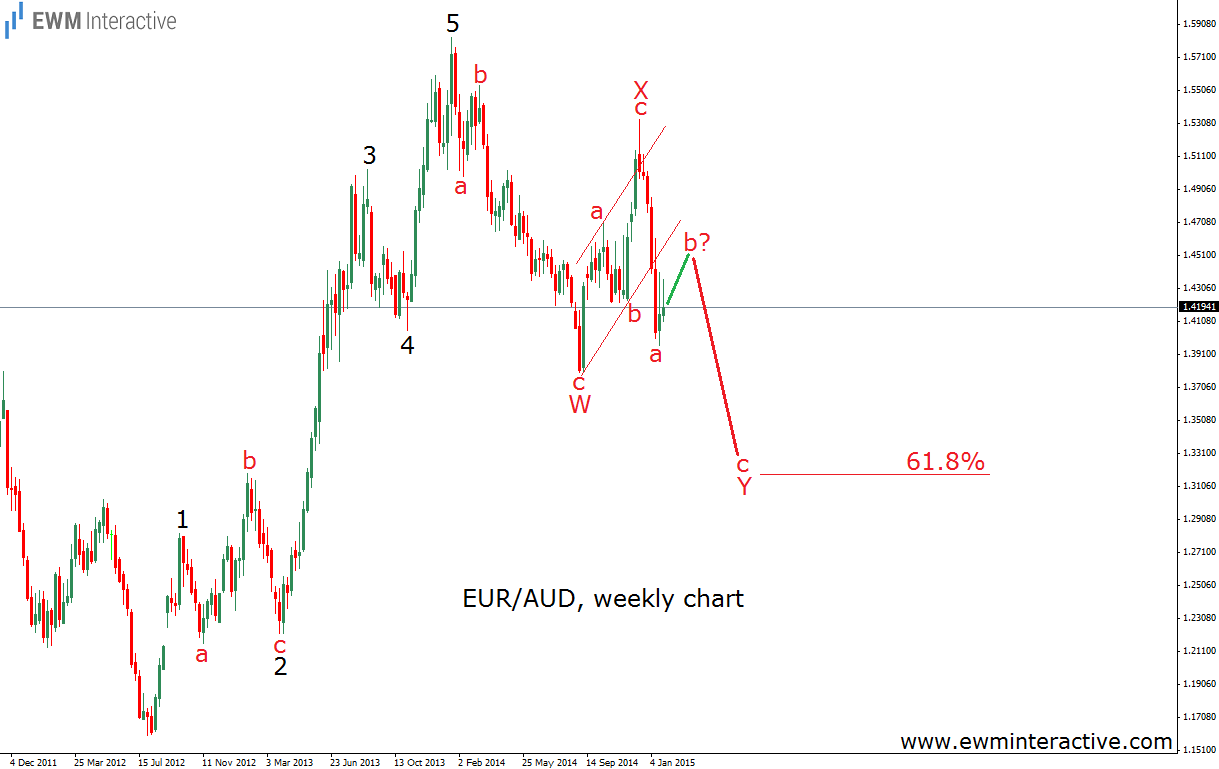

Both the euro and the Australian dollar fell victims to the US dollar, but it is interesting to see the perspective, when they face each other. The charts of the EURAUD exchange rate could provide some very clear patterns. It is always wiser to start an Elliott Wave analysis from the big picture. So, Let’s start with the weekly chart.

EURAUD rose from 1.16 in August 2012 to 1.5830 in January 2014. The important thing here is the five-wave impulsive structure of this rally. According to the Wave Principle, after a five-wave sequence we should expect a three-wave retracement in the opposite direction. As visible, this is exactly what happened. EURAUD declined to 1.38 in three waves marked with “W”. This was the minimum requirement for a corrective pull-back. However, it looks like the market has decided to stay in corrective mode, because the advance to 1.5330 was also limited to three waves for X. This brings to mind the idea of a W-X-Y double zig-zag, where wave Y is still unfolding. In order to find out what is left of it, we need to move to a smaller time-frame. The hourly chart comes in handy.

