Briefly: In our opinion, no speculative positions are justified.

Our intraday outlook is now neutral, and our short-term outlook is neutral:

Intraday outlook (next 24 hours): neutral

Short-term outlook (next 1-2 weeks): neutral

Medium-term outlook (next 1-3 months): bearish

Long-term outlook (next year): bullish

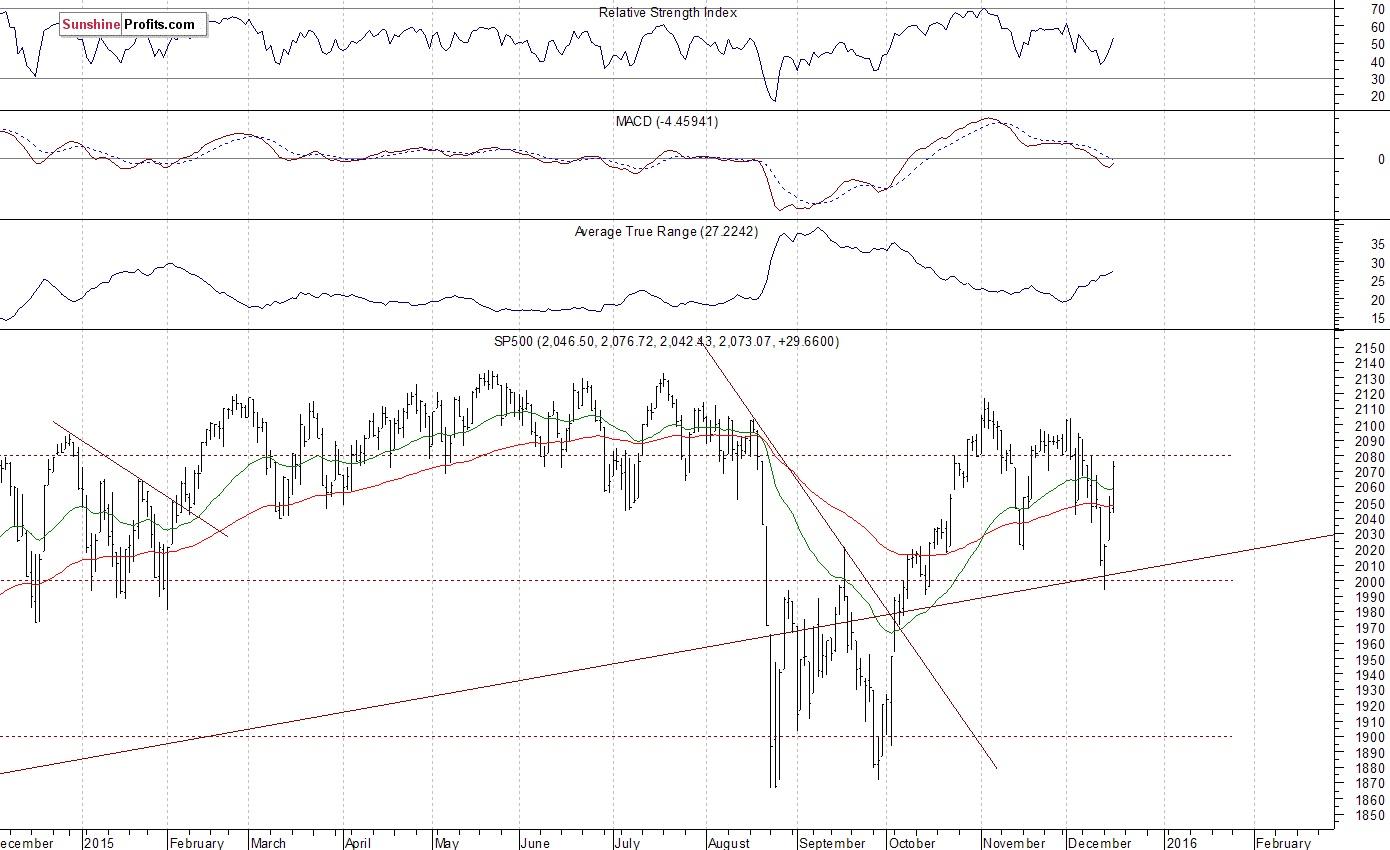

The main U.S. stock market indexes gained 1.3-1.5% on Wednesday, as investors reacted to the FOMC's Rate Decision announcement. The S&P 500 index extended its short-term uptrend, retracing more of its recent move down. The nearest important level of resistance is at around 2,080-2,100. On the other hand, support level remains at 2,000-2,020, among others. For now, it looks like a consolidation following October rally:

Expectations before the opening of today's trading session are positive, with index futures currently up 0.2-0.3%. The European stock market indexes have gained 1.4-3.0% so far. Investors will now wait for some economic data announcements: Initial Claims, Philadelphia Fed number at 8:30 a.m. The S&P 500 futures contract trades within an intraday uptrend, as it continues its yesterday's move up. The nearest important level of resistance is at around 2,080. On the other hand, support level remains at 2,050, among others, as the 15-minute chart shows:

The technology Nasdaq 100 futures contract follows a similar path, as it continues yesterday's advance. The nearest important level of resistance is at 4,700, and support level is at 4,650, as we can see on the 15-minute chart:

Concluding, the broad stock market reacted positively to yesterday's FOMC Interest Rate Decision release. However, it continues to trade within medium-term consolidation. Our short position (2,088.35, S&P 500 index) has been closed at the stop-loss (profit taking) level of 2,060 - S&P 500 index. Overall, we gained almost 30 index points on that one-and-a-half month long trade. We prefer to be out of the market, avoiding low risk/reward ratio trades. We will let you know when we think it is safe to get back in the market.

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' employees and associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Recommended Content

Editors’ Picks

EUR/USD rises toward 1.0700 after Germany and EU PMI data

EUR/USD gains traction and rises toward 1.0700 in the European session on Monday. HCOB Composite PMI data from Germany and the Eurozone came in better than expected, providing a boost to the Euro. Focus shifts US PMI readings.

GBP/USD regains 1.2350 ahead of UK PMIs

GBP/USD is recovering ground above 1.2350 in the European session, as the US Dollar comes under fresh selling pressure on improving risk sentiment. The further upside in the pair could be capped, as traders await the UK PMI reports for fresh trading impetus.

Gold price flirts with $2,300 amid receding safe-haven demand, reduced Fed rate cut bets

Gold price (XAU/USD) remains under heavy selling pressure for the second straight day on Tuesday and languishes near its lowest level in over two weeks, around the $2,300 mark heading into the European session.

PENDLE price soars 10% after Arthur Hayes’ optimism on Pendle derivative exchange

Pendle is among the top performers in the cryptocurrency market today, posting double-digit gains. Its peers in the altcoin space are not as forthcoming even as the market enjoys bullish sentiment inspired by Bitcoin price.

US S&P Global PMIs Preview: Economic expansion set to keep momentum in April

S&P Global Manufacturing PMI and Services PMI are both expected to come in at 52 in April’s flash estimate, highlighting an ongoing expansion in the private sector’s economic activity.