Briefly: In our opinion, speculative short positions are favored (with stop-loss at 2,085 and profit target at 1,950, S&P 500 index).

Our intraday outlook is bearish, and our short-term outlook is bearish:

Intraday (next 24 hours) outlook: bearish

Short-term (next 1-2 weeks) outlook: bearish

Medium-term (next 1-3 months) outlook: neutral

Long-term outlook (next year): bullish

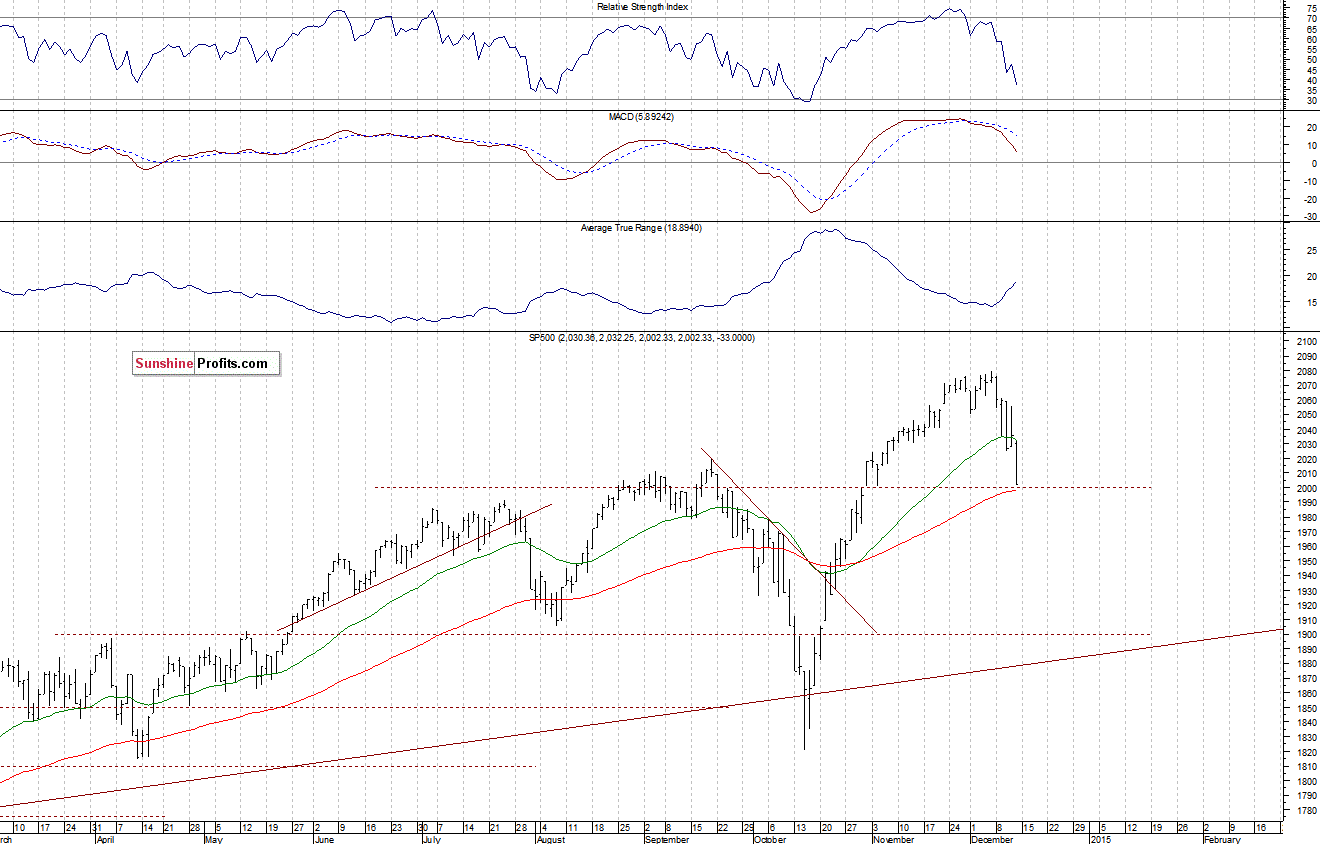

The U.S. stock market indexes lost between 1.1% and 1.8% on Friday, extending their short-term downtrend, as investors reacted to worsening global economic outlook following oil prices sell-off, among others. The S&P 500 index is the lowest since late October, as it trades close to the level of 2,000. The nearest important support level is at around 2,000, marked by the October 31st daily gap up of 1,999.4-2,001.2, among others. On the other hand, level of resistance remains at around 2,020-2,025, marked by recent local lows, as we can see on the daily chart:

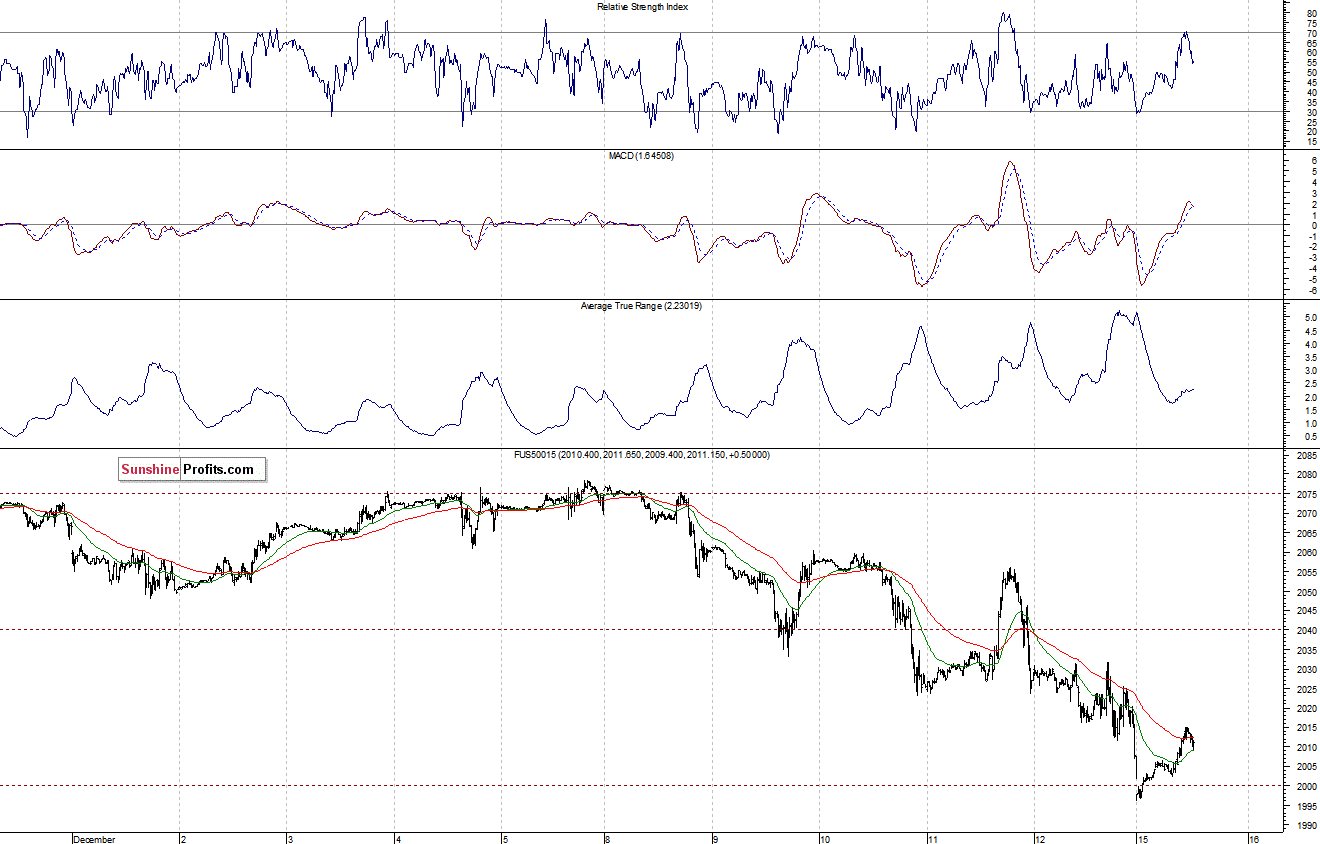

Expectations before the opening of today’s trading session are positive, with index futures currently up 0.7-0.8%. The main European stock market indexes have gained 0.3-0.5% so far. Investors will now wait for some economic data announcements: Empire Manufacturing number at 8:30 a.m., Industrial Production, Capacity Utilization at 9:15 a.m., NAHB Housing Market Index at 10:00 a.m. The S&P 500 futures contract (CFD) is in an intraday uptrend, as it retraces some of its recent decline. The nearest important level of support is at around 1,990-2,000, and resistance level is at 2,020-2,030, among others, as the 15-minute chart shows:

The technology Nasdaq 100 futures contract (CFD) follows a similar path as it trades above the level of 4,200. The nearest important level of support remains at 4,180-4,200, and resistance level is at 4,250, among others:

Concluding, the broad stock market extended its short-term downtrend, as the S&P 500 index got closer to the level of 2,000. We continue to maintain our already profitable short position with entry point at 2,038 (November 12th opening price of the S&P 500 index). Stop-loss is at 2,085 and potential profit target is at 1,950 (S&P 500 index). It is always important to set some exit price level in case some events cause the price to move in the unlikely direction. Having safety measures in place helps limit potential losses while letting the gains grow.

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' employees and associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.