Briefly: In our opinion, no speculative positions are justified.

Our intraday outlook is now neutral, and our short‐term outlook is neutral:

Intraday outlook (next 24 hours): neutral

Short‐term outlook (next 1‐2 weeks): neutral

Medium‐term outlook (next 1‐3 months): bearish

Long‐term outlook (next year): bullish

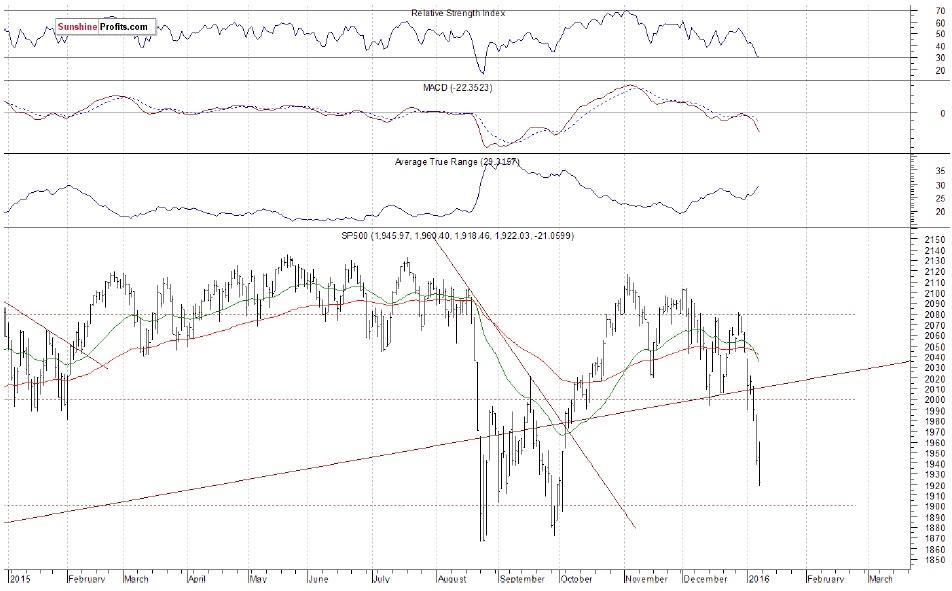

The U.S. stock market indexes lost 0.8‐1.1% on Friday, extending their recent sell‐off, as investors reacted to global stock markets' decline, monthly jobs data release, among others. The S&P 500 index got closer to its last year's August ‐ September lows. The nearest important level of support is at around 1,870‐1,900. On the other hand, resistance level is at 1,980‐2,000, marked by recent local lows. There have been no confirmed positive signals so far. However, we can see short‐term oversold conditions which may lead to an upward correction at some point. The market continues to trade below last year's February ‐ August consolidation. It has become a crucial medium‐term resistance level, as we can see on the daily chart:

Expectations before the opening of today's trading session are slightly positive, with index futures currently up 0.1‐0.2%. The main European stock market indexes have been mixed so far. The S&P 500 futures contract trades within an intraday uptrend, as it retraces some of Friday's sell‐off. The nearest important level of resistance is at around 1,930, marked by recent local lows. On the other hand, support level is at 1,890‐1,900. For now, it looks like another upward correction within a short‐term downtrend. There have been no confirmed downtrend reversal signals so far. However, we can see oversold conditions:

