Many Bitcoin fans like to say, that we – chartists – do not understand the crypto-currency and its behavior. There are Bitcoin lovers, still blinded by the past performance of the virtual currency, neglecting the change in trend. Ignorance is the cause why many investors took a hit, when Bitcoin topped in December 2013. Today we are presenting a second overview of the future price movement in Bitcoin.

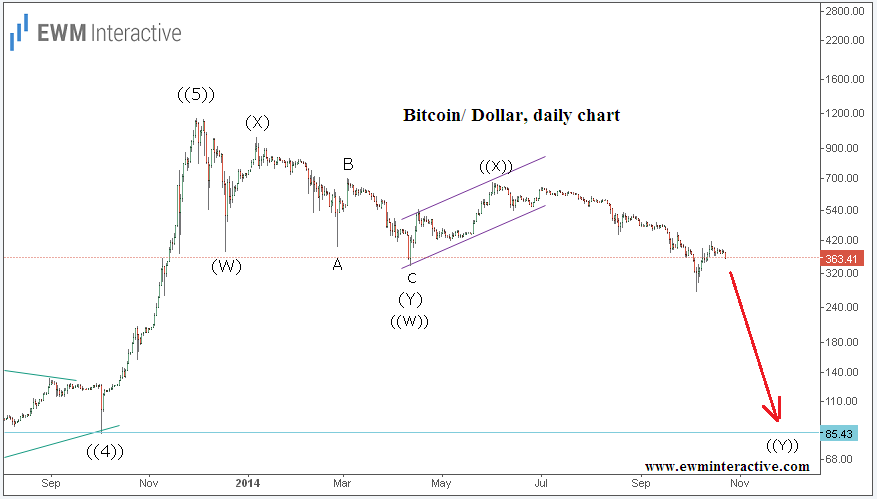

The crypto-currency topped at the remarkable level of 1151.49. In December 2013 the currency reached its termination point. Since then it has lost over 70 percent of its value and still moves in a corrective fashion, validating the ongoing bear market. The price movement from the top, which has ended in April, is counted as a double zig-zag “(W)-(X)-(Y)”.

The countertrend rally form April to June is labeled ((X)) due to its three-wave structure. Afterwards the market dragged prices down to the 270 level, tracing out the first wave of the next decline for wave “((Y))”.

In conclusion, the Elliott Wave Principle is based on mass psychology and, in our opinion, it is the best method for understanding the markets. Our long-term forecast states that prices will continue to move lower, all the way to the price territory of wave “((4))”, dropping below the 100 level. There could be short-term, counter-trend movements, but for now the trend remains to the downside.

Trading financial instruments entails a great degree of uncertainty and a variety of risks. EMW Interactive’s materials and market analysis are provided for educational purposes only. As such, their main purpose is to illustrate how the Elliott Wave Principle can be applied to predict movements in the financial markets. As a perfectly accurate method for technical analysis does not exist, the Elliott Wave Principle is also not flawless. As a result, the company does not take any responsibility for the potential losses our end-user might incur. Simply, any decision to trade or invest, based on the information from this website, is at your own risk.

Recommended Content

Editors’ Picks

EUR/USD regains traction, recovers above 1.0700

EUR/USD regained its traction and turned positive on the day above 1.0700 in the American session. The US Dollar struggles to preserve its strength after the data from the US showed that the economy grew at a softer pace than expected in Q1.

GBP/USD returns to 1.2500 area in volatile session

GBP/USD reversed its direction and recovered to 1.2500 after falling to the 1.2450 area earlier in the day. Although markets remain risk-averse, the US Dollar struggles to find demand following the disappointing GDP data.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.