Briefly: In our opinion, speculative short positions are favored (with stop-loss at 2,150 and profit target at 1,980, S&P 500 index)

Our intraday outlook is bearish, and our short-term outlook is bearish:

Intraday outlook (next 24 hours): bearish

Short-term outlook (next 1-2 weeks): bearish

Medium-term outlook (next 1-3 months): neutral

Long-term outlook (next year): bullish

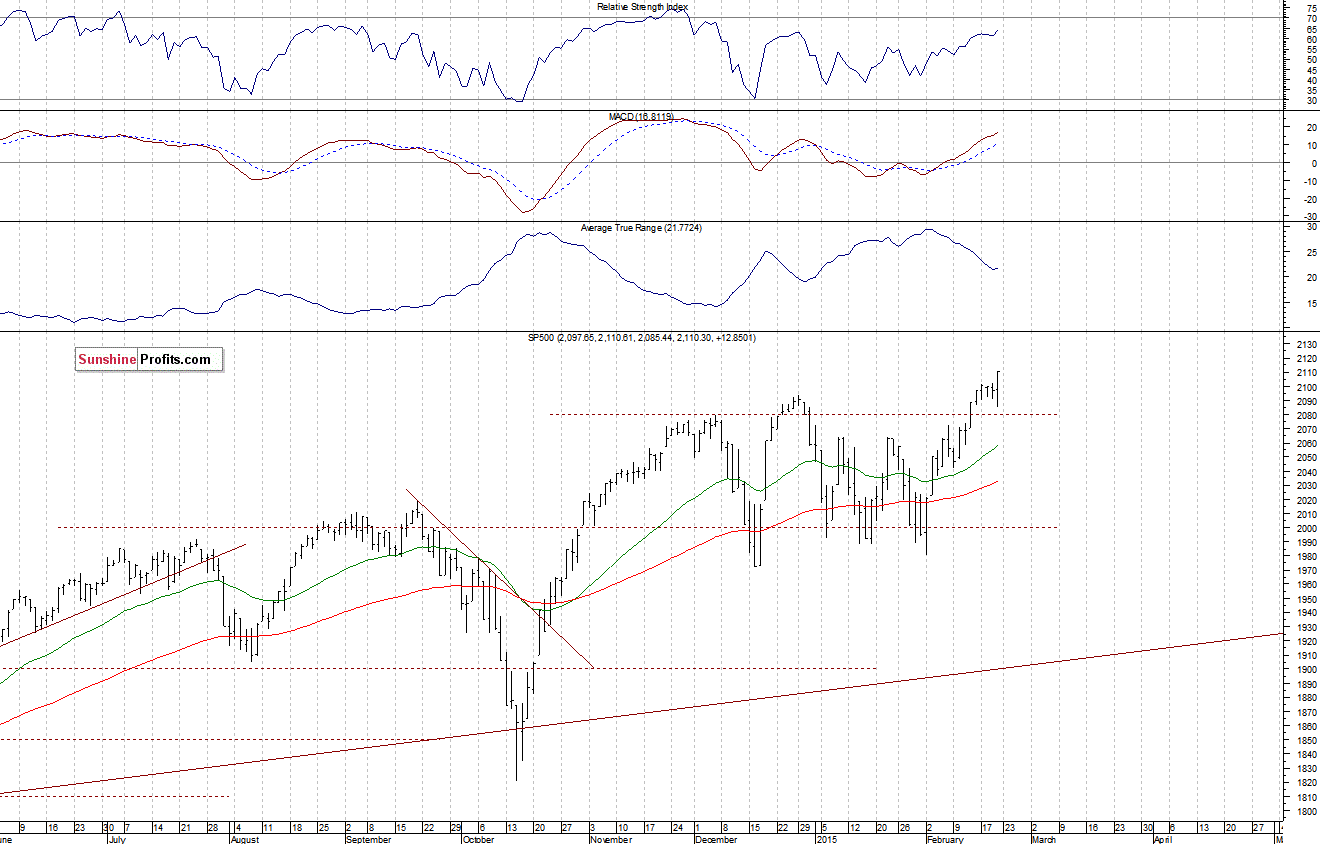

The U.S. stock market indexes gained between 0.6% and 0.9% on Friday, extending their short-term uptrend, as investors remained bullish following economic news releases. The S&P 500 index has reached yet another new all-time high at the level of 2,110.61. The nearest important level of support is at around 2,100, marked by previous resistance level. There have been no confirmed negative signals so far. However, we can see overbought conditions accompanied by negative divergences:

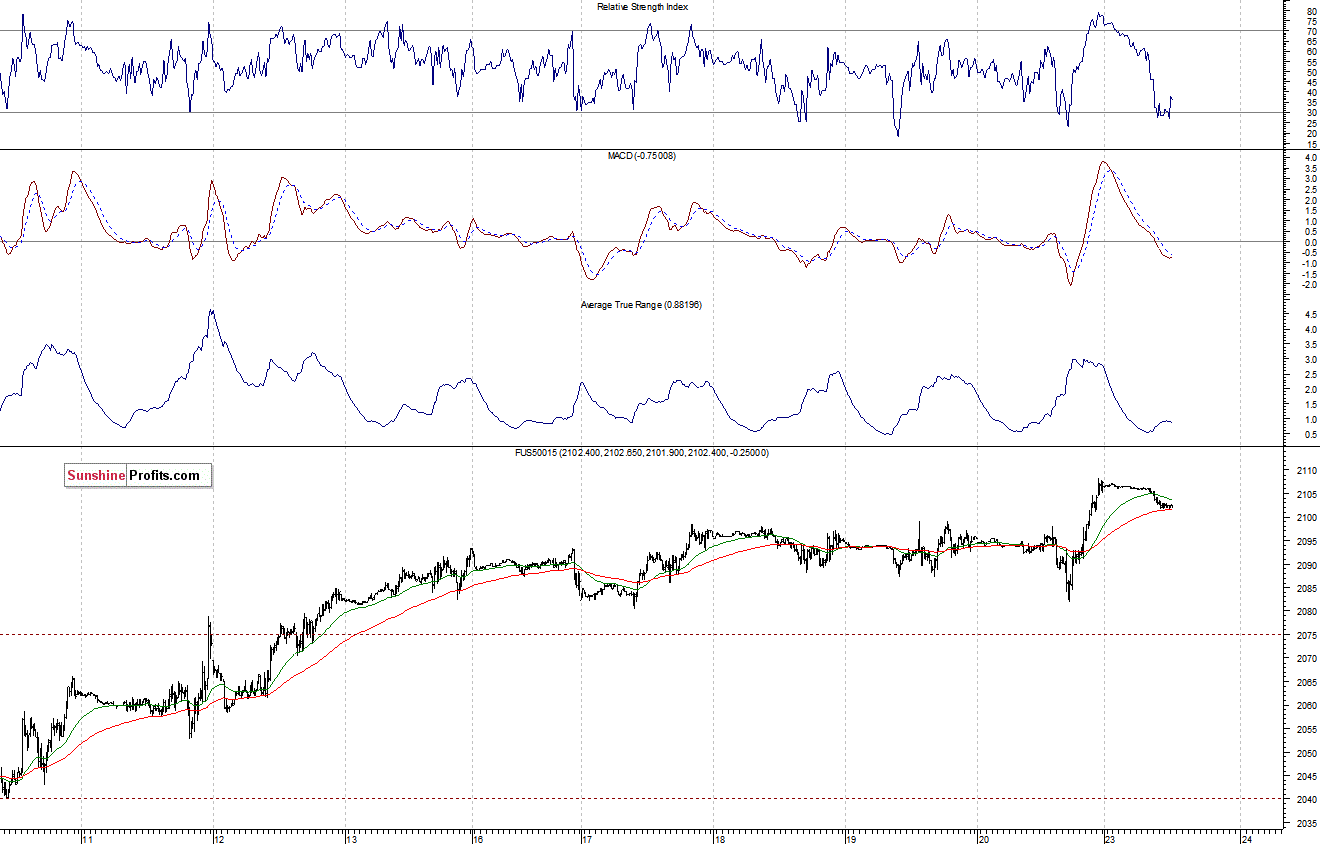

Expectations before the opening of today's trading session are slightly negative, with index futures currently down 0.1-0.2%. The main European stock market indexes have been mixed so far. Investors will now wait for the Existing Home Sales number announcement at 10:00 a.m. The S&P 500 futures contract (CFD) is in an intraday downtrend, as it retraces some of its Friday's move up. The nearest important resistance level is at around 2,110, marked by Friday's local high. On the other hand, support level is at 2,100, among others, as we can see on the 15-minute chart:

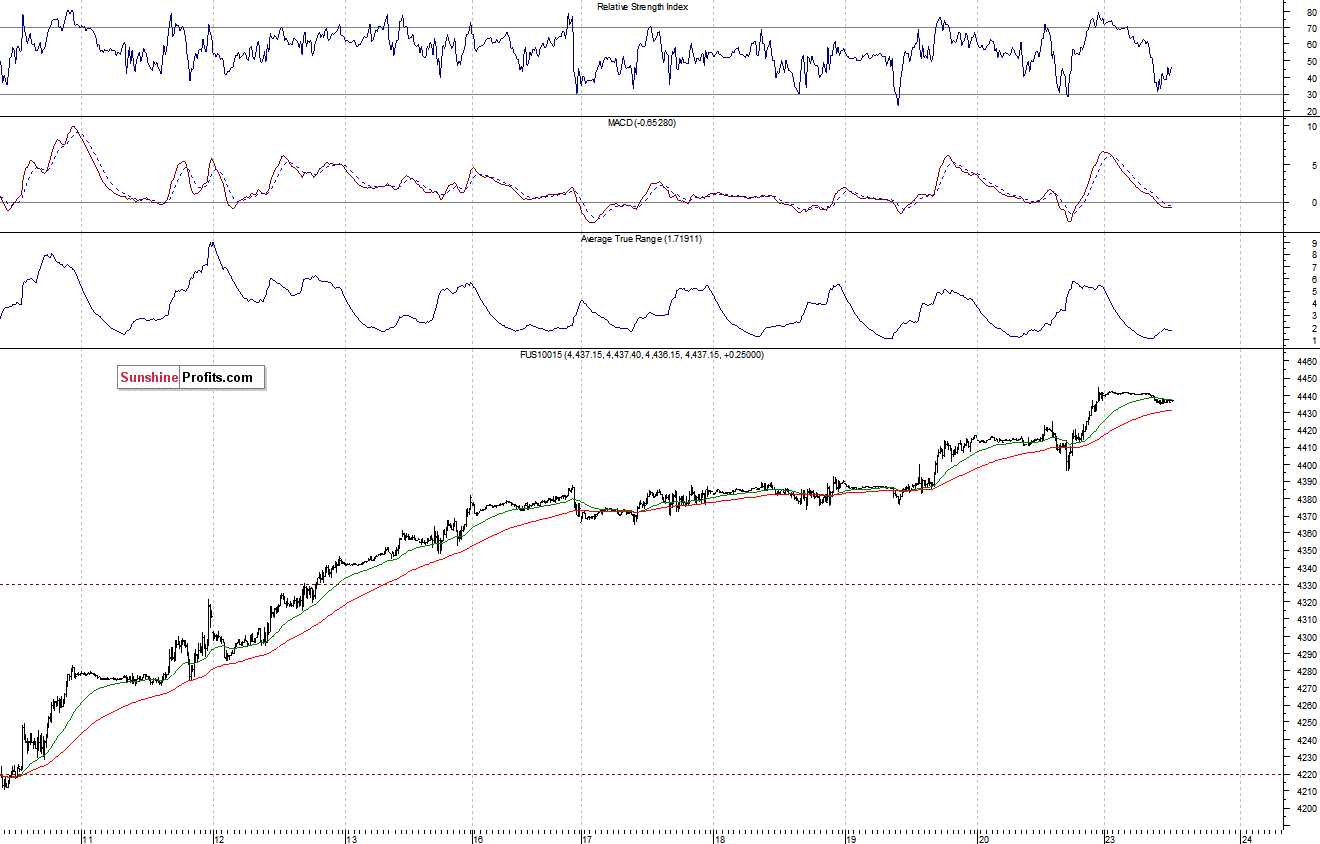

The technology Nasdaq 100 futures contract (CFD) remains relatively stronger than the broad stock market, as it trades close to long-term high. The nearest important level of resistance is at 4,440-4,450, and support level is at 4,420-4,430, among others, as the 15-minute chart shows:

Concluding, the broad stock market extended its short-term uptrend on Friday. There have been no confirmed negative signals. However, we continue to maintain our speculative short position (S&P 500 index), as we expect a downward correction or an uptrend reversal. Stop-loss is at 2,150, and potential profit target is at 1,980. It is always important to set some exit price level in case some events cause the price to move in the unlikely direction. Having safety measures in place helps limit potential losses while letting the gains grow.

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' employees and associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Recommended Content

Editors’ Picks

AUD/USD remained bid above 0.6500

AUD/USD extended further its bullish performance, advancing for the fourth session in a row on Thursday, although a sustainable breakout of the key 200-day SMA at 0.6526 still remain elusive.

EUR/USD faces a minor resistance near at 1.0750

EUR/USD quickly left behind Wednesday’s small downtick and resumed its uptrend north of 1.0700 the figure, always on the back of the persistent sell-off in the US Dollar ahead of key PCE data on Friday.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

Bitcoin price continues to get rejected from $65K resistance as SEC delays decision on spot BTC ETF options

Bitcoin (BTC) price has markets in disarray, provoking a broader market crash as it slumped to the $62,000 range on Thursday. Meanwhile, reverberations from spot BTC exchange-traded funds (ETFs) continue to influence the market.

US economy: slower growth with stronger inflation

The dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.