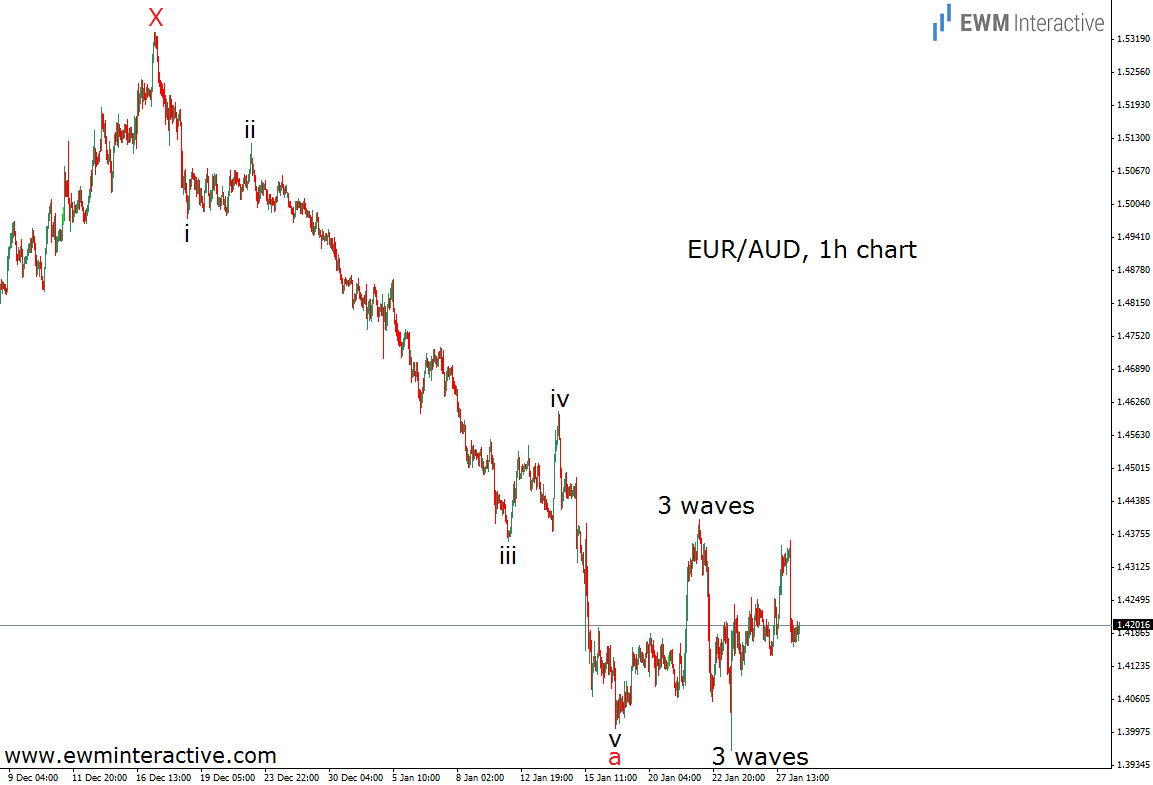

The top of wave X gave the start of another decline to 1.40, which, as the chart shows, can easily be counted as a five-wave impulse. We think it is wave “a” of Y. Since the bottom of wave “a”, EURAUD has been moving sideways, which is a characteristic only corrections posses. This means wave “b” could take the form of a triangle or an expanding flat. It is too early to say what it will be right now, but once it is finished, we will expect wave “c” of Y to the downside. It would probably lead EURAUD to the 61.8% Fibonacci level. In terms of price, this means the area around 1.32.

Trading financial instruments entails a great degree of uncertainty and a variety of risks. EMW Interactive’s materials and market analysis are provided for educational purposes only. As such, their main purpose is to illustrate how the Elliott Wave Principle can be applied to predict movements in the financial markets. As a perfectly accurate method for technical analysis does not exist, the Elliott Wave Principle is also not flawless. As a result, the company does not take any responsibility for the potential losses our end-user might incur. Simply, any decision to trade or invest, based on the information from this website, is at your own risk.

Recommended Content

Editors’ Picks

EUR/USD stays below 1.0700 after US data

EUR/USD stays in a consolidation phase below 1.0700 in the early American session on Wednesday. The data from the US showed a strong increase in Durable Goods Orders, supporting the USD and making it difficult for the pair to gain traction.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold trades on the back foot, manages to hold above $2,300

Gold struggles to stage a rebound midweek following Monday's sharp decline but manages to hold above $2,300. The benchmark 10-year US Treasury bond yield stays in the green above 4.6% after US data, not allowing the pair to reverse its direction.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.