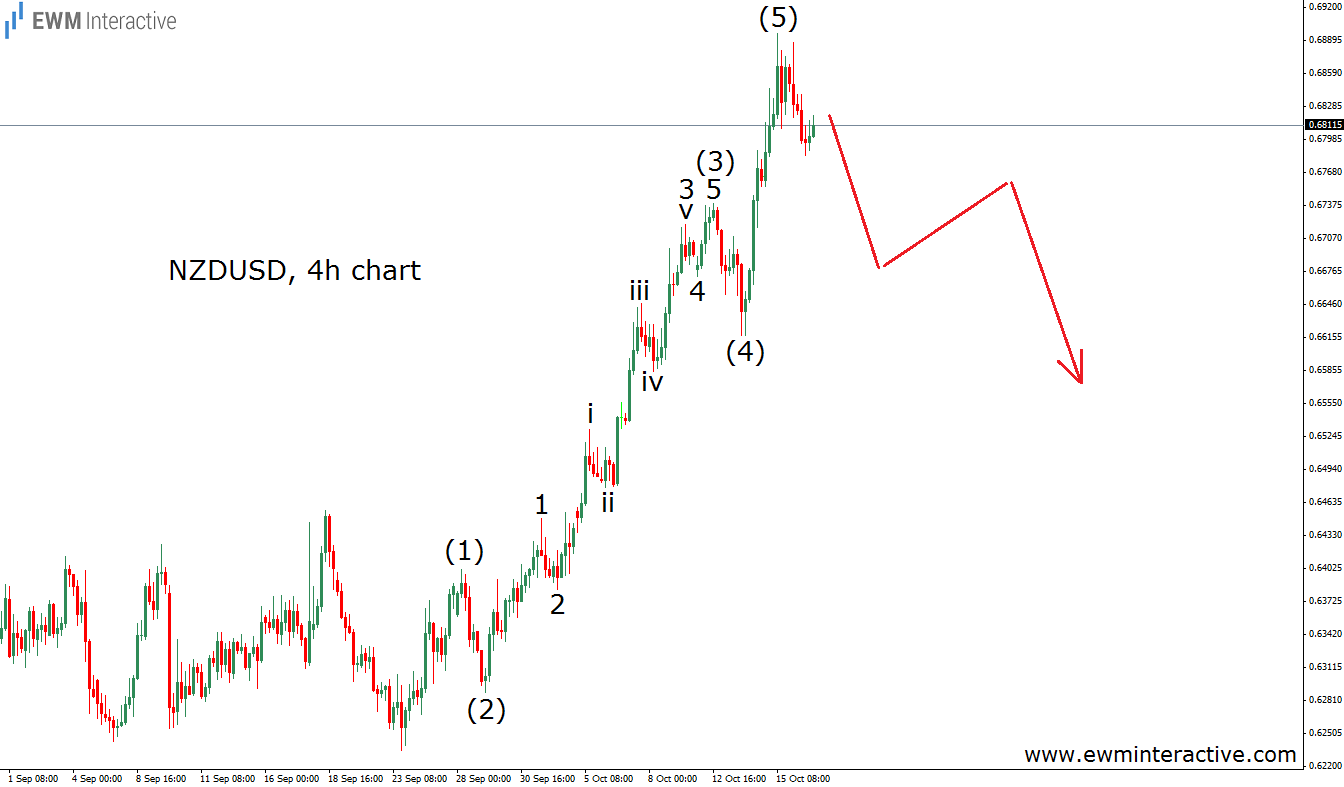

In our previous analysis on NZDUSD, titled “A Disappointing Week Ahead For NZDUSD?”, we shared our bearish view of the pair, saying that “buying NZDUSD now is the exact opposite to the right decision”. We thought so, because there was a clear five-wave impulse on the 4-hour chart. And, according to the Elliott Wave Principle, every impulse is followed by a three-wave correction in the opposite direction. See the chart below, if you need a reminder.

As visible, while NZDUSD was trading near 0.6810, we were preparing for a decline of around 200 pips. The next chart shows how the situation developed.

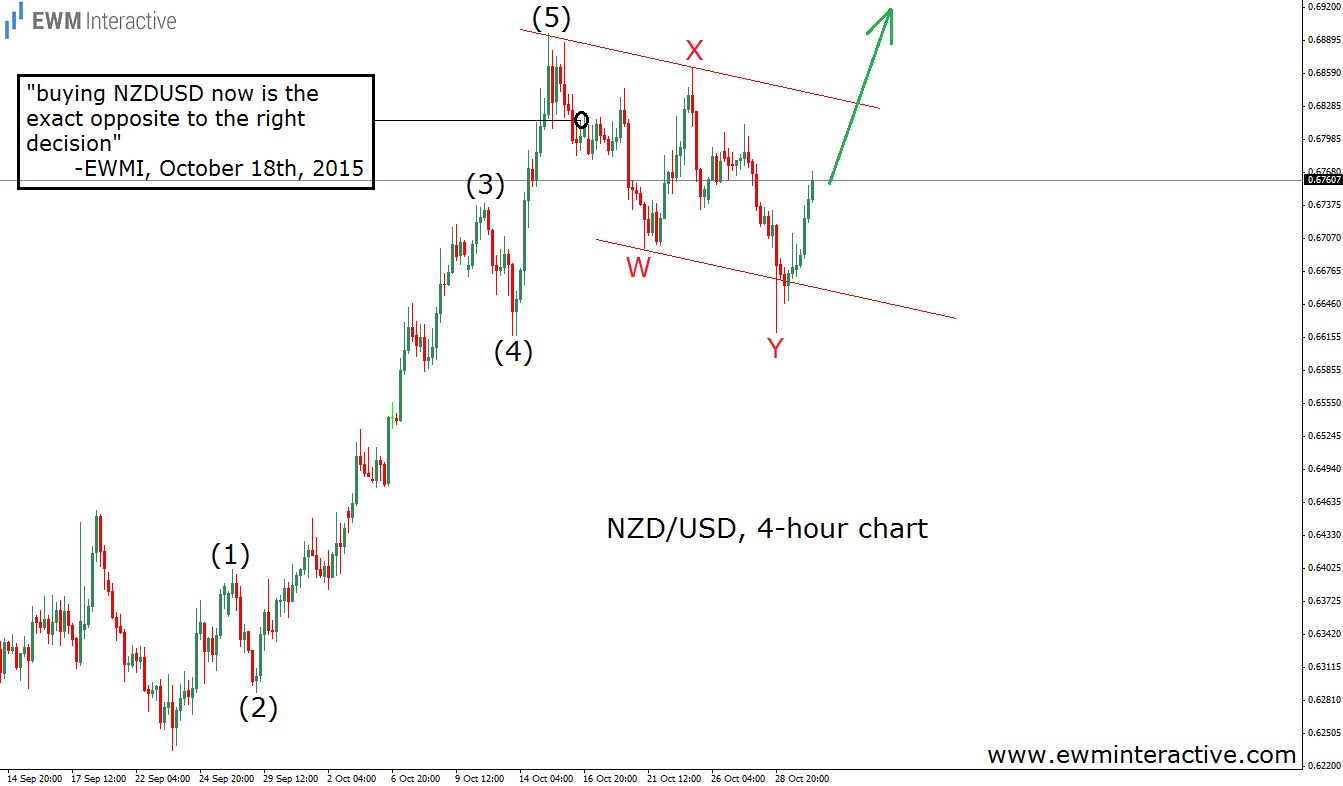

The correction we have been expecting, turned out to be a W-X-Y double zig-zag. Wave Y fell as low as 0.6620. NZDUSD gave us another example of the accuracy the Elliott Wave Principle often provides. But now what?

Now, when the anticipated correction seems to be over, the 5-3 wave cycle looks complete as well. This means the larger uptrend might be ready to resume. If this is the correct count, levels above 0.6900 should not be surprising. The bulls look eager to return to NZDUSD again.

Trading financial instruments entails a great degree of uncertainty and a variety of risks. EMW Interactive’s materials and market analysis are provided for educational purposes only. As such, their main purpose is to illustrate how the Elliott Wave Principle can be applied to predict movements in the financial markets. As a perfectly accurate method for technical analysis does not exist, the Elliott Wave Principle is also not flawless. As a result, the company does not take any responsibility for the potential losses our end-user might incur. Simply, any decision to trade or invest, based on the information from this website, is at your own risk.

Recommended Content

Editors’ Picks

EUR/USD consolidates gains below 1.0700 amid upbeat mood

EUR/USD is consolidating its recovery below 1.0700 in the European session on Thursday. The US Dollar holds its corrective decline amid improving market mood, despite looming Middle East geopolitical risks. Speeches from ECB and Fed officials remain on tap.

GBP/USD clings to moderate gains above 1.2450 on US Dollar weakness

GBP/USD is clinging to recovery gains above 1.2450 in European trading on Thursday. The pair stays supported by a sustained US Dollar weakness alongside the US Treasury bond yields. Risk appetite also underpins the higher-yielding currency pair. ahead of mid-tier US data and Fedspeak.

Gold price shines amid fears of fresh escalation in Middle East tensions

Gold price rebounds to $2,380 in Thursday’s European session after posting losses on Wednesday. The precious metal holds gains amid fears that Middle East tensions could worsen and spread beyond Gaza if Israel responds brutally to Iran.

Ripple faces significant correction as former SEC litigator says lawsuit could make it to Supreme Court

Ripple (XRP) price hovers below the key $0.50 level on Thursday after failing at another attempt to break and close above the resistance for the fourth day in a row.

Have we seen the extent of the Fed rate repricing?

Markets have been mostly consolidating recent moves into Thursday. We’ve seen some profit taking on Dollar longs and renewed demand for US equities into the dip. Whether or not this holds up is a completely different story.