Briefly: In our opinion, speculative short positions are favored (with stop‐loss at 2,140, and profit target at 1,980, S&P 500 index)

Our intraday outlook is bearish, and our short‐term outlook is bearish:

Intraday outlook (next 24 hours): bearish

Short‐term outlook (next 1‐2 weeks): bearish

Medium‐term outlook (next 1‐3 months): neutral

Long‐term outlook (next year): bullish

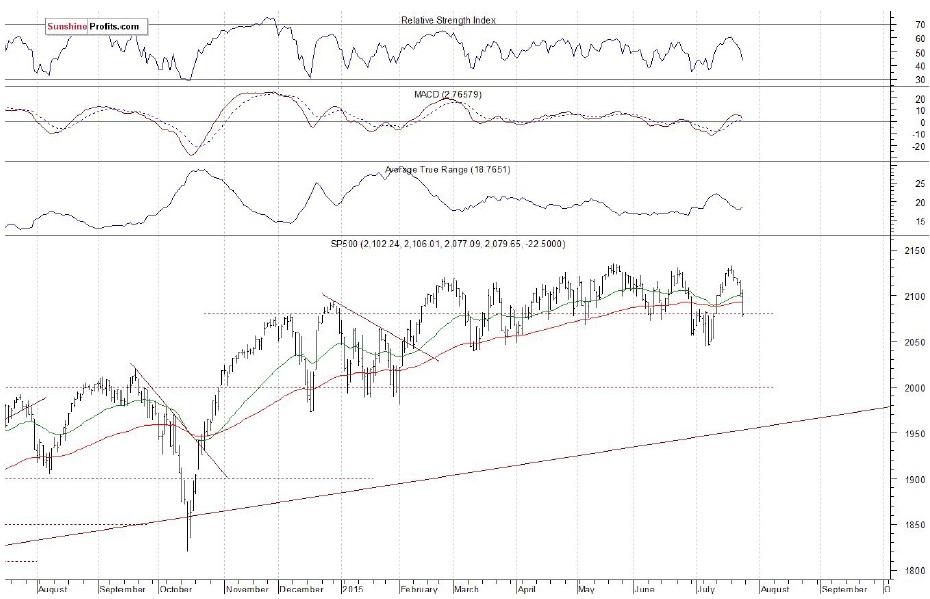

The U.S. stock market indexes lost 0.9‐1.1% on Friday, as investors reacted to quarterly earnings releases, economic data announcements. Our Friday's bearish intraday outlook has proved accurate. The S&P 500 index broke below the level of 2,100. The nearest important level of resistance is at around 2,090‐2,100. On the other hand, support level is at around 2,040‐2,060, marked by previous local lows. There have been no confirmed negative signals so far, however, we can see negative technical divergences:

Expectations before the opening of today's trading session are negative, with index futures currently down 0.4‐0.5%. The main European stock market indexes have lost between 0.2% and 1.4% so far. Investors will now wait for the Durable Orders number release at 7:30 a.m. The S&P 500 futures contract (CFD) trades within an intraday downtrend. The nearest important level of support is at around 2,070, and resistance level is at 2,080, among others, as the 15‐minute chart shows:

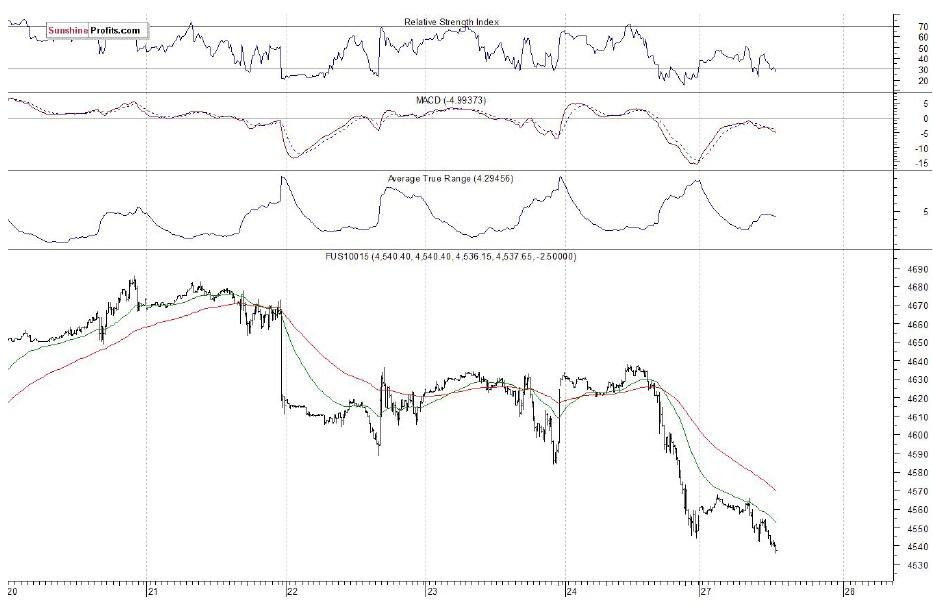

The technology Nasdaq 100 futures contract (CFD) follows a similar path, as it continues its short‐term downtrend. The nearest important level of resistance is at around 4,560, marked by local highs, as we can see on the 15‐minute chart:

Concluding, the broad stock market continues its short‐term downtrend, as investors react to quarterly earnings releases, economic data announcements. There have been no confirmed medium‐term negative signals so far. However, we continue to maintain our speculative short position (2,098.27, S&P 500 index), as we expect a medium‐term downward correction or an uptrend reversal. Stop‐loss is at 2,140, and potential profit target is at 1,980. You can trade S&P 500 index using futures contracts (S&P 500 futures contract ‐ SP, E‐mini S&P 500 futures contract ‐ ES) or an ETF like the SPDR S&P 500 ETF ‐ SPY. It is always important to set some exit price level in case some events cause the price to move in the unlikely direction. Having safety measures in place helps limit potential losses while letting the gains grow.

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' employees and associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Recommended Content

Editors’ Picks

AUD/USD jumps above 0.6500 after hot Australian CPI data

AUD/USD extended gains and recaptured 0.6500 in Asian trading, following the release of hotter-than-expected Australian inflation data. The Australian CPI rose 1% in QoQ in Q1 against 0.8% forecast, providing extra legs to the Australian Dollar upside.

USD/JPY hangs near 34-year high at 154.88 as intervention risks loom

USD/JPY is sitting at a multi-decade high of 154.88 reached on Tuesday. Traders refrain from placing fresh bets on the pair as Japan's FX intervention risks loom. Broad US Dollar weakness also caps the upside in the major. US Durable Goods data are next on tap.

Gold price cautious despite weaker US Dollar and falling US yields

Gold retreats modestly after failing to sustain gains despite fall in US Treasury yields, weaker US Dollar. XAU/USD struggles to capitalize following release of weaker-than-expected S&P Global PMIs, fueling speculation about potential Fed rate cuts.

Crypto community reacts as BRICS considers launching stablecoin for international trade settlement

BRICS is intensifying efforts to reduce its reliance on the US dollar after plans for its stablecoin effort surfaced online on Tuesday. Most people expect the stablecoin to be backed by gold, considering BRICS nations have been accumulating large holdings of the commodity.

US versus the Eurozone: Inflation divergence causes monetary desynchronization

Historically there is a very close correlation between changes in US Treasury yields and German Bund yields. This is relevant at the current juncture, considering that the recent hawkish twist in the tone of the Fed might continue to push US long-term interest rates higher and put upward pressure on bond yields in the Eurozone.