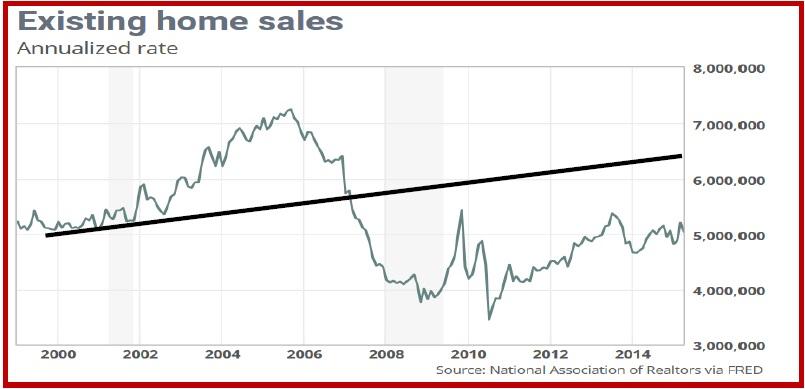

A final note: the chart below shows existing home sales wobbling ahead of matching the post-crisis high. The employment and inflation numbers are what people are watching, but we say the existing home sales should be added to that list. It looks like 2004-2006 was a bubble, but we will have “recovery” when the pre-bubble trajectory is met (trajectory line is added).

Note to Readers: No reports on Monday.

This morning FX briefing is an information service, not a trading system. All trade recommendations are included in the afternoon report.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.