It’s been 7 months since we published “NZDUSD Approaching a Major Resistance” on June 30th, 2014. The forecast assumed NZDUSD is getting close to the point of reversal, somewhere in the 0.88 – 0.89 area. This is the chart we used to make this assumption:

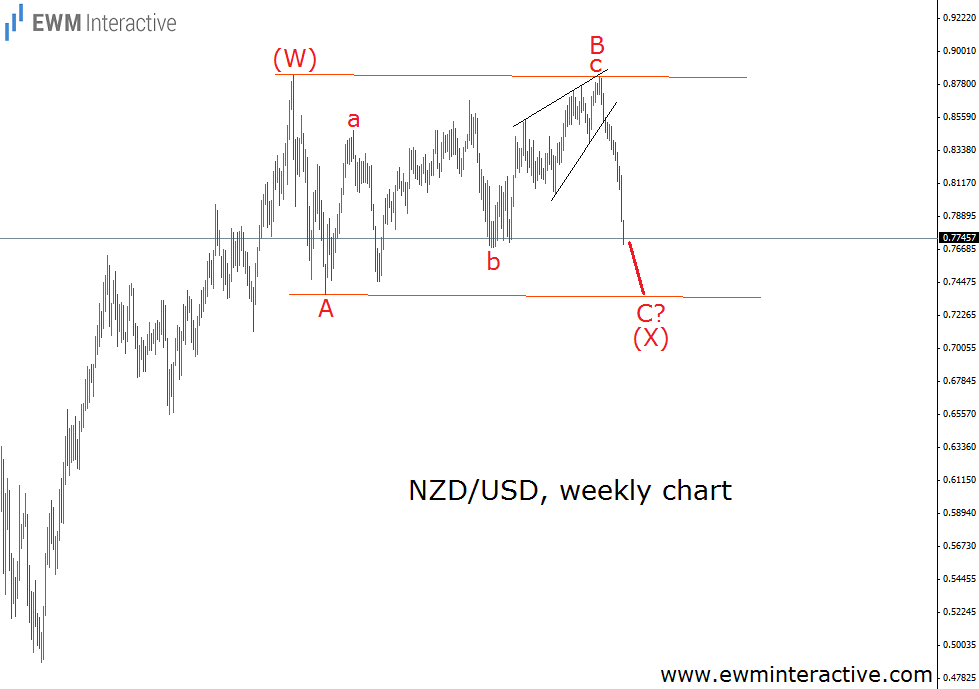

Soon after that, the pair topped at 0.8835 on July 11th and started declining. Some 11 cents lower we published an update. The following chart gave an idea of where to place our minimum targets: “0.7350 should be reached before we start looking for a bottom.”