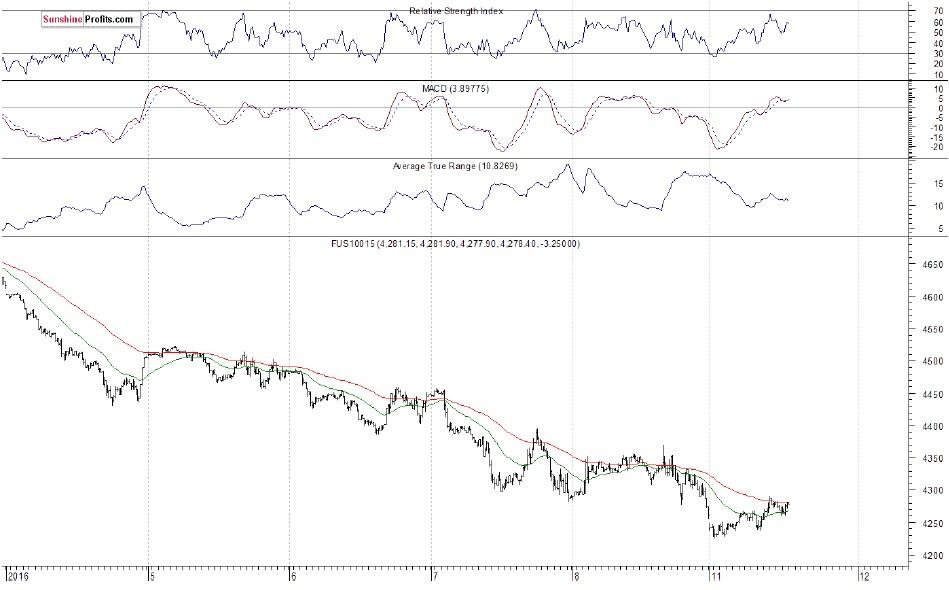

The technology Nasdaq 100 futures contract follows a similar path, as it retraces some of its recent move down. The nearest important level of support is at 4,200‐4,220. On the other hand, resistance level is at 4,280‐4,300, among others. Is this just a flat correction following recent sell‐off or some bottoming pattern before a downtrend reversal? The market continues its lower highs ‐ lower lows sequence so far:

Concluding, the broad stock market extended its short‐term downtrend on Friday, as the S&P 500 index got closer to the level of 1,900. It currently trades 10 percent below its last year's May all‐time high of 2,134.72, so technically, it is still just a correction following long‐term bull market. Will it continue towards last year's August ‐ September lows? There have been no confirmed positive signals so far, however, we can see some short‐term technical oversold conditions, which may lead to an upward correction at some point. Therefore, we decided to close our profitable speculative short position (2,077.34, S&P 500 index) on Thursday. It has been closed at the opening of Thursday's cash market trading session (S&P 500 index at around 1,965, following temporary opening price of 1,985.32, S&P 500 futures contract 1,947.90 at 9:30 a.m.). Overall, we gained around 112 index points on that trade. We prefer to be out of the market, avoiding low risk/reward ratio trades. We will let you know when we think it is safe to get back in the market.

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' employees and associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0600 as focus shifts to Powell speech

EUR/USD fluctuates in a narrow range above 1.0600 on Tuesday as the better-than-expected Economic Sentiment data from Germany helps the Euro hold its ground. Fed Chairman Powell will speak on the policy outlook later in the day.

GBP/USD stays near 1.2450 after UK employment data

GBP/USD gains traction and trades near 1.2450 after falling toward 1.2400 earlier in the day. The data from the UK showed that the ILO Unemployment Rate in February rose to 4.2% from 4%, limiting Pound Sterling's upside.

Gold retreats to $2,370 as US yields push higher

Gold stages a correction on Tuesday and fluctuates in negative territory near $2,370 following Monday's upsurge. The benchmark 10-year US Treasury bond yield continues to push higher above 4.6% and makes it difficult for XAU/USD to gain traction.

XRP struggles below $0.50 resistance as SEC vs. Ripple lawsuit likely to enter final pretrial conference

XRP is struggling with resistance at $0.50 as Ripple and the US Securities and Exchange Commission (SEC) are gearing up for the final pretrial conference on Tuesday at a New York court.

US outperformance continues

The economic divergence between the US and the rest of the world has become increasingly pronounced. The latest US inflation prints highlight that underlying inflation pressures seemingly remain stickier than in most other parts of the world supported by a strong US labour market.