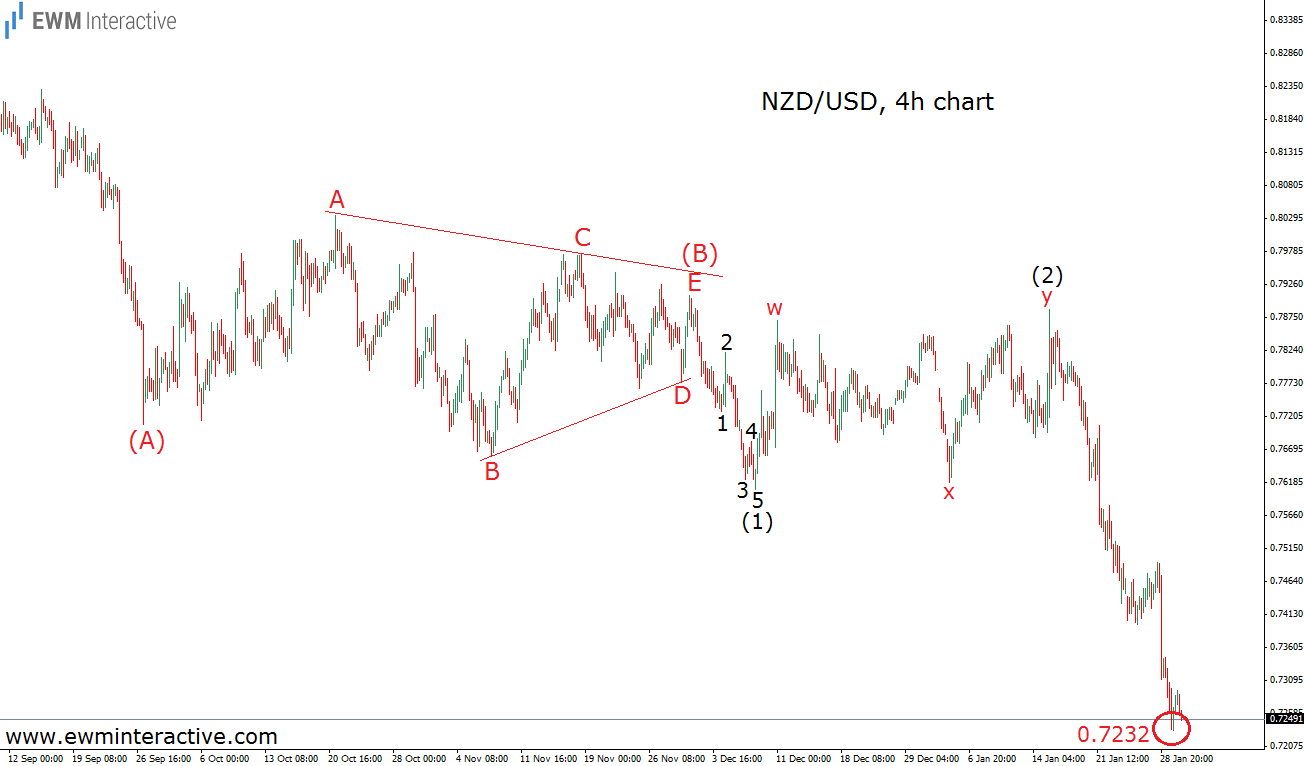

In other words, we were expecting at least 400 more pips to the south. Unfortunately, the market decided to put things off for a while. The zone between 0.77 and 0.80 offered nothing but sideways movement. This brought us to the idea of a triangle correction in progress, so on December 4th, 2014, we provided you with an update, called “NZDUSD And The Lack of Direction”. The chart below shows NZDUSD as it was almost two months ago.

As visible, the Elliott Wave Principle suggested we should expect another sell-off in the face of wave (C), as soon as this wave (B) triangle is finished. Yesterday, January 29th, 2015, the New Zealand dollar fell to 0.7232 against the US dollar, thus reaching some 120 pips beyond the minimum target of 0.7350.

However, there are still no signs of reversal. In fact, we think NZDUSD is still somewhere in the middle of wave 3 of (C). This means we should expect lower levels, because waves 4 and 5 of (C) of Y need to be completed, before the whole W-X-Y pattern is over. Here is how this looks on the big picture:

It seems there is still room for more weakness. If this analysis is correct, we should not be surprised to see NZDUSD touching the 0.70 mark. Stay tuned for further updates and do not forget to share your thoughts with us in the comment section below.

Trading financial instruments entails a great degree of uncertainty and a variety of risks. EMW Interactive’s materials and market analysis are provided for educational purposes only. As such, their main purpose is to illustrate how the Elliott Wave Principle can be applied to predict movements in the financial markets. As a perfectly accurate method for technical analysis does not exist, the Elliott Wave Principle is also not flawless. As a result, the company does not take any responsibility for the potential losses our end-user might incur. Simply, any decision to trade or invest, based on the information from this website, is at your own risk.

Recommended Content

Editors’ Picks

How will US Dollar react to Q1 GDP data? – LIVE

The US' GDP is forecast to grow at an annual rate of 2.5% in the first quarter of the year. The US Dollar struggles to find demand as investors stay on the sidelines, while waiting to assess the impact of the US economic performance on the Fed rate outlook.

EUR/USD holds gains above 1.0700, as key US data loom

EUR/USD holds gains above 1.0700 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

GBP/USD extends recovery above 1.2500, awaits US GDP data

GBP/USD is catching a fresh bid wave, rising above 1.2500 in European trading on Thursday. The US Dollar resumes its corrective downside, as traders resort to repositioning ahead of the high-impact US advance GDP data for the first quarter.

Gold price edges higher amid weaker USD and softer risk tone, focus remains on US GDP

Gold price (XAU/USD) attracts some dip-buying in the vicinity of the $2,300 mark on Thursday and for now, seems to have snapped a three-day losing streak, though the upside potential seems limited.